Equity Moves on Sell-Side Sentiment for July 19, 2012

Following three days where 20-plus stocks were re-rated into daily Buy- or Sell-equivalent views, sell-side analysts had a light day. Five stocks received new bullish views (upgrades to or initiations with Buy, Overweight or Outperform) and three others were subject to bearish ratings actions (downgrades to, or initiations with, Sell, Underweight or Underperform).

Stocks with new bullish ratings are bought (a long position is established) whereas the ones with new bearish ratings are sold (a short position is opened). All transactions are completed at each stock's opening price. Positions are equal-weighted - each stock is bought or sold at equal total position values.

Such a portfolio does well when sold (shorts) stocks work their ways toward intraday lows and bought (longs) stocks continue towards intraday highs. These levels, so-called optimal price points, do not always occur simultaneously, but their average almost always will beat the major indices.

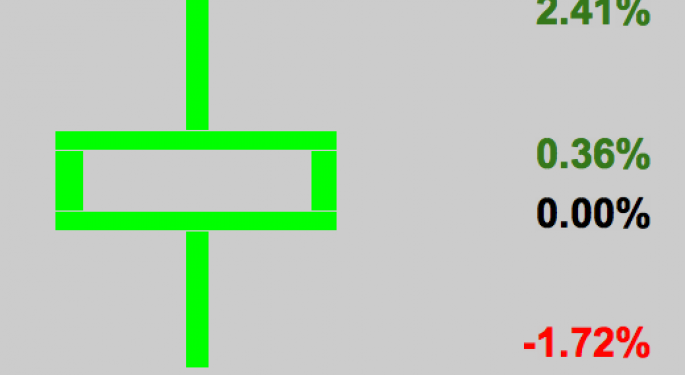

Today, that average equaled 2.34 percent. All eight stocks touched positive territory (shorts were down on the open, longs were up) for at least part of the session. The smallest such move was a positive 0.34 percent. The largest was 7.4 percent.

That move belonged to ISIS Pharmaceuticals (NASDAQ: ISIS). Benzinga Professional reported at 7:37 AM that Jefferies had downgraded the stock from Buy to Underperform. Therefore, ISIS shares joined our portfolio as a short today. The stock opened at $13.52 and reached a low of $12.52 at 11:11 AM.

Of course, what goes up, also goes down. All eight stocks also touched negative territory at one point or another in today's session. The worst price points (intraday highs for shorts and intraday lows for longs) averaged 1.72 percent, ranging from -0.54 to -3.50 percent.

Currently, the composite is up 0.36 percent, roughly in line with S&P, whereas the Dow Jones Industrial Average had added 27 points.

Latest Ratings for ISIS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Dec 2015 | Wells Fargo | Initiates Coverage On | Outperform | |

| Nov 2015 | Goldman Sachs | Initiates Coverage On | Neutral | |

| Nov 2015 | Barclays | Maintains | Equal-Weight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Dow JonesLong Ideas Short Ideas Downgrades Intraday Update Analyst Ratings Movers Trading Ideas Best of Benzinga