Goldman Sachs, T-Mobile US, Corteva, And An ETF Rocketing Toward All-Time High On CNBC's 'Final Trades'

On CNBC’s "Halftime Report Final Trades," Jim Lebenthal of Cerity Partners named The Goldman Sachs Group, Inc. (NYSE: GS), saying IPOs are expected to start picking up.

On Tuesday, Goldman Sachs reported mixed financial results for the first quarter.

Jason Snipe of Odyssey Capital Advisors said he likes T-Mobile US, Inc. (NYSE: TMUS) here.

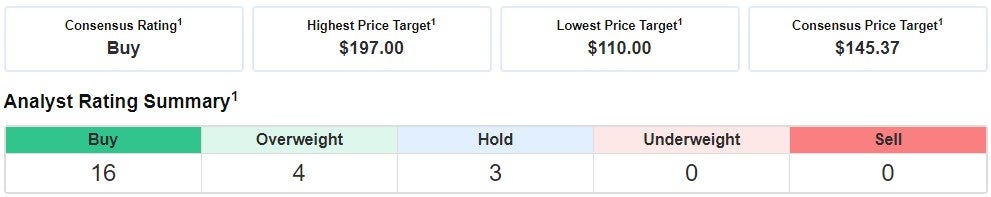

Analysts are bullish on TMUS, giving the stock a consensus Buy rating, according to Benzinga's analyst ratings data.

T-Mobile and Major League Baseball announced a new long-term deal, creating more 5G experiences for fans.

Don’t forget to check out our premarket coverage here

Stephanie Link of Hightower said Corteva, Inc. (NYSE: CTVA) has got great products. Adding that pricing power and their costs are coming down.

Corteva Agriscience and Bunge reported a collaboration to develop amino acid-enhanced soybeans.

Josh Brown of Ritholtz Wealth Management said iShares U.S. Aerospace & Defense ETF (NYSE: ITA) is heading back towards its February 2020 high or resistance level.

Price Action: Goldman Sachs shares fell 1.7% to close at $333.91, while T-Mobile US slipped 0.1% to settle at $150.32 on Tuesday. ITA fell 1.1% to $117.41, while Corteva rose 2.3% to $29.25 on Tuesday.

Check This Out: Top 5 Real Estate Stocks That Could Lead To Your Biggest Gains In April

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: CNBC Halftime Report Final Trades Jason SnipeLong Ideas News Markets Media Trading Ideas Best of Benzinga