Top 2 Risk Off Stocks That Are Ticking Portfolio Bombs

As of May 20, 2025, two stocks in the consumer staples sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Chefs’ Warehouse Inc (NASDAQ:CHEF)

- On April 30, The Chefs’ Warehouse reported better-than-expected first-quarter financial results and raised its FY25 sales guidance. “First quarter 2025 business activity displayed typical seasonal cadence as revenue trends coming out of January increased steadily into February and March. During the quarter, our business units, international and domestic, delivered strong growth in unique item placements and solid operating leverage versus the prior year first quarter”, said Christopher Pappas, Chairman and Chief Executive of the Company. The company's stock jumped around 23% over the past month and has a 52-week high of $66.51.

- RSI Value: 74.1

- CHEF Price Action: Shares of Chefs’ Warehouse fell 0.5% to close at $64.80 on Monday.

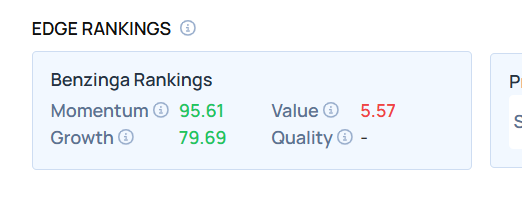

- Edge Stock Ratings: 95.61 Momentum score with Value at 5.57.

Dollar General Corp (NYSE:DG)

- On May 19, Morgan Stanley analyst Simeon Gutman maintained Dollar General with an Equal-Weight rating and raised the price target from $80 to $85, while Goldman Sachs analyst Kate McShane maintained the stock with a Buy and raised the price target from $85 to $96. The company's stock gained around 10% over the past five days and has a 52-week high of $147.79.

- RSI Value: 70.3

- DG Price Action: Shares of Dollar General gained 5% to close at $98.18 on Monday.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Read This Next:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: consumer staples Expert Ideas Overbought stocksNews Short Ideas Pre-Market Outlook Markets Trading Ideas