Winter's Wild Card: How Weather And Politics Could Fuel Unexpected LNG Market Volatility

Liquefied Natural Gas (LNG) has emerged as a central player in the energy market, particularly since the onset of the Ukraine/Russia conflict. As Russian natural gas supplies were disrupted due to the conflict, the United States stepped into a leading role in global LNG supply, a position expected to influence trade for years. Despite Europe and Asia having peak natural gas inventories going into winter, even slight hints of supply disruptions from weather or geopolitical tensions could benefit domestic producers over the next three months, with minimal downside premium currently factored into prices.

For some background, LNG is created by cooling natural gas to -260 degrees Fahrenheit, transforming it from a gas to a liquid. This process reduces its volume by 600 times, enabling transportation in designed tankers. Upon reaching its destination, LNG undergoes regasification, turning back into gas for residential and industrial use. Now that we have the background, here’s the reason to keep it on your radar.

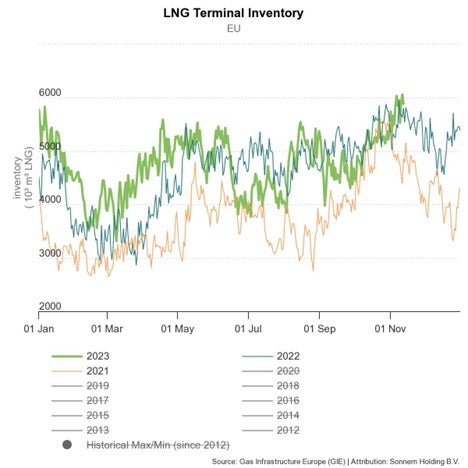

Traditionally, natural gas demand spikes in colder months for heating and industrial energy needs. Even before the Ukraine/Russia conflict, countries will build natural gas reserves in anticipation of this increased demand. However, winter's unpredictability can strain these reserves.Currently, the natural gas market anticipates a mild winter in the Northern Hemisphere, hence the lack of a significant price premium for natural gas, excluding seasonal factors. Yet, stocks like Cheniere Energy (AMEX: LNG) with LNG exposure remain priced at a premium, despite market expectations of a mild winter and stable geopolitical conditions. What remains unpriced, however, are potential supply disruptions.

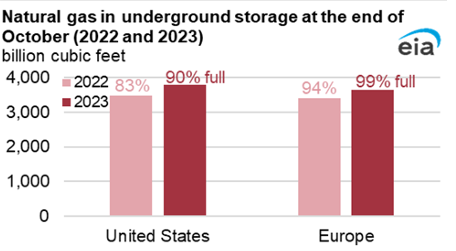

In recent months we have seen a dip in energy demand due to “pseudo” demand destruction and China's tepid COVID-19 reopening. But an aggressive economic stimulus by China could spike natural gas demand, pressuring the market. While China largely sources its natural gas from Russia through long-term contracts, spot market supplies during peak winter months still rely on the U.S. and Australia. This reliance might compel other regional players to seek readily available supplies, potentially sparking demand. According to the Energy Information Administration (EIA), the U.S. accounted for 34% of global spot and short-term LNG volumes. Despite proactive measures by the U.K. and the E.U. to bolster their stockpiles, their risk of supply disruptions remains with approximately 65 days of natural gas supplies as of October 31, per EIA data.

The LNG market is currently factoring in an ideal scenario of favorable winter conditions, minimal geopolitical disruptions, and a smooth supply chain. However, any deviation from these conditions could significantly impact market dynamics.

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

Posted-In: contributors energy Expert Ideas LNGMarkets Trading Ideas General