Top 3 Tech Stocks That Are Preparing To Pump This Quarter

The most oversold stocks in the information technology sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

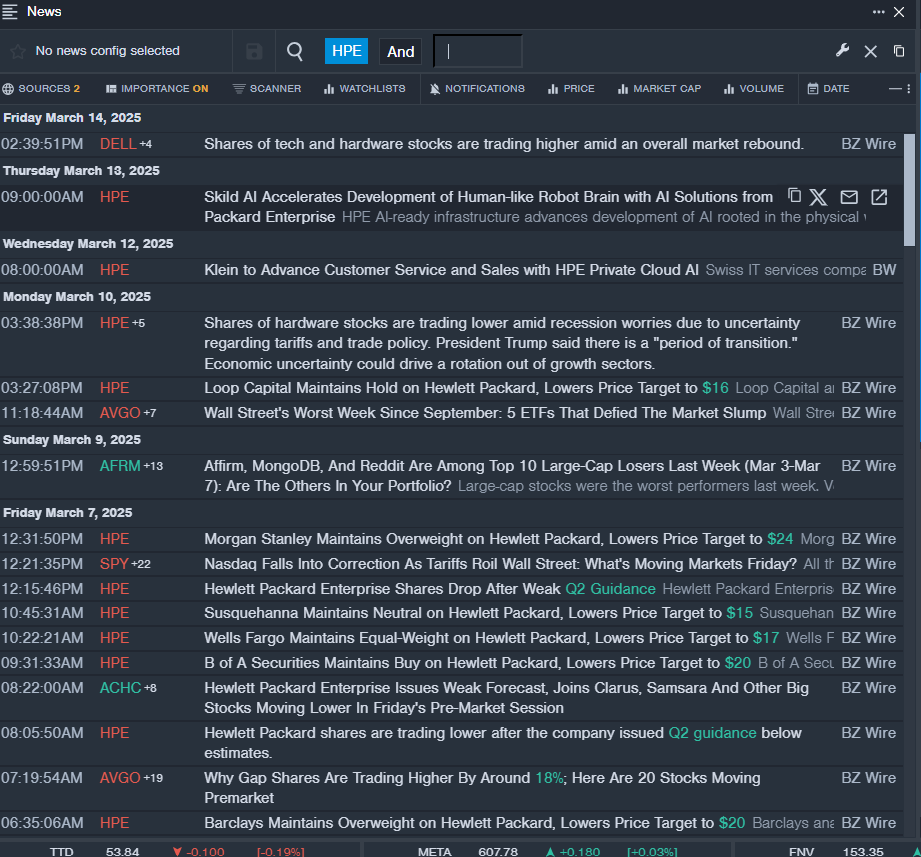

Hewlett Packard Enterprise Co (NYSE:HPE)

- On March 6, Hewlett Packard issued second-quarter guidance below estimates. "HPE achieved our fourth consecutive quarter of year-over-year revenue growth, increasing revenue by double digits in Q1," said Antonio Neri, CEO of Hewlett Packard Enterprise. The company's stock fell around 28% over the past month and has a 52-week low of $14.64.

- RSI Value: 25.6

- HPE Price Action: Shares of Hewlett Packard Enterprise gained 5.8% to close at $15.62 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest HPE news.

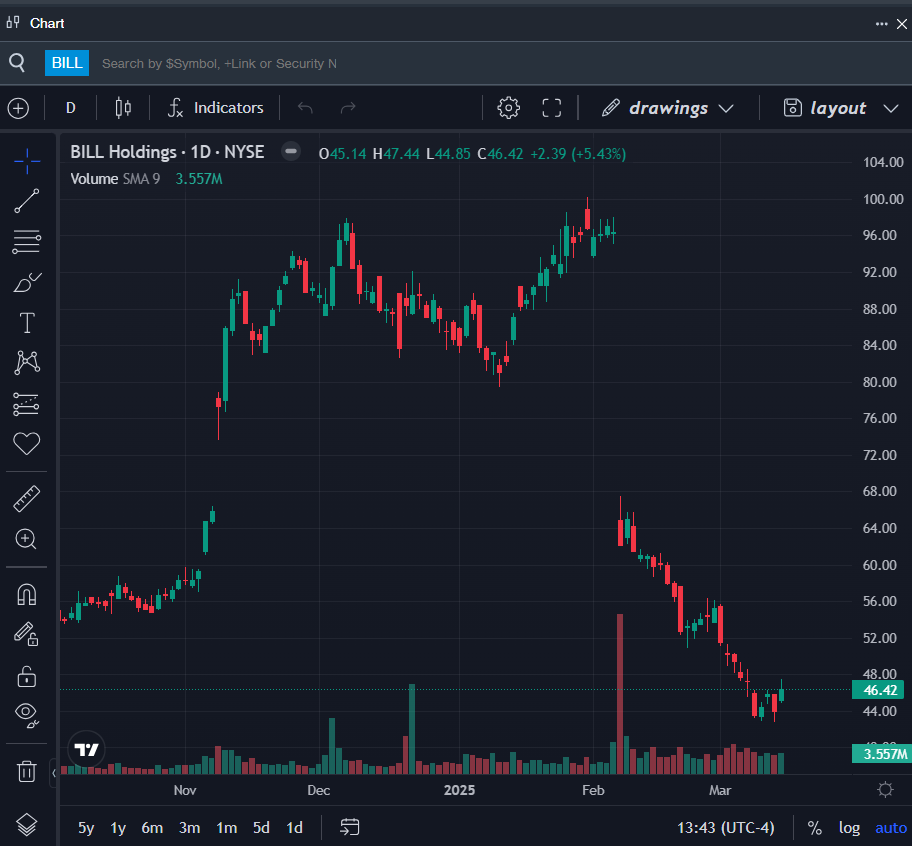

BILL Holdings Inc (NYSE:BILL)

- On Feb. 6, the company issued third-quarter total revenue guidance below estimates. "We delivered strong financial results and innovated at a rapid pace as we executed on our vision to be the de facto intelligent financial operations platform for SMBs," said René Lacerte, founder and CEO of Bill Holdings. The company's stock fell around 23% over the past month and has a 52-week low of $42.82.

- RSI Value: 29.1

- BILL Price Action: Shares of BILL Holdings gained 5.4% to close at $46.42 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in BILL stock.

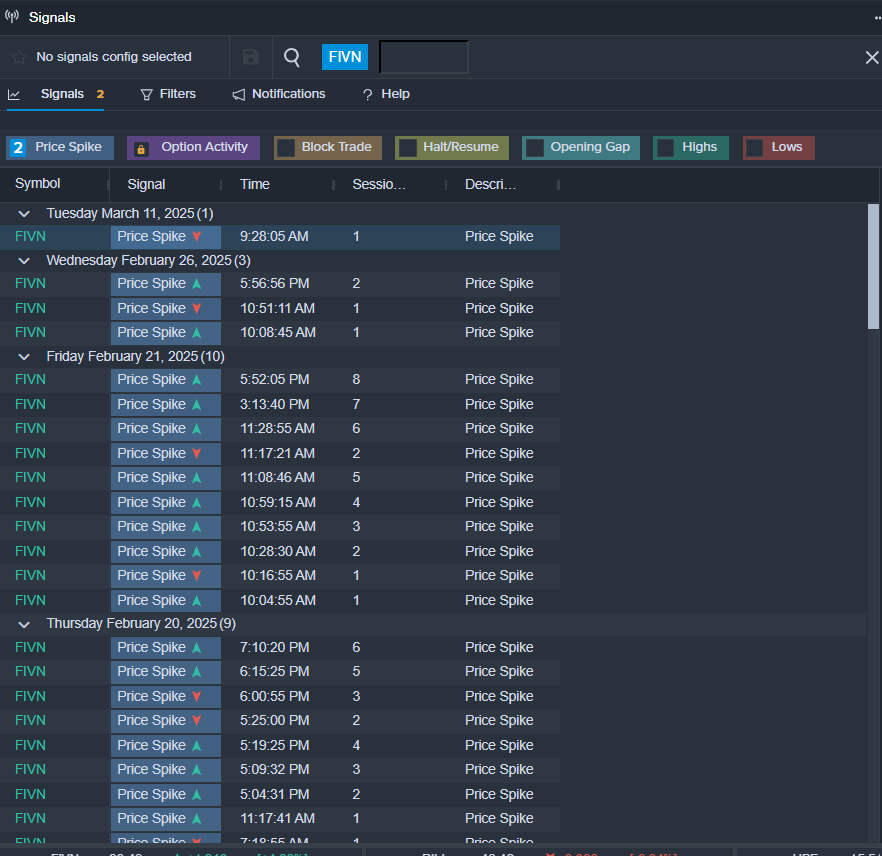

Five9 Inc (NASDAQ:FIVN)

- On Feb. 20, Five9 reported better-than-expected fourth-quarter financial results. "We are very pleased to report strong year end results, with 2024 annual revenue exceeding $1 billion. Fourth quarter revenue growth accelerated to 17%, driven by our subscription revenue growing 19%. We reached an all-time record adjusted EBITDA margin of 23%, helping drive our highest ever quarterly operating cash flow of $50 million," said Mike Burkland, Five9 CEO. The company's stock fell around 31% over the past month and has a 52-week low of $26.60.

- RSI Value: 26.9

- FIVN Price Action: Shares of Five9 gained 4.4% to close at $29.47 on Friday.

- Benzinga Pro’s signals feature notified of a potential breakout in FIVN shares.

Read This Next:

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert Ideas Pro Project RSILong Ideas News Pre-Market Outlook Markets Trading Ideas