Home-Purchase Agreements In Sun Belt Cities Falling Through At Highest Rate In US

As of Sept. 23, the national average for a 30-year fixed mortgage is 6.43%, stalling the housing market across the country.

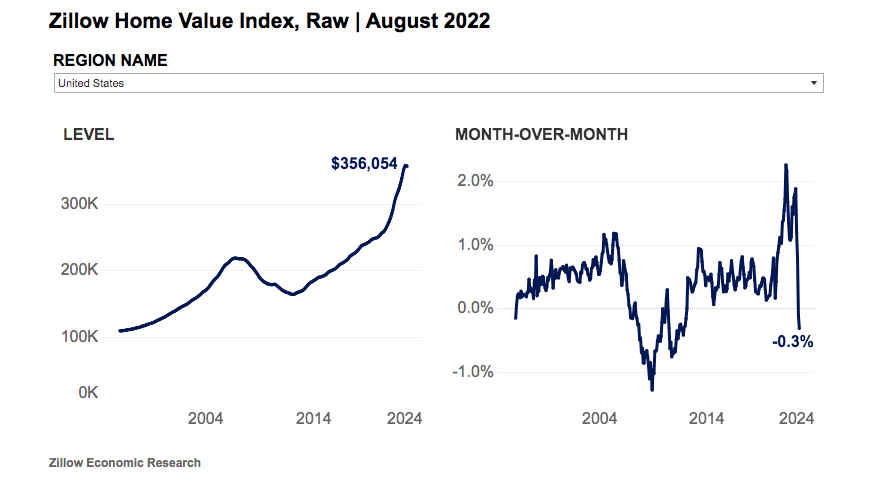

The standard home value in the U.S. is $356,026, up 16.5% over the past year, although home values fell by 0.3% from July, the largest monthly decrease since 2011, per Zillow Group (NASDAQ: Z).

What Happened: Approximately 64,000 home-purchase agreements fell through in August, identical to 15.2% of homes that went under contract for the month, RedFin reported.

The percentage of home-purchase agreements that fell through has floated around 15% over the past three months, and before the pandemic, this percentage had maintained at 12%.

Although home values have fallen since their peak in April, they are still up 43.6% since August 2019, according to Zillow.

On top of record home values, the Fed's interest rate policy is also adding to higher mortgage payments as the monthly mortgage is now $1,643 from $897 at the end of August 2019, up 83% from before the pandemic.

The locations most impacted by rising rates are the Sun Belt cities that were rising in popularity during the pandemic, including Jacksonville, Las Vegas, and Atlanta.

In Jacksonville, 26.1% of homes that were under contract in August fell through, the highest percentage among 50 of the most populous U.S. cities.

Also Read: BEST REAL ESTATE CROWDFUNDING PLATFORMS

Why It Matters: On Sept. 21, Federal Reserve Chair Jerome Powell acknowledged that the housing market has been running hot and that there needs to be a “reset” as home values have reached record levels.

“Some homebuyers are finding that by the time they go under contract and lock in their mortgage rates, rates could be much higher than they were when they toured the home and/or got pre-approved. That can kill the deal because the buyer is no longer financially comfortable with the purchase,” said Sam Chute, a Redfin (NASDAQ: RDFN) real estate agent who works with sellers in Miami.

With more buyers backing out of the market due to sky-high home values, the rental market has been surging as the typical monthly rent is $2,090, up 12.3% year-over-year.

Furthermore, cities such as Miami and New York are leading the way in annual rental growth, up 21.9% and 17.9% year over year respectively.

It should be noted that metropolitan areas in the Sun Belt saw the highest growth in home-buyers since the pandemic. Inevitably causing home values to skyrocket, leaving those unwilling or unable to lock in a mortgage to rent.

For prospective buyers who are looking to purchase their dream home, mortgage lender NASB Financial Inc. (OTC: NASB) is offering a variety of banking products including checking, savings, and certificate of deposit accounts. It is also offering mortgage and refinancing options, including self-employed mortgage options for the handyman or self-incorporated day trader.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Mid Cap News Short Ideas Small Cap Econ #s Economics Federal Reserve Trading Ideas