-

Brent Poised To Post Fourth Weekly Loss

Friday, March 21, 2014 - 7:34am | 296Read More...Brent crude oil was set to end its fourth consecutive week on a loss as a strong dollar and weak demand pressured prices. The commodity traded at $106.24 at 5:55 GMT on Friday morning. With severe winter weather coming to a close, a seasonal demand slump has weighed on crude prices and driven US...

-

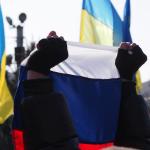

#PreMarket Primer: Friday, March 21: US Expands Russian Sanctions

Friday, March 21, 2014 - 7:17am | 1139Read More...The US expanded the list of wealthy Russians being targeted by economic sanctions in order to put more pressure on Moscow to heed international calls for diplomacy in Ukraine. Russian President Vladimir Putin has been unresponsive and went ahead with the procedure to annex Crimea this week....

-

Market Wrap For March 20: Investors Showing No Post-Fed Decision Hangover

Thursday, March 20, 2014 - 4:44pm | 1946Read More...U.S. stocks recovered most of Wednesday's losses after Fed Chief Janet Yellen spooked the markets a bit by hinting a rate hike could occur as soon as six months after the central bank terminates its quantitative-easing program. Investors found positives in several economic reports released...

-

Brent Gains On Fed's Confidence

Thursday, March 20, 2014 - 7:10am | 321Read More...Brent crude oil prices picked up on Thursday after the US Federal Reserve was more positive than expected about the nation’s economic strength. The commodity traded at $106.03 at 6:21 GMT on Thursday morning. CNBC reported that Fed Chair Janet Yellen closed her first meeting as head of the US...

-

Euro Loses Against A Stronger Dollar

Thursday, March 20, 2014 - 7:10am | 316Read More...The euro lost a full cent overnight after the US Federal Reserve meeting ended with investors worried that the bank would raise its key interest rate sooner than expected. The common currency traded at $1.3836 at 6:00 GMT on Thursday morning. Reuters reported that US stocks and bonds slid while...

-

#PreMarket Primer: Thursday, March 20: Fed Surprises With Talk Of Tightening Sooner Than Expected

Thursday, March 20, 2014 - 7:06am | 1038Read More...US bond yields soared and the dollar strengthened after the US Federal Reserve announced that it could begin to increase its key interest rate sooner than expected. Fed Chair Janet Yellen wrapped up her first meeting as head of the bank by saying the bank plans to finish tapering its asset...

-

Market Wrap For March 19: Yellen Hints of Higher Rates & Sooner Than Expected End To Taper

Wednesday, March 19, 2014 - 6:03pm | 2470Read More...The Fed announced that it will increase its tapering by a further $10 billion in addition to dropping the 6.5 percent unemployment rate threshold which has been the target rate to hike the Fund Funds rate. Thirteen of 16 Fed officials expect the Fed Funds rate to rise by the end of 2015. The...

-

Should Investors Be Focusing More On China?

Wednesday, March 19, 2014 - 3:44pm | 1057Read More...For the past week or so, the market has been focused on Crimea -- and what could happen if the geopolitical tensions there continued to mount. Would the referendum take place? Would Russia decide to expand into eastern Ukraine? Would the West do anything besides raise a stink? Was there really...

-

Market Wrap For March 18: Markets Positive Despite Crimea Concerns

Tuesday, March 18, 2014 - 4:35pm | 2079Read More...U.S. stocks extended Monday's gains despite lingering concerns over Crimea. Russian President Vladimir Putin has authorized a draft treaty for Crimea to join Russia. U.S. economic data showed that housing starts in February remain healthy with modest gains. The Dow gained 0.55 percent,...

-

Top Trending Tickers On StockTwits For March 18

Tuesday, March 18, 2014 - 9:33am | 601Read More...Here's a look at the top tickers trending on StockTwits.com. S&P 500 futures: What's in store for today? Stock index futures were bouncing around from slightly negative to marginally positive territory prior to the opening bell. Investors have a lot on their plate including an FOMC meeting...

-

Bargain Hunters Boost Brent Prices

Tuesday, March 18, 2014 - 7:10am | 302Read More...Bargain hunters took Brent crude oil prices higher over night after the commodity lost almost $2 on Monday. Brent traded at $106.65 at 7:25 GMT on Tuesday as investors turned their attention from the problems in Ukraine to the global demand outlook. After Crimean citizens voted to succeed from...

-

#PreMarket Primer: Tuesday, March 18: Market Tension Over Crimea Fades For Now

Tuesday, March 18, 2014 - 7:04am | 1159Read More...Fears of military action in Ukraine subsided for the time being and gave markets some breathing room to focus on economic data after the result of Crimea’s weekend vote to succeed from Ukraine and join Russia created uncertainty around the globe. Russian President Vladimir Putin seems to have...

-

Crimea Vote Props Up Eastern Europe ETFs

Monday, March 17, 2014 - 3:20pm | 416Read More...Overseas financial markets opened strongly on Monday morning as news of the weekend referendum in Crimea to formally join Russia was passed with an overwhelming majority vote. The Crimean peninsula is seen as a key strategic asset for Russia in both their military and economic endeavors which...

-

Markets Enter Unknown Territory as U.S., EU Begin Imposing Sanctions On Russia

Monday, March 17, 2014 - 11:36am | 508Read More...The next several weeks could be a critical and historic time for U.S. and European economic ties with Russia, as linked to the ongoing crisis in Crimea and Ukraine. On Monday,The White House outlined its first sanctions against Moscow, following Russia's de facto occupation of Crimea and Sunday...

-

Should Traders Be Worried About Crimea?

Monday, March 17, 2014 - 11:22am | 1436Read More...It is clear that the focus of the stock market remains squarely on the geopolitical situation in Ukraine/Crimea/Russia (NYSE: RSX). What is not quite so clear is why this actually matters to traders. Before we go any further on this topic, let me first state that this missive is not a...