Top 3 Health Care Stocks You May Want To Dump This Quarter

As of April 15, 2025, three stocks in the health care sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Certara Inc (NASDAQ:CERT)

- On April 14, Certara issued a year-over-year increase in its first-quarter revenue guidance and announced a $100 million share repurchase program. Additionally, the company announced it launched a non-animal navigator solution to help drug developers reduce reliance on animal testing. The company's stock jumped around 50% over the past five days and has a 52-week high of $17.94.

- RSI Value: 80.6

- CERT Price Action: Shares of Certara gained 11.5% to close at $14.40 on Monday.

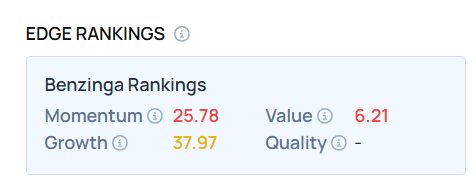

- Edge Stock Ratings: 25.78 Momentum score with Value at 6.21.

Summit Therapeutics Inc (NASDAQ:SMMT)

- On March 26, Citigroup analyst Yigal Nochomovitz upgraded Summit Therapeutics from Neutral to Buy and raised the price target from $23 to $35. The company's stock gained around 45% over the past five days and has a 52-week high of $33.89.

- RSI Value: 74.6

- SMMT Price Action: Shares of Summit Therapeutics gained 12.4% to close at $26.13 on Monday.

Third Harmonic Bio Inc (NASDAQ:THRD)

- On April 14, Third Harmonic announced that its board approved and adopted a plan for the liquidation and dissolution of the company and the distribution of remaining cash to shareholders, including any proceeds from asset and intellectual property sales. "Our management team and board of directors together have completed an efficient review of our strategic alternatives for maximizing the value of our assets and have determined that returning cash to shareholders and selling our assets, including THB335, is the best path forward," said Natalie Holles, CEO of Third Harmonic Bio. The company's stock gained around 46% over the past month and has a 52-week high of $16.94.

- RSI Value: 87.7

- THRD Price Action: Shares of Third Harmonic Bio gained 39.8% to close at $5.09 on Monday.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Read This Next:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert Ideas health care stocks Overbought stocksNews Short Ideas Pre-Market Outlook Markets