Venture Capital: 5 Signals Democratization Has Arrived

While Tesla Inc. (TSLA) and Amazon.com Inc. (AMZN) made early venture investors wealthy, everyday investors were locked out—until now. The venture capital industry, historically reserved for institutions and ultra-wealthy individuals, is undergoing a fundamental transformation that’s opening doors for sophisticated investors with as little as $10,000.

1. The $10,000 Venture Capital Revolution Breaks Million-Dollar Barriers

Traditional VC funds require minimum investments of $1 million or more, effectively excluding 99% of accredited investors. Today, innovative fund structures are lowering minimums to $10,000—a 100x reduction that democratizes access to startup investments. Platforms now offer quarterly rolling funds with $5,000-$10,000 minimums, while new digital-first vehicles launch in under 24 hours with zero upfront legal costs. This shift reflects how companies like Robinhood Markets Inc. (HOOD) have transformed public market investing by eliminating barriers.

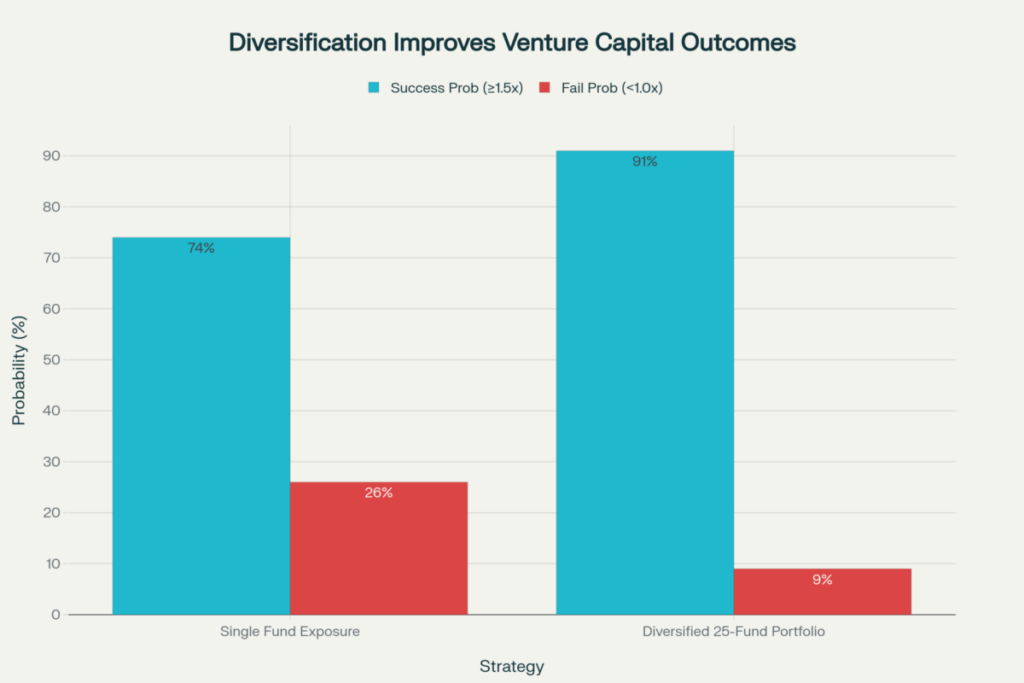

2. Venture Capital Success Rates Jump from 74% to 91% Through Systematic Diversification

Data from Cambridge Associates and institutional research reveals that systematic diversification across 20-25 funds can improve investment success probability from 74% to 91%. This 17-percentage-point improvement comes from spreading risk across multiple vintages, geographies, and sectors—a strategy previously available only to large institutions. When investing in 25+ funds, the probability of achieving less than 1.5x returns decreases from 26% to 9%, while risk-adjusted performance measured by the Sortino ratio increases from 0.7 to 3.0.

3. Algorithmic Selection Replaces Old Boys’ Venture Capital Networks

The venture capital industry now processes millions of data points monthly through advanced analytics platforms. SignalFire’s Beacon AI platform alone tracks 80 million companies and 650 million professionals, updating continuously. This shift parallels how firms like BlackRock Inc. (BLK) use systematic approaches in public markets—their Aladdin system manages $21.6 trillion using algorithmic risk assessment. Data-driven fund selection identifies patterns in successful investments that human networks often miss, democratizing access to top-performing funds previously reserved for insiders.

4. Global Innovation Access Expands Beyond Silicon Valley

Modern venture platforms provide exposure to innovation hubs worldwide, not just Bay Area startups. While Silicon Valley captured $90 billion (57% of US venture capital) in 2024, international opportunities offer compelling diversification. Israel produces 2.77 unicorns per million people—the world’s highest density—with Tel Aviv creating 83 unicorns in five years. Southeast Asia generated $4.56 billion in venture funding, while Latin America’s startup ecosystem rebounded to $1.23 billion in Q4 2024. This geographic diversification reduces concentration risk while capturing global innovation.

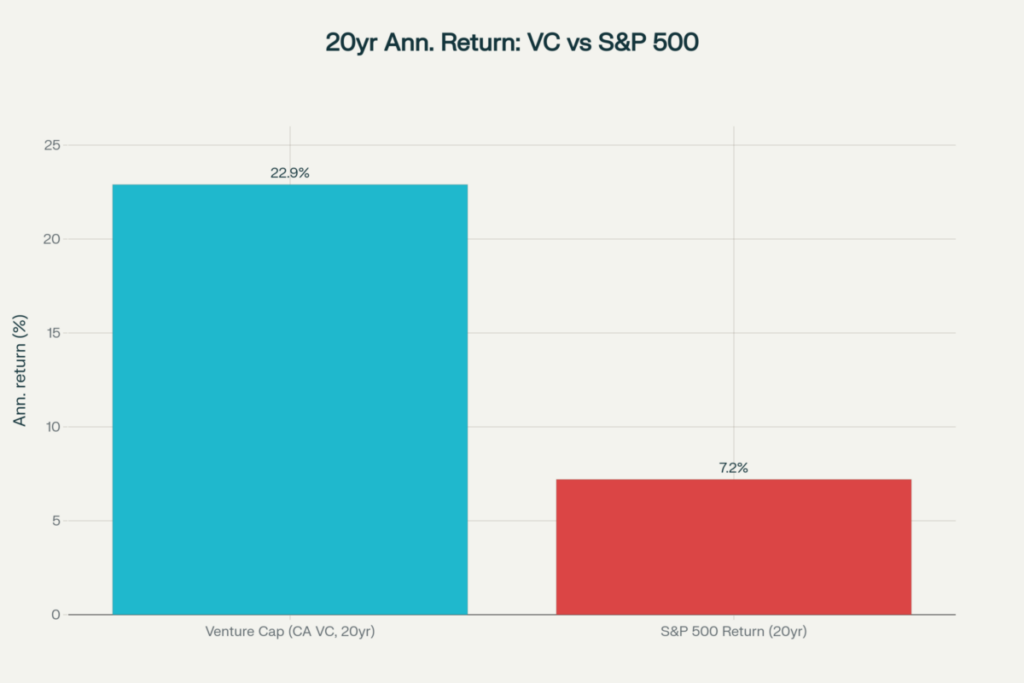

5. Returns Validate Venture Capital Advantage

Historical performance data shows venture capital delivering 22.9% annual returns over 20 years compared to 7.2% for the S&P 500. The Cambridge Associates US VC Index demonstrates consistent outperformance, with top-quartile funds achieving IRRs exceeding 25.6%. The illiquidity premium—additional returns for patient capital—adds 3-5% annually above liquid alternatives. Recent platform data shows interval and tender offer fund assets exceeding $158 billion, growing at nearly 40% annually as institutional-quality returns become accessible through regulated structures.

The Future of Venture Investing

The convergence of technology, regulatory evolution, and innovative fund structures is creating unprecedented access to venture capital. As artificial intelligence companies capture 37% of all venture funding and drive innovation across sectors, sophisticated investors are recognizing that portfolio allocation to venture capital is becoming essential, not optional.

The democratization of venture capital represents more than lower minimums—it’s about systematic access to innovation, professional management, and institutional-quality returns. For accredited investors seeking portfolio diversification beyond public markets, the barriers that once made venture capital inaccessible are rapidly disappearing.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Posted-In: contributors Expert IdeasGlobal Opinion Signals Trading Ideas General