Alcoa (AA) - Needs a Better Brillo

On January 19th I suggested that Alcoa (NYSE: AA) was a good candidate for shorting at 15.50 . The initial target of 14.67 was easily surpassed with the stock price reaching a low of 12.26 . A conservative investor, with an entry at 15.50 could have gained 3.24 per share exiting at the low.

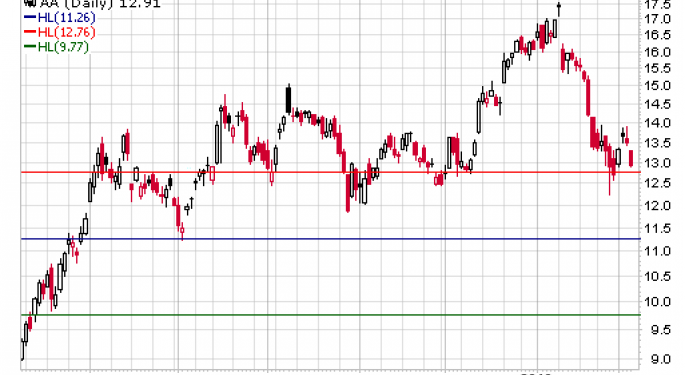

The investor, who believed that the downside retracement was not completed, had to watch the Alcoa share price undergo a minor correction topping at 13.90. Since that intraday high the stock, as part of the NYSE Dow 30, has participated in the downside reversal that brought smiles to the faces of the "Bears". In the last session the share price of Alcoa closed at 12.91. In the upcoming session the support levels, based on Fibonacci retracement ratios, are as follows:

------- 12.76 ---- 11.26 ---- 9.77

The RSI(14) finished at 36.70 and looks to be headed for a test of the 30 level. The CCI (20) reversed and presently sits at -80.92 and if it continues downward it will be testing the -100 level.

In my opinion the preferred direction of the Alcoa share price will be downward. If the interpretation of the pattern is correct the share price could drop down to sub 9.00 .

The calculated daily Resistance and Support levels are as follows:

- DR4- 14.20

- DR3- 13.81

- DR2- 13.42

- DR1- 13.17

- DC- 12.91

- DS1- 12.78

- DS2- 12.64

- DS3- 12.25

- DS4- 11.86

Additional information on the background this short suggestion can be found at :

http://www.benzinga.com/trading-ideas/technicals/92008/tarnished-aluminum

and

http://www.benzinga.com/trading-ideas/technicals/97044/where-s-the-brillo

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Alcoa AluminumShort Ideas Technicals Pre-Market Outlook Intraday Update Markets Movers