5 Stocks To Have On Your Radar Next Week

The following stocks are currently in the midst of strong trendsaccording to VantagePoint, an AI charting platform that uses intermarket analysis and artificial intelligence to predict future price action 1-3 days in advance. For a more detailed look at VantagePoint's charts, click here.

A couple of things to know in order to understand the charts below:

- Each chart is a 3-month chart. Candles represent one day of trading

- The blue line is a predicted moving average, and the black line is a simple 10-day moving average

- When the blue line crosses above the black, that's a bullish signal. When the black crosses over the blue, that's bearish

Garmin

Garmin Ltd. (NASDAQ: GRMN) has been in a clear uptrend since breaking out on August 29. The catalyst for that move was the acquisition of FitPlan, which was announced that morning. According to VantagePoint's two main indicators, GRMN is expected to continue moving higher. The neural index is green, and the three-day predicted moving average is well above the simple 10-day moving average, indicating a strong uptrend.

Teledyne Technologies

Teledyne Technologies Incorporatd (NYSE: TDY) has been in an uptrend since it had a bullish crossover on July 9. Since that day the stock is up nearly 20 percent and has continually made new all-time highs. VantagePoint's indicators are predicting continued upside for TDY as well.

TJX

TJX Companies Inc (NYSE: TJX) is in a little more precarious position than the first two. While the stock did have a big gap up after the company's Q2 earnings report on August 21, the trend appears to have weakened significantly over the last few days. VantagePoint's one-day predicted average appears to show a bearish crossover, and this is confirmed by the neural index's shift to red. Combined, these tell us we should be watching for more downside in TJX next week.

O'Reilly Automotive

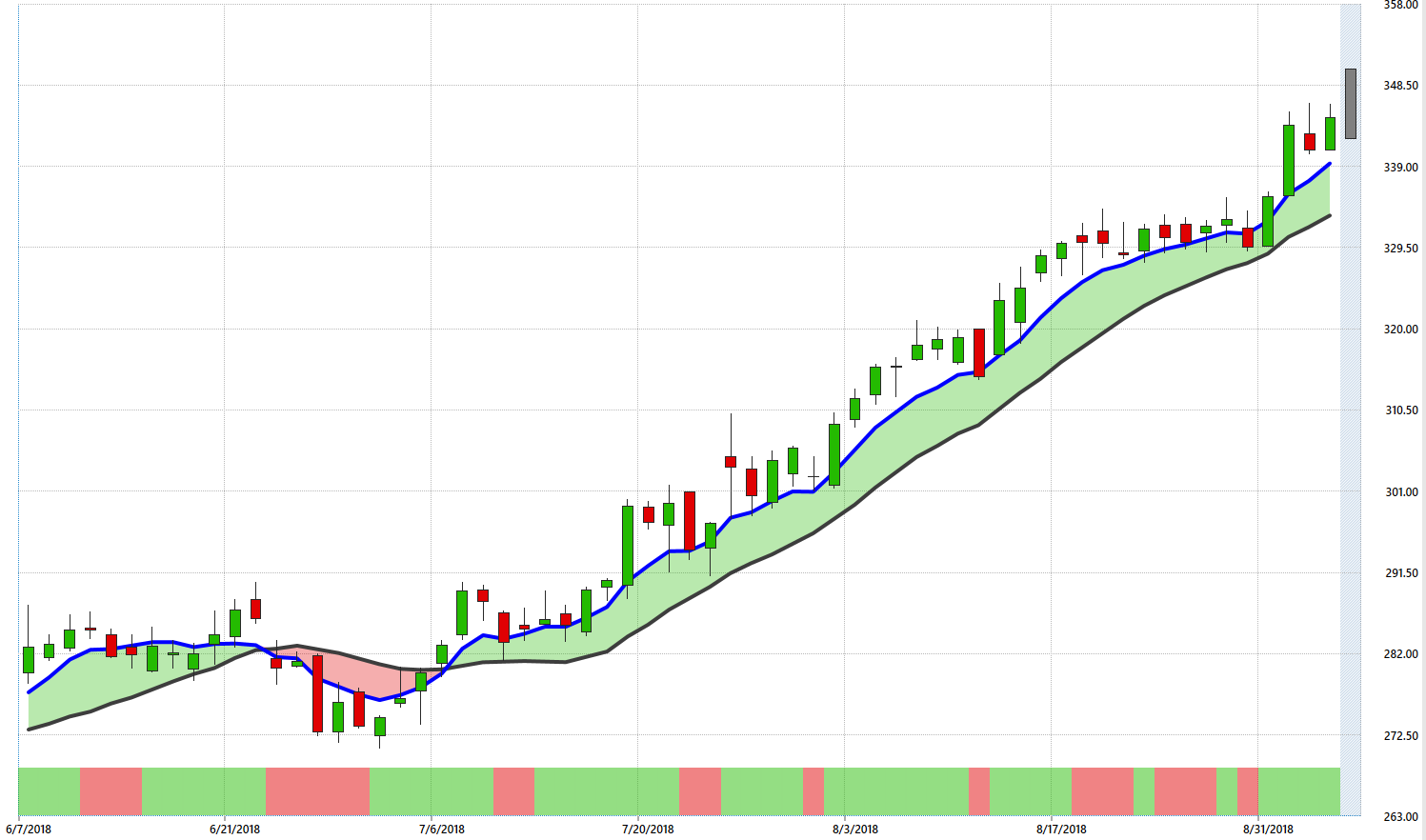

O'Reilly Automotive Inc (NASDAQ: ORLY) has been one of the best-performing stocks of 2018, and has been in a clear uptrend since July 6 according to VantagePoint. Despite some periods of weakness in the eight weeks since, the predicted moving average has not crossed the simple moving average. As long as these lines stay parallel, the uptrend remains intact.

Incyte

Incyte Corporation (NASDAQ: INCY) looks to have entered into a clear downtrend based on VantagePoint's indicators. INCY was in a clear uptrend beginning August 7, but that appears to have ended. VantagePoint's one-day predicted moving average has crossed over the simple moving average, indicating a clear change in trend. The neural index's shift to red confirms the beginning of the downtrend. Watch for more downside in INCY going forward.

VantagePoint is a content partner of Benzinga. For a free demo, click here. `

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: vantagepointLong Ideas Short Ideas Technicals Markets Trading Ideas General