Marriott International Stock At New All-Time-High Due To Pent-Up Demand For Tourism

Marriott International Inc (NASDAQ:MAR) stock made new all-time highs on Jan. 8 as it closed above $228, up 2.6% for the day.

The high-end of the 52-week range for the stock now stands at $228.29. The hospitality sector firm known for its hotels, resorts, and lodging facilities has been buoyed through 2023 by post-covid tailwinds.

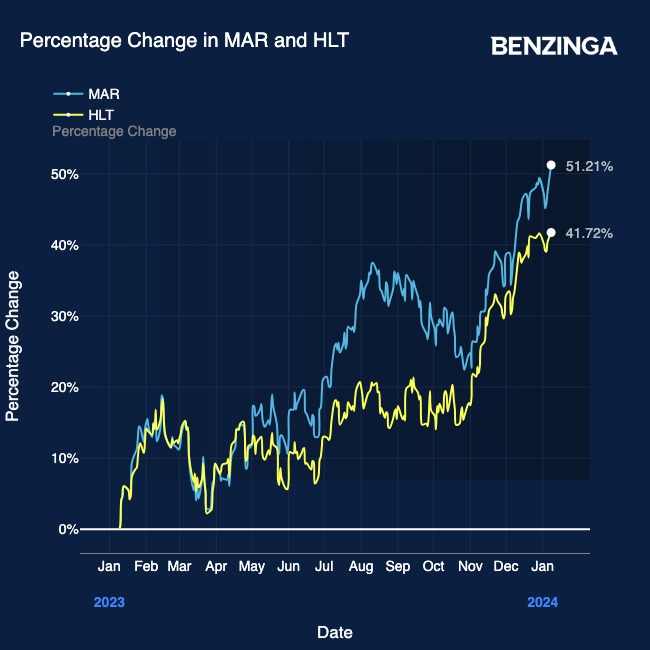

Pent-up demand for tourism steered the stock up over 50% over the past year, surpassing its peer Hilton Worldwide Holdings Inc (NYSE:HLT) and the S&P 500.

For the past year, Marriott International’s stock has been fueled by:

- Pent-up post-covid demand helping the top line.

- Operational excellence protecting the bottom line of the business.

Marriott’s business fundamentals remain solid. The company has maintained impeccable top-line growth amid its sustained expansion. Marriott also has adequate liquidity to cover its operations and dividends while increasing its operating capacity.

Also Read: Hotel Brand Marriott Tightens Annual EPS Forecast; Records 12% Topline Growth In Q3

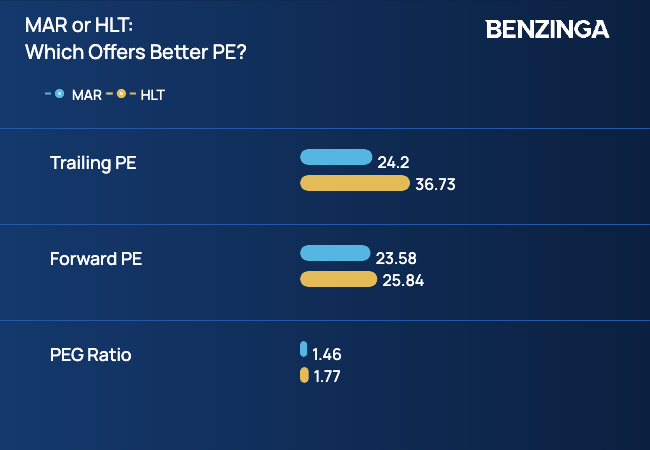

On the valuation front, Marriott International stock currently offers better value relative to its close competitor, Hilton Worldwide Holdings. On a forward P/E basis, the difference gets marginal.

However, analyst consensus on the stock does not indicate an upside from here. Jefferies analyst David Katz, who recently rated the stock on Jan. 2 maintained a Hold rating with a price target of $227.

Consensus Wall Street analyst ratings indicate an average price target of $213.84, 6.31% below the new all-time-high level the stock just made.

Could it be time to take profits off the table?

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert Ideas Stories That Matter tourismTop Stories