TotalEnergies: Why I Expect Dividend Growth To Slow From Recent Years

TotalEnergies (NYSE:TTE) is a French company with over 100 years of experience in the oil industry and a presence in more than 130 countries.

It is considered one of the major oil companies, with a leading position in the upstream, midstream, and downstream oil segments.

The Company also plays a significant role in the LNG market and has increased its capital expenditures on low-carbon energies to strengthen its position in this industry.

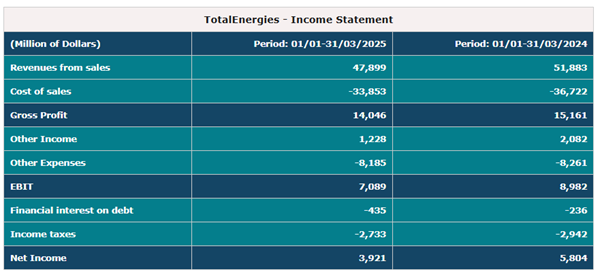

In the first three months of 2025, Totalenergies recorded "revenues from sales" for an amount of $47,899m ($51,883m for the same period of 2024) and "cost of sales" for an amount of $33,853m ($36,722 in 2024).

Gross Profit result was $14,046m, EBIT was recorded at an amount of $7,089m while the net income for the period was $3,921m.

TotalEnergies primarily focuses on the exploration and production of oil and gas.

However, in recent years, the French company has restructured its operations to align with its long-term strategy of increasing low-carbon activities and aims to become a net-zero company by 2050.

In 2024, Totalenergies was organised into five business segments:

- “Exploration & Production” includes the oil and natural gas exploration and production activities (excluding LNG) in about 50 countries and the carbon neutrality activities.

- “Integrated LNG” includes the integrated gas chain, biogas, hydrogen and gas trading activities.

- “Integrated Power” includes renewable energy activities, electricity generation, storage, trading, and B2B and B2C marketing activities.

- “Refining & Chemicals” includes refining, base petrochemicals, polymer derivatives, biomass transformation, and trading and shipping activities.

- “Marketing & Services” includes the global supply and marketing activities of oil products and services, low-carbon fuels, and new energies for mobility.

TotalEnergies is a stock usually selected by investors seeking a reliable dividend income source at low risk and at a cheap price.

In this article, we analyse the dividends the French company has offered to its shareholders since 2012 and the returns that investors can reasonably expect in the coming years.

Dividend Analysis

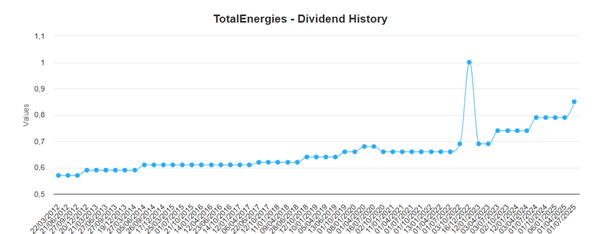

TotalEnergies has a solid tradition of dividend returns.

In the period 2012-2025, the French Company has offered increasing dividends, from 0.57 Euro paid in 2012 to 0.85 Euro the Company will pay in July 2025 (+49.12%).

The Company also paid dividends during difficult times (e.g. COVID) thanks to a strong balance sheet and financial discipline.

Since 2012, Totalenergies has offered the following annual dividend increases to its shareholders:

- 3.13% and 4.48% in 2018 and 2019

- 6.05%, 6.64% and 6.52% in 2022, 2023 and 2024

- Up to 2.46% (2013) in the other periods.

(The calculation does not consider the interim dividend of 1 Euro paid in 2022).

In 2020 (COVID), the Company paid the dividends with a decrease of 1.52% compared to 2019.

In July 2025, TotalEnergies will pay a final 2024 dividend of 0.85 Euro per share resulting in an increase for the 2024 dividend to 3.22 Euro per share compared to the 2023 dividend. Furthermore, the Board of Directors also confirmed a shareholder return policy for 2025 targeting >40% CFFO payout, which will combine interim dividends increasing to 0.85 Euro per share and $2 billion of share buybacks per quarter, a level which will be pursued under reasonable market conditions.

The “Exploration & Production” segment: the Company’s primary cash generator

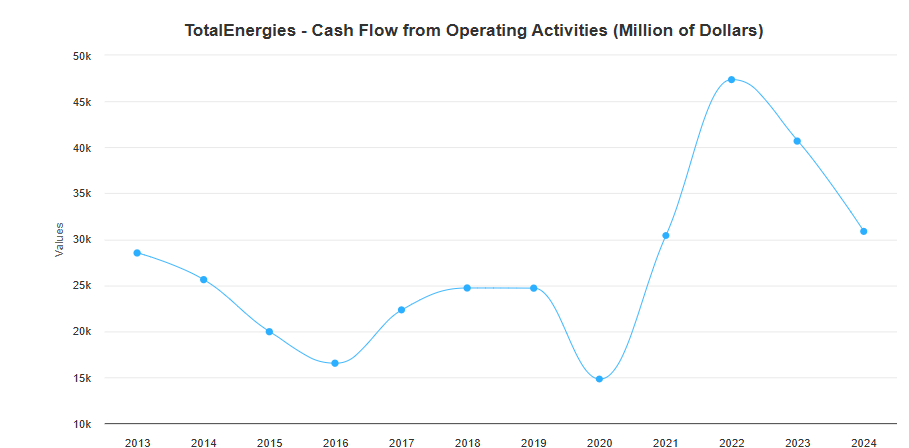

Historically, the French Company has offered increasing dividends thanks to its capacity to generate solid cash flows from its core business.

In the period 2012-2024, Totalenergies generated “cash flow from operating activities” in the range of 15-25 billion dollars (based on the cycle).

In 2024, the French company recorded 30.854 million of dollars of cash flow from operating activities:

- 56.36% from the "Exploration & Production" segment

- 16.8% from the "Integrated LNG" segment

(Only 1% was generated by the "Integrated Power" segment).

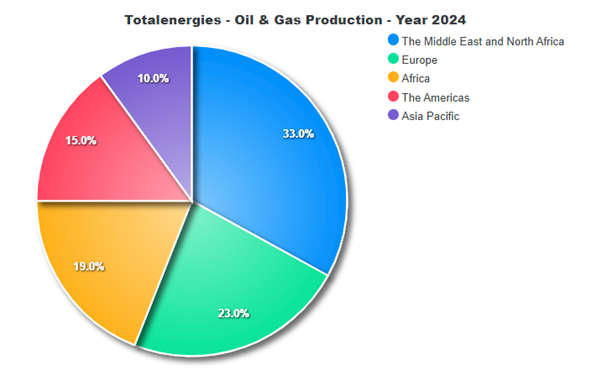

With regard to the upstream activities, the production reached 2.4 Mboe/d, including 1.5 Mboe/d of oil and 1.1 Mboe/d of gas around different countries.

The Company’s portfolio has a low breakeven point, in line with its objective of keeping it below $30/b (Totalenergies’ organic cash breakeven point before dividend was $25.4/b in 2024), which ensures the competitiveness of its resources.

For its Upstream Oil & Gas assets in 2024, the French Company has the lowest production cost per barrel of around $4.9/boe among its peers (e.g., BP PLC (NYSE: BP), Chevron (NYSE:CVX), ExxonMobil (NYSE:XOM), Shell (NYSE:SHEL).

Although the Company has established a long-term strategy to move from oil to low-carbon energies, Totalenergies does not plan a quick retreat from oil.

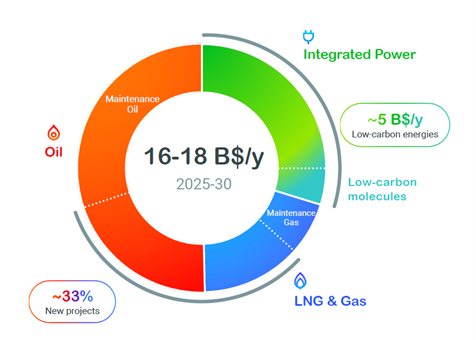

In 2025, the French firm expects net investments of $17-17.5 billion.

Through cycles, Totalenergies expects net investments between $14 billion and $18 billion per year along the following lines:

- 33% of net investments in low-carbon energies

- 20% of net investments in natural gas, mainly LNG

- 45% of net investments in the oil chain.

With regard to CAPEX investments on oil, Totalenergies is focusing on selecting projects that can offer higher margins and generate more cash flow.

In line with this strategy, TotalEnergies has increased the selectivity of its exploration investments, with a greater focus on oil prospects with low technical costs, low GHG emissions, and short timelines for production.

The Company assesses its EP investment projects by considering an environment of $50/b and a CO2 price of $100/t from 2025 in all countries and focuses on projects with costs of less than $20/boe or where the break-even is less than $30/b and where GHG emissions (Scope 1+2) are less than the average of its portfolio in 2023.

In addition to those criteria, the French Company intends to balance its exploration investments among mature areas, emerging provinces, and frontier basins:

- 35% in mature areas, which should be situated near existing producing fields and infrastructures with relatively low levels of geological risk.

- 50% in emerging provinces, which should be in under-explored areas where the presence of hydrocarbons is already proven.

- 15% in frontier basins where the highest resource potential exists.

Based on this analysis, the “Exploration & Production” segment will continue to serve as the Company’s primary cash generator for many years, influencing the dividends that TotalEnergies can provide to its shareholders.

Is a 7% increase in dividends a reasonable expectation for the next 5 to 7 years?

If we compare the dividends offered by the Company and the cash flow it generated from its operating activities, we note that:

- TotalEnergies recorded the all-time high result in “cash flow from operating activities” in 2022; the French Company distributed an interim dividend to its shareholders that year.

- In 2023 and 2024, cash flow generation results exceeded the normal trend. Over the last two years, Totalenergies provided its two highest dividend increases at 6.64% and 6.52%.

Totalenergies achieved record earnings and generated an all-time high of $46 billion in cash flow in 2022.

All segments contributed to stronger cash flow generation:

- $26 billion from E&P (+39% on higher oil and gas prices and despite the UK windfall tax profit, which represented $1 billion in 2022).

- $10 billion from LNG, a record high.

- $10 billion from the downstream activities, driven by the contribution from the refining of close to $8 billion (more than 2.5 times 2021 contribution), thanks to a higher refining utilization rate that allowed Totalenergies to capture high margins.

- $1 billion from the Integrated Power business unit.

The cash flow was allocated as per the following:

- $17 billion return to shareholders: $7.3 billion of ordinary dividend plus $7 billion of buybacks and $2.7 billion of special dividend that was paid in December.

- $16.3 billion for investment.

- $14.5 billion of debt reduction, which cut company’s gearing by more than half, to 7% end of 2022 compared to 15.3% end of 2021.

An exceptional macroeconomic situation supported these outstanding results.

In February 2022, Russia invaded Ukraine, and oil prices jumped above $100 a barrel and increased to $127 per barrel on the 8th of March before falling back to below $100 in June of that year, where they have remained since.

This event also significantly impacted the LNG market; the Russia-Ukraine war drove gas and LNG prices to never-seen-before levels as Europe scrambled to decouple from Russian pipe gas by importing an additional 50 million tons of LNG in 2022. This represents more than 10% of the market.

In this scenario, Totalenergies was in a favourable position: in 2022, the Company managed 48 million tons of LNG, 12% of the market; the French firm was the first US exporter and first European regas holder.

Thanks to the results recorded in 2022, Totalenergies significantly improved the solidity of its balance sheet and supported significant dividend increases in 2023 and 2024.

In our opinion, the macroeconomic scenario in the coming years will not offer the same opportunities for big oil companies.

Oil quotations are expected to be between 60 and 80 dollars per barrel in the next 5-7 years; they are unlikely to reach 100 dollars.

Also, LNG and refining activities, two important businesses for Totalenergies, are not expected to offer the same opportunities as in 2022.

LNG Market

In 2024, the “Integrated LNG” segment generated 16.8% of the Company’s cash flow.

CAPEX investments in new LNG projects will increase the percentage of cash flow that Totalenergies will generate from this business unit.

However, the LNG market is not expected to offer the same opportunities it did in 2022 because the price should slow down in the period 2027-2029 due to increasing production of 50 million tons of new capacity per year (+30% increase in three years) and reduce the potential profit for companies in this sector.

Asia represents about 70% of the world’s LNG demand and is expected to be a major outlet for the next wave of LNG.

- The LNG market in Asia recorded a growth of 8% per year during the period: 2015-2021.

- It recorded a dip in demand in 2022 when Asia had to compete for available LNG cargos with Europe.

- Since then, the Asian market recorded a renewed demand growth.

Analysts expect a strong demand pull from the region between 2025 and 2030 because the expected wave on the supplied side will create softening prices, which will trigger additional demand from price-sensitive countries such as India and South-East Asia, as it has happened in the past.

Refining market

In 2022, the Refining business generated 8 billion in cash flow.

The result was supported by supply shortages caused by Russia’s invasion of Ukraine, disruptions to Red Sea navigation by Houthi militants, and a significant recovery in demand following the COVID-19 pandemic.

The macroeconomic scenario has changed now: the industry is currently recording a significant oversupply, which is significantly stressing the profit margins.

There are three main reasons to explain the actual oversupply:

- In 2022 and 2023, when margins were positive, some companies that planned to restructure their refineries, stopped the process. This situation increased the supply more than expected.

- Some old Chinese refineries called the “teapots”, which should be shut down, are still cooking.

- New refineries coming on stream in Africa, the Middle East, and Asia have increased the supply of refinery products.

Final Comment

TotalEnergies has a solid tradition of dividend returns.

Historically, the French Company has offered increasing dividends thanks to its capacity to generate solid cash flows from its oil & gas businesses.

Although the Company has established a long-term strategy to move from oil to low-carbon energies, Totalenergies does not plan a quick retreat from oil.

Based on this analysis, the “Exploration & Production” segment will continue to serve as the Company’s primary cash generator for many years, influencing the dividends that TotalEnergies can offer to its shareholders.

In our opinion, dividend distribution in the last three years have been significantly influenced by an exceptional macroeconomic situation which is unlikely to happen in the coming years.

For this reason, we do not believe that the French Company will be able to maintain a 7% increase in the mid-term period. Based also on its track history, we believe that an increase of 3-5% is a more reasonable expectation for investors.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Posted-In: contributors Expert IdeasDividends Commodities Opinion Trading Ideas