Meta Shareholders Sue Mark Zuckerberg, Peter Thiel For $8 Billion Over Privacy Violations Linked To Cambridge Analytica Scandal

On Wednesday, a trial began in Delaware, where Meta Platforms, Inc. (NASDAQ:META) shareholders are seeking $8 billion in damages from top executives, including Mark Zuckerberg, Peter Thiel and Sheryl Sandberg, over alleged failures to protect user data following the Cambridge Analytica scandal.

What Happened: At the trial's opening, privacy law expert Neil Richards testified, "Facebook's privacy disclosures were misleading," reported The Guardian.

The non-jury trial is being overseen by Delaware Chancery Court Chief Judge Kathaleen McCormick, who previously voided Elon Musk's $56 billion Tesla Inc. (NASDAQ:TSLA) pay package.

The lawsuit claims Zuckerberg and other board members failed to uphold a 2012 agreement with the Federal Trade Commission requiring Facebook to safeguard user privacy.

What Is The Lawsuit About: The alleged oversight led to the 2018 revelations that data from millions of users had been harvested by political consultancy Cambridge Analytica, known for Donald Trump's 2016 presidential campaign.

Following the scandal, the FTC fined Facebook $5 billion in 2019, citing violations of the prior settlement. Shareholders now argue that the company's leadership should personally reimburse Meta for that fine and related legal costs, totaling over $8 billion.

See Also: Scale AI Slashes 14% Of Workforce After Meta’s $14 Billion Investment

The defendants — including venture capitalist Marc Andreessen and Netflix Inc. (NASDAQ:NFLX) co-founder Reed Hastings — deny wrongdoing.

They say Facebook hired outside consultants to ensure FTC compliance and that the company was misled by Cambridge Analytica. Zuckerberg is also accused of selling Facebook stock before the scandal broke, allegedly profiting by at least $1 billion.

His legal team insists the sales followed a pre-approved trading plan designed to avoid insider trading.

Why It's Important: This is the first Caremark oversight lawsuit to go to trial, targeting board members for allegedly failing to monitor corporate conduct — a historically difficult legal claim to prove, the report said.

However, Delaware courts have shown more openness to such cases. A similar case involving Boeing Co.'s (NYSE:BA) board resulted in a $237.5 million settlement.

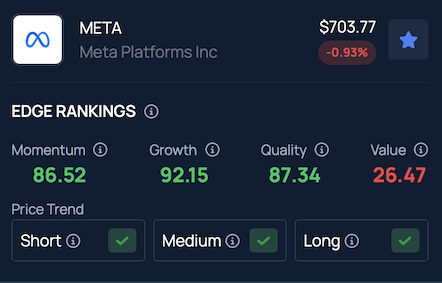

Price Action: Meta shares fell 1.05% on Wednesday, closing at $702.91, but recovered slightly with a 0.19% gain in after-hours trading, according to Benzinga Pro data.

Benzinga's Edge Stock Rankings indicate that META continues to exhibit consistent upward momentum over the short, medium and long term. While its growth score remains strong, the stock's value rating lags behind. Additional performance insights are available here.

Read Next:

Photo Courtesy: Skorzewiak on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.