Wall Street's Most Accurate Analysts Say Buy These 3 Utilities Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, even when markets are at all-time highs, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the utilities sector.

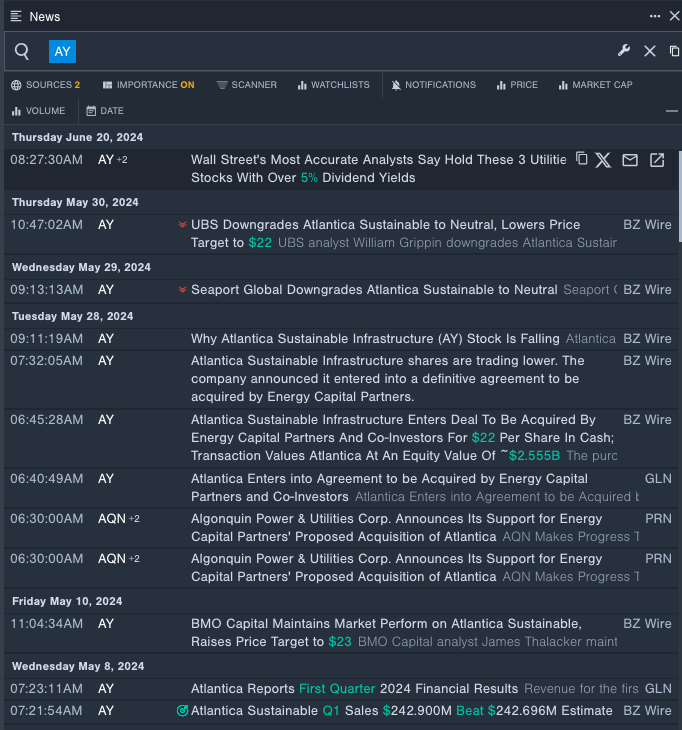

Atlantica Sustainable Infrastructure plc (NASDAQ:AY)

- Dividend Yield: 8.10%

- B of A Securities analyst Julien Dumoulin-Smith maintained a Buy rating and cut the price target from $22 to $20 on March 26. This analyst has an accuracy rate of 70%.

- RBC Capital analyst Shelby Tucker maintained an Outperform rating and slashed the price target from $26 to $24 on March 4. This analyst has an accuracy rate of 63%.

- Recent News: On May 28, the company announced it entered into a definitive agreement to be acquired by Energy Capital Partners.

- Benzinga Pro's real-time newsfeed alerted to latest Atlantica Sustainable Infrastructure's news

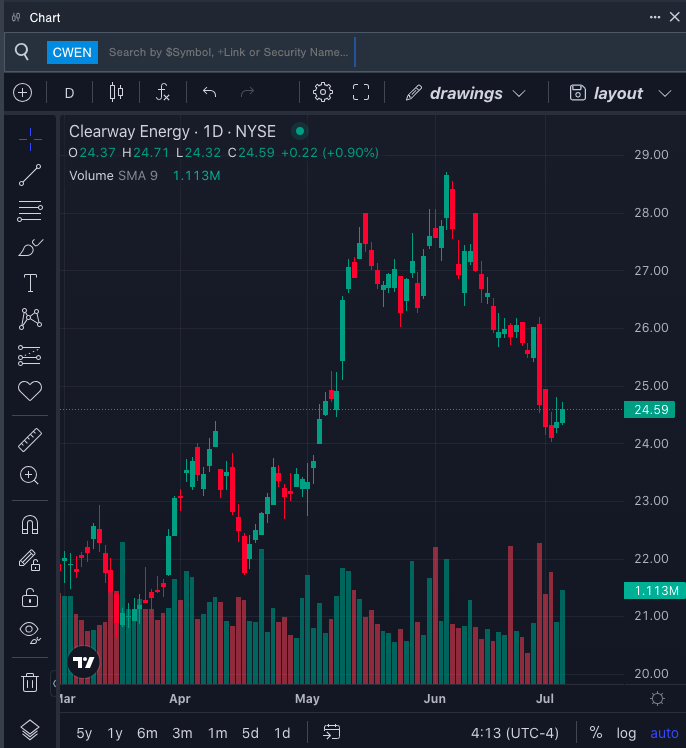

Clearway Energy, Inc. (NYSE:CWEN)

- Dividend Yield: 6.67%

- Oppenheimer analyst Noah Kaye maintained an Outperform rating and raised the price target from $33 to $37 on Jan. 19. This analyst has an accuracy rate of 67%.

- B of A Securities analyst Julien Dumoulin-Smithupgraded the stock from Neutral to Buy on Oct. 6, 2023. This analyst has an accuracy rate of 70%.

- Recent News: On May 9, Clearway Energy posted a first-quarter GAAP loss of 2 cents per share.

- Benzinga Pro's charting tool helped identify the trend in CWEN's stock.

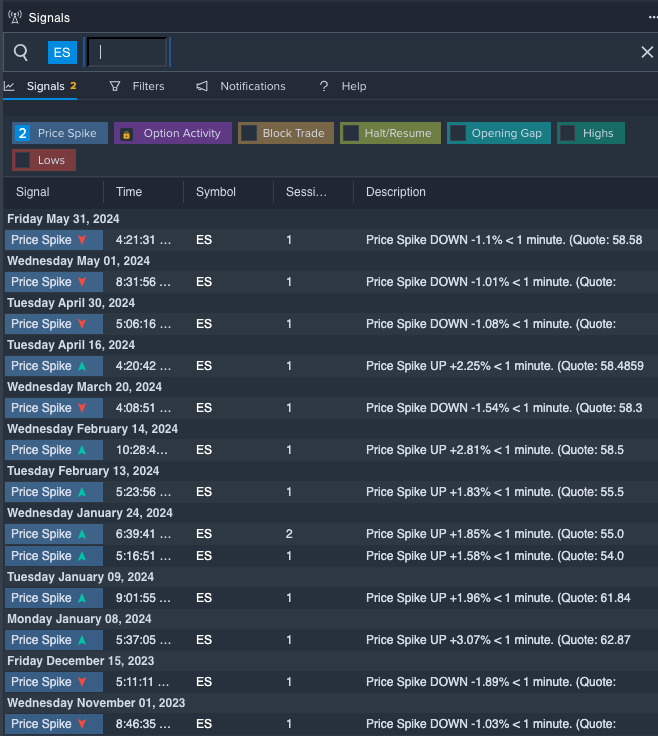

Eversource Energy (NYSE:ES)

- Dividend Yield: 4.99%

- Wells Fargo analyst Neil Kalton maintained an Overweight rating and raised the price target from $69 to $72 on May 3. This analyst has an accuracy rate of 67%.

- Guggenheim analyst Shahriar Pourreza upgraded the stock from Neutral to Buy and boosted the price target from $60 to $72 on Jan. 22. This analyst has an accuracy rate of 66%.

- Recent News: On May 1, Eversource Energy posted better-than-expected first-quarter earnings.

- Benzinga Pro's signals feature notified of a potential breakout in Eversource Energy's shares.

Check This Out: How to Find Dividend Stocks: Scan, Analyze, and Capture with Benzinga Pro

Latest Ratings for CWEN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Dec 2021 | Morgan Stanley | Maintains | Equal-Weight | |

| Nov 2021 | Oppenheimer | Upgrades | Perform | Outperform |

| Oct 2021 | Evercore ISI Group | Upgrades | In-Line | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Long Ideas News Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas