Top 3 Industrials Stocks That May Explode This Quarter

The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Regal Rexnord Corp (NYSE:RRX)

- On Feb. 5, Regal Rexnord posted weaker-than-expected quarterly results. CEO Louis Pinkham commented, “In the fourth quarter, our team continued to make good progress on our many growth, margin, and debt reduction initiatives, despite weaker-than-expected end markets. Most notably, our IPS segment continued to leverage its unrivaled scale and scope to achieve solid outgrowth and healthy margin gains, with adjusted EBITDA margins up two points versus prior year, to 26.0%.” The company' stock fell around 12% over the past five days and has a 52-week low of $130.94.

- RSI Value: 28.2

- RRX Price Action: Shares of Regal Rexnord fell 7.9% to close at $142.87 on Thursday.

- Benzinga Pro's real-time newsfeed alerted to latest RRX news.

Deluxe Corp (NYSE:DLX)

- On Feb. 5, Deluxe reported worse-than-expected fourth-quarter sales results and issued FY25 revenue guidance below estimates.. The company's stock fell around 15% over the past five days and has a 52-week low of $18.48.

- RSI Value: 21.6

- DLX Price Action: Shares of Deluxe dipped 11.3% to close at $20.02 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in DLX stock.

Kennametal Inc (NYSE:KMT)

- On Feb. 5, Kennametal reported worse-than-expected second-quarter financial results. “This quarter we once again generated strong cash flow from operations,” said Sanjay Chowbey, President and CEO. “However, conditions in a number of our end markets, primarily in EMEA, continued to weaken resulting in sales at the lower end of our expectations.” The company's stock fell around 9% over the past five days and has a 52-week low of $20.50.

- RSI Value: 22

- KMT Price Action: Shares of Kennametal fell 3.1% to close at $21.97 on Thursday.

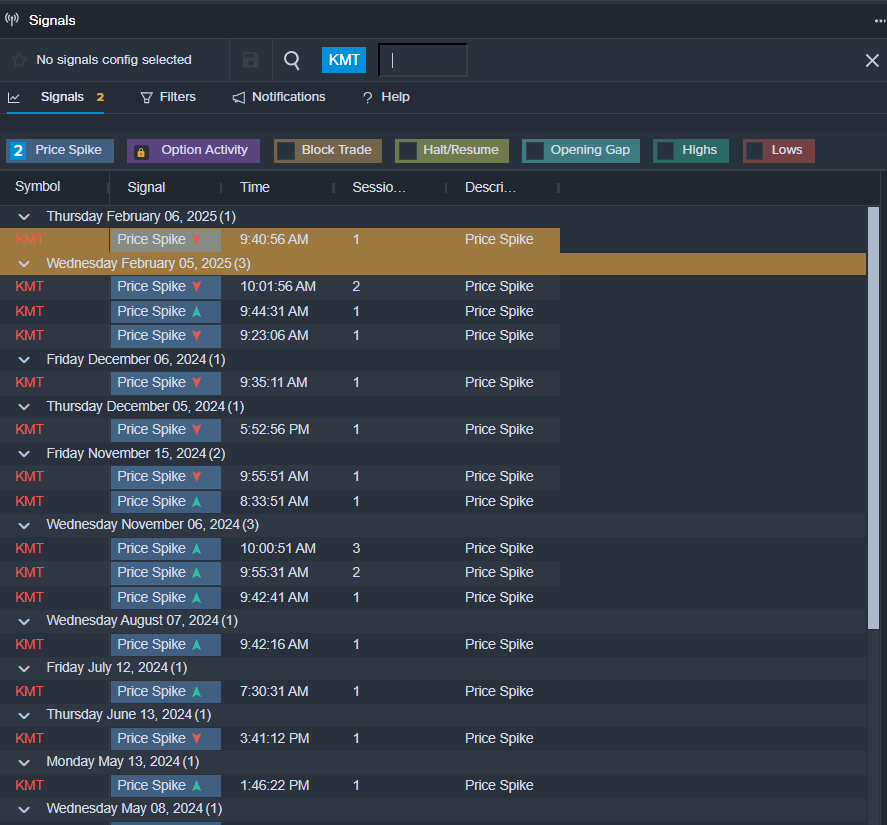

- Benzinga Pro’s signals feature notified of a potential breakout in KMT shares.

Read This Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert Ideas industrials Oversold StocksLong Ideas News Pre-Market Outlook Markets Trading Ideas