Top 2 Materials Stocks That May Fall Off A Cliff In August

As of Aug. 8, 2025, two stocks in the materials sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Mp Materials Corp (NYSE:MP)

- On Aug. 7, MP Materials reported better-than-expected quarterly financial results. “In the second quarter, our Materials segment achieved record NdPr oxide production and delivered the second-highest REO output in MP’s history. At the same time, our Magnetics segment advanced commissioning and began profitably ramping metal production,” said James Litinsky, Founder, Chairman & CEO of MP Materials. “We also recently announced transformational partnerships with the Department of Defense and Apple—cornerstone agreements that we believe will drive significant long-term profitability and position MP as a platform for sustained growth in the emerging era of physical AI.” The company's stock jumped around 128% over the past month and has a 52-week high of $72.35.

- RSI Value: 84.2

- MP Price Action: Shares of MP gained 5.3% to close at $71.07 on Thursday.

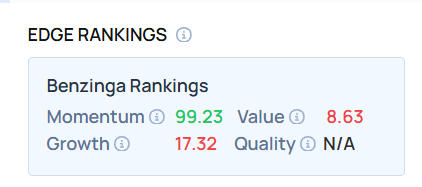

- Edge Stock Ratings: 99.23 Momentum score with Value at 8.63.

Hecla Mining Co (NYSE:HL)

- On Aug. 6, Hecla Mining reported better-than-expected second-quarter financial results. Rob Krcmarov, President and Chief Executive Officer, said, “Our second quarter results demonstrate exceptional execution across all facets of the business. We generated record sales of $304 million, record free cash flow of $103.8 million, and record Adjusted EBITDA of $132.5 million, while dramatically improving our net leverage to 0.7x.” The company's stock gained around 29% over the past month and has a 52-week high of $7.68.

- RSI Value: 80.7

- HL Price Action: Shares of Hecla Mining gained 18.2% to close at $7.22 on Thursday.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Read This Next:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert Ideas materials Overbought stocksNews Short Ideas Pre-Market Outlook Markets Trading Ideas