Real Estate Market Turmoil Looms As Tech Giants Flee Offices: Watch These 5 Stocks, Short Sellers Circling For Potential Collapse

The great exodus from workplaces caused by the COVID-19 pandemic and the rising adoption of remote or hybrid work is claiming a victim in the market: commercial real estate.

It could be just the start of a prolonged sector turmoil.

The latest news adds fuel to the fire as Microsoft Corp (NASDAQ: MSFT) joins the ranks of tech giants looking to sublease its office space in Manhattan’s Times Square.

Major technology companies, including Alphabet Inc. (NASDAQ: GOOG) (NASDAQ: GOOGL), Meta Platforms Inc. (NASDAQ: META) and Amazon.com, Inc. (NASDAQ: AMZN) are also scaling back their real estate footprints — and this trend shows no signs of abating.

Tesla Inc. (NASDAQ: TSLA)'s CEO Elon Musk further intensified concerns surrounding commercial real estate with his tweet on May 29. Musk stated, "Commercial real estate is melting down fast. Home values next," indicating a potential ripple effect in the real estate market.

Return To Office Struggles, Creating Downside Pressure On Commercial Real Estate Prices: According to The Flex Report, the share of people working full time at the office dropped from 49% to 42% in the second quarter of 2023, intensifying challenges faced by the industry.

Office real estate prices have declined 15% over the past year, according to Green Street Commercial Property Price Index.

Peter Rothemund, co-head of strategic research at Green Street, suggested that this may not mark the end of the slump. “There’s not much transacting these days because buyers and sellers can’t seem to agree on pricing," he said, adding that "these situations eventually resolve themselves, and usually it’s in favor of the buyers."

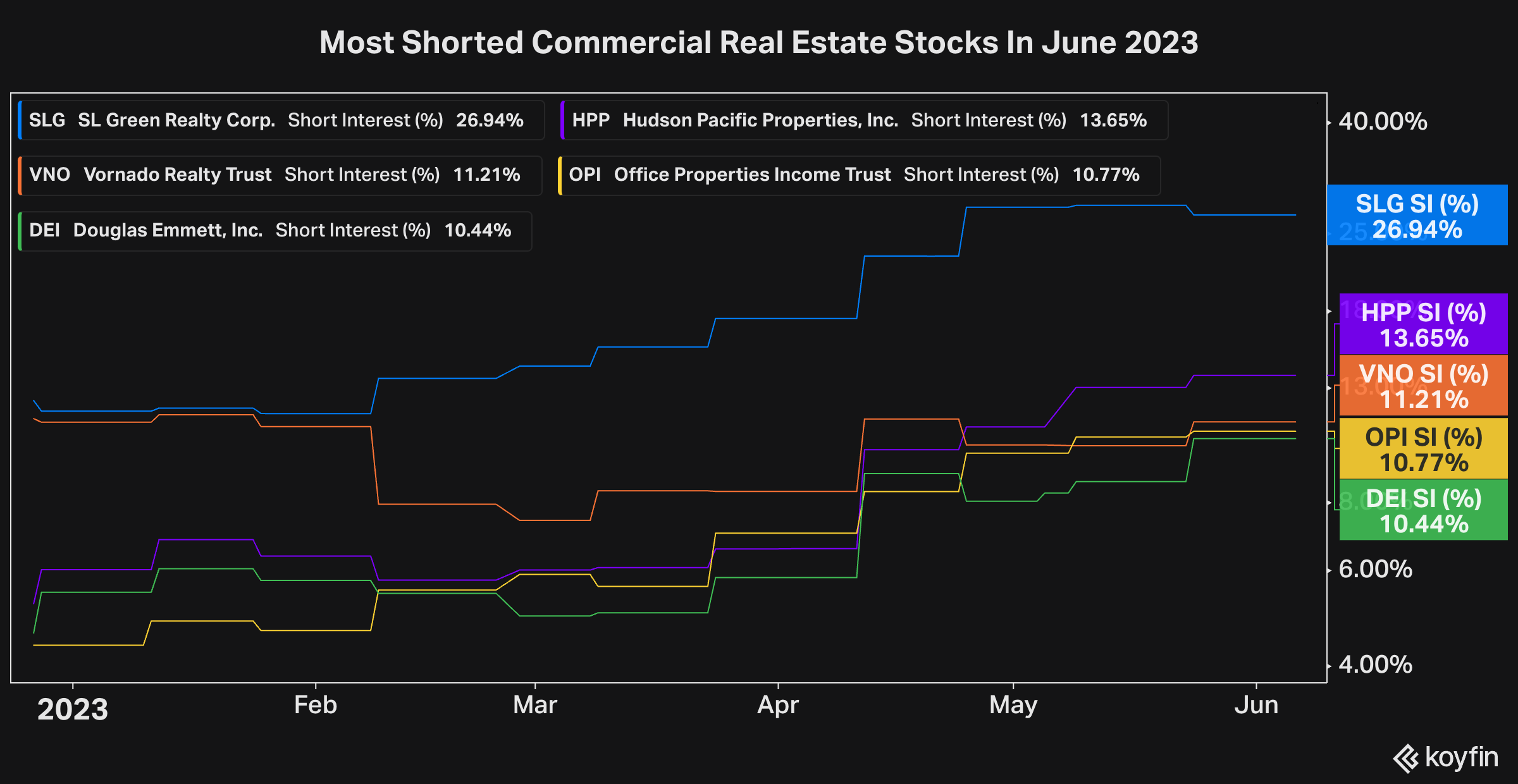

Short Interest Rising: 5 Commercial Real Estate Stocks in Focus

SL Green Realty Corp. (NYSE: SLG)

- Description: A leading real estate investment trust (REIT) focused on owning, managing and developing commercial properties in New York City.

- Market cap: $1.71 billion

- Performance year-to-date: down by 21.7% as of June 7, 2023

- Current price vs. median analysts' price target: 3.67% higher

- Short interest (as % of outstanding shares): 26.9%

Hudson Pacific Properties, Inc. (NYSE: HPP)

- Description: A real estate company specializing in acquiring, repositioning, and operating office and studio properties in West Coast markets.

- Market cap: $777 million

- Performance year-to-date: down by 44% as of June 7, 2023

- Current price vs. median analysts' price target: 4.5% higher

- Short interest (as % of outstanding shares): 13.65%

Vornado Realty Trust (NYSE: VNO)

- Description: One of the largest owners and managers of commercial real estate in the U.S., with a diverse portfolio of office, retail and residential properties.

- Market cap: $3.18 billion

- Performance year-to-date: down by 25% as of June 7, 2023

- Current price vs. median analysts' price target: 6% lower

- Short interest (as % of outstanding shares): 11.2%

Office Properties Income Trust (NASDAQ: OPI)

- Description: A REIT that owns and operates a portfolio of office buildings primarily leased to government tenants across the U.S.

- Market cap: $397 million

- Performance year-to-date: down by 38.7% as of June 7, 2023

- Current price vs. median analysts' price target: 23% higher

- Short interest (as % of outstanding shares): 10.8%

Douglas Emmet Inc (NYSE: DEI)

- Description: Real estate investment and property management company with a focus on office and multifamily properties in high-demand markets like Los Angeles and Honolulu.

- Market cap: $2.57 billion

- Performance year-to-date: down by 18% as of June 7, 2023

- Current price vs. median analysts' price target: 1.5% lower.

- Short interest (as % of outstanding shares): 10.4%

Chart To Watch: Speculators Have Increased Their Short Bets On CRE Companies This Year

Source: Koyfin

Photo: Shutterstock

Latest Ratings for SLG

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Deutsche Bank | Upgrades | Hold | Buy |

| Dec 2021 | Morgan Stanley | Maintains | Equal-Weight | |

| Dec 2021 | Truist Securities | Maintains | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: REIT Short Sellers Short Ideas Price Target Small Cap Top Stories Economics Analyst Ratings Best of Benzinga