Mark Zuckerberg, Peter Thiel And Meta Board Dodge Courtroom Showdown As Shareholders Abruptly Settle $8 Billion Privacy Lawsuit

Meta Platforms, Inc. (NASDAQ:META) shareholders ended a landmark $8 billion lawsuit against Mark Zuckerberg and several current and former executives on Thursday, reaching a surprise settlement just as the high-profile privacy trial was set to enter its second day.

What Happened: The surprise settlement was announced Thursday morning by the plaintiffs' lawyer without disclosing terms. Delaware Judge Kathaleen McCormick adjourned the trial, reported Reuters.

The case, heard in Delaware's Court of Chancery, accused Zuckerberg, Sheryl Sandberg, Marc Andreessen, Peter Thiel and others of allowing repeated violations of Facebook users' privacy, which led to billions in regulatory fines, including a record-setting $5 billion penalty from the Federal Trade Commission in 2019.

See Also: Here’s How Much You Would Have Made Owning Meta Platforms Stock In The Last 10 Years

Shareholders claimed the board failed to oversee compliance with a 2012 FTC agreement that required Facebook to protect user data.

The case was built around so-called Caremark claims, a rare and difficult legal theory under Delaware law that seeks to hold directors liable for oversight failures.

Why It's Important: The settlement allows Zuckerberg and other defendants to avoid public testimony. Zuckerberg was expected to take the stand on Monday, with Sandberg and others, including Netflix Inc. (NASDAQ:NFLX) co-founder Reed Hastings and Palantir Technologies, Inc. (NASDAQ:PLTR) co-founder Peter Thiel, scheduled to testify later.

The case marked the first time Caremark claims reached trial, with the potential to set a precedent for board accountability in data privacy governance. By settling, the plaintiffs avoid a difficult legal battle, while Meta's leadership sidesteps deeper public scrutiny over its role in the Cambridge Analytica scandal.

Critics, however, say the settlement is a missed opportunity for transparency, the report added. It is pertinent to note that Meta was not a defendant in the case.

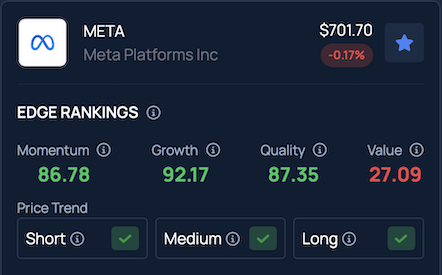

Price Action: Meta stock dipped 0.21% on Thursday, closing at $701.41, but edged up 0.18% in after-hours trading, according to Benzinga Pro.

Benzinga's Edge Stock Rankings show that META maintains steady upward momentum across short, medium and long-term periods. Its growth metrics remain robust, though the stock's value rating is comparatively weaker. More detailed performance data is available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.