#PreMarket Prep Recap - Coming Out Of Earnings Season, Action Is Sideways

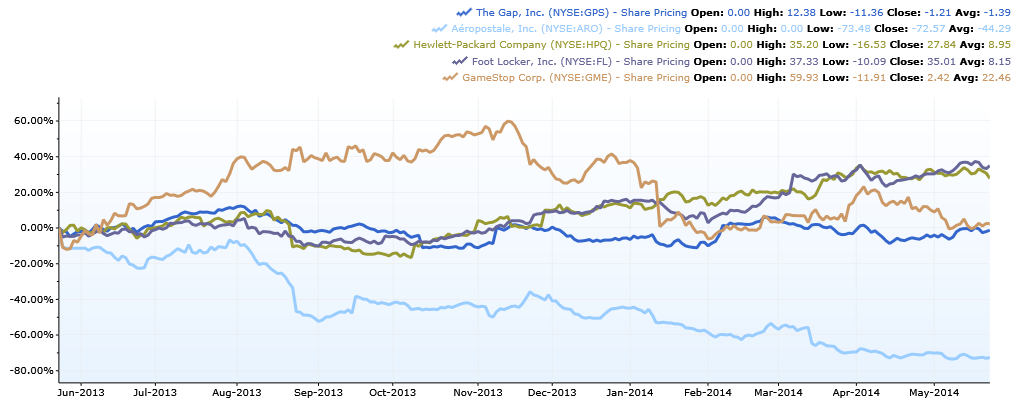

Joel Elconin and Dennis Dick covered more retailers and have continued with the theme this quarter that low-end retailers are getting smashed, while high-end retailers have seen all the bullish action.

For the broad market S&P 500, $1,900 is the level to break through, which keeps getting hitting at this level and selling off. Gold remains at its new "magnet" level of $1,290. Anytime the precious metal steps away from the level, it winds up trading back and has offered many traders a great intraday trade.

Both the equity index and gold have been range bound coming out of earnings season.

1-Year Performance in Percent

Hewlett-Packard (NYSE: HPQ) released its earnings information early, possibly because of a time-zone error. The data hit at 3:30 p.m. EST and promptly knocked four percent off the stock. The report showed HPQ earnings coming in-line with expectation -- $0.88 EPS, with sales missing at $27.3 billion versus the $27.42 billion estimate.

Hewlett-Packard's low is $31.01 and the level to hold will be $32.44 ($0.15 above Thursday's VWAP) if the stock is to rally from Thursday's beat down. If the stock falls below the $31 handle, the low level to watch will be around $29.69.

The Gap (NYSE: GPS) beat by $0.01, reporting $0.58 on revenue of $3.77 billion versus the $3.71 billion estimated. The response to the release has been muted. The pre-market dip in the equity price to $40.10 is in line with the previous three lows in the lower 40 handle. Resistance will be at $41.50.

Aeropostale (NYSE: ARO) reported a loss of $0.52, in the face of an expected loss of $0.72, on revenues of $359.9 million-- analysts were expecting a higher number of $409.44 million. RBC has downgraded the stock and a cheap stock is now even cheaper. $3.58 is the low Friday morning and resistance is around $4.30-$4.40.

GameStop (NYSE: GME) had a very decent quarter. Resistance is around $40 and as for the momentum needed to go that high, it's highly unlikely. $39.58 is the pre-market high to watch. There doesn't appear to be any support until the stock slides back to the $36 handle.

Foot Locker (NYSE: FL) reported an earnings beat of 5.71 percent for Q1 with $1.11 EPS versus $1.05 estimates; revenue of $1.87 billion versus $1.79 billion estimates.

Foot Locker is trading at its all-time high in the pre-market, up $1.00, and is above its previous high of $49.63 on May 13. With the nice round number of $50 being so close, there is the potential for some nice paper to come into the stock, as is the norm with these round psychological levels.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Benzinga PreMarket Prep Dennis Dick Joel ElconinRetail Sales Pre-Market Outlook Best of Benzinga