-

A New Small-Cap ETF To Consider

Friday, December 9, 2016 - 5:12pm | 444Read More...This has been a very good year for major small-cap benchmarks. For example, the widely followed Russell 2000 Index and the S&P SmallCap 600 Index are up 24 percent and 29 percent, respectively, year-to-date. Some small-cap strategies are doing even better, namely small-cap exchange-traded funds...

-

Wonderful Wearables Get Their Own ETF

Friday, December 9, 2016 - 4:07pm | 433Read More...The wearable technology trend has been legitimized in the world of exchange-traded funds, as the first ETF dedicated to public companies that make or sell wearable devices debuted Friday. The WEAR ETF (BATS: WEAR) is the rookie wearable technology ETF. WEAR tracks the Wearables Index, a benchmark...

-

A Nifty New Emerging Markets ETF

Tuesday, November 22, 2016 - 9:28am | 457Read More...Emerging markets equities hit a rough patch following the U.S. presidential election, but for the bulk of this year, stocks in developing economies have been among the world's most resurgent asset classes. That sentiment extends to emerging markets dividend payers as lower volatility developing...

-

Happy Customers, Happy ETF Investors?

Wednesday, November 2, 2016 - 10:46am | 387Read More...Obviously, there are times when investors favor airline stocks, banks and cable companies — all industries that have notoriously poor customer service track records. Financial markets prove it is possible for a company to engage in poor customer relationships and still see their shares rise....

-

A Conservative Approach To Bond ETFs

Thursday, October 13, 2016 - 2:38pm | 559Read More...Many fixed income investments are viewed as conservative, but in today's potentially turbulent bond markets, it does not hurt to get some assistance. The SPDR DoubleLine Total Return Tactical ETF (NYSE: TOTL) is an exchange-traded fund that can do just that. Taking On TOTL TOTL, Jeff Gundlach...

-

With Muni ETFs, Focus On Fundamentals

Wednesday, October 12, 2016 - 9:48am | 576Read More...The combination of interest rates remaining lower for longer and investors demanding more income and yield have been driving forces behind the resurgence of municipal bond exchange-traded funds this year. The Case Of The Munis Municipal ETFs have been popular destinations this year as investors...

-

A Rookie ETF To Consider

Thursday, September 1, 2016 - 10:11am | 495Read More...There is almost always plenty to talk about in the world of exchange-traded funds. Two of this year's more prominent topics include the resurgence of emerging markets debt and the ongoing struggles of many new ETFs, although there is no shortage of such funds. Looking Into EMTL While the field...

-

Legg Mason Introduces International High Dividend, Low Vol ETF

Friday, July 29, 2016 - 3:27pm | 641Read More...Earlier this week, Benzinga highlighted the Legg Mason Low Volatility High Dividend ETF (NASDAQ: LVHD), noting that this high-flying exchange-traded fund is benefiting from the dividend and low volatility factor themes. LVHD And LVHI The Legg Mason Low Volatility High Dividend ETF is proving to be...

-

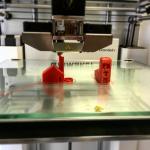

Print This: A 3D Printing ETF Comes To Town

Wednesday, July 20, 2016 - 11:50am | 537Read More...A couple of years ago, 3D printing stocks were all the rage. That phenomenon cooled, but revenue growth estimates for the industry over the next several years are staggering. Fortunately, if 3D printing gets scorching hot again, investors will not to play stock picker within the group because they...

-

Shareholder Rewards For Investors In This New ETF

Friday, July 15, 2016 - 3:04pm | 503Read More...Cambria Funds is taking the cornerstone concepts of the Cambria Shareholder Yield ETF (Cambria ETF Trust (NYSE: SYLD)) and the Cambria Foreign Shareholder Yield ETF (NYSE: FYLD) and putting them to work in the new Cambria Emerging Shareholder Yield ETF(BATS: EYLD). In The Blink Of An Eye The new...

-

Investors Just Can't Get Enough Of Bond ETFs

Friday, July 1, 2016 - 4:13pm | 465Read More...At the halfway point of 2016, it is starting to sound like a broken record, but advisors and investors are enthralled by fixed income exchange-traded funds. Year-to-date, four of the top 10 asset-gathering ETFs are bond funds and investors are pouring into plenty of others that are outside the top...

-

Winklevoss Twins Approach BATS Global Markets To List Bitcoin ETF

Thursday, June 30, 2016 - 10:23am | 341Read More...Cameron and Tyler Winklevoss are notable Bitcoin investors and run a family office called Winklevoss Capital Management, which invests in various asset classes. The twin brothers also own approximately 1 percent of all bitcoins in circulation through their family office. According to a regularity...

-

Why This Could Be The Preferred ETF Of The Future

Tuesday, June 21, 2016 - 3:29pm | 526Read More...Preferred stocks and the relevant exchange-traded funds are once again a popular destination for income investors thanks in large part to the Federal Reserve continually holding off on raising interest rates to this point in the year. High Quality Preferred Joins BATS Relative to other corners of...

-

Right After MSCI Snub, A New A-Shares ETF Debuts

Thursday, June 16, 2016 - 8:27am | 508Read More...A day after index provider Msci Inc (NYSE: MSCI) opted against including stocks trading on mainland China, also known as A-shares, in its major emerging markets benchmarks, BlackRock, Inc. (NYSE: BLK)'s iShares unit launched a new exchange-traded fund tracking A-shares. Picking Up The Slack The...

-

Cash Flow Emphasis Bolsters This Corporate Bond ETF

Wednesday, June 15, 2016 - 3:41pm | 574Read More...A simple view of investment-grade and high-yield corporate bonds is these are instruments sold to investors who, in most cases, are not looking to take on significant. Hence why creditworthiness is an integral part of evaluating corporate bonds. After all, investors in these bonds not only want...