These 4 Charts Reveal 2 Big Trends In The Department Store Space

The graphs below were produced by Capital Market Labs.

Strong economic headwinds are reshaping the department store sector, so let's look at sales trends in this troubled segment.

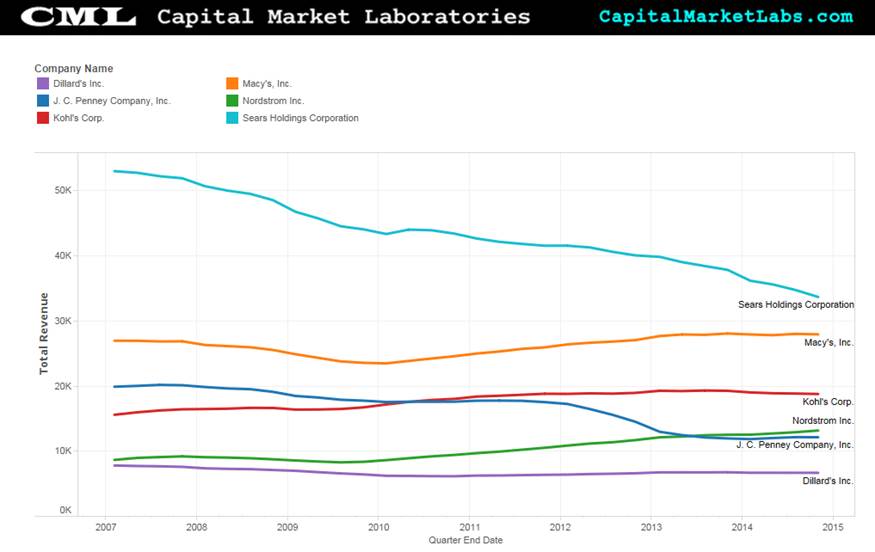

Most striking, of course, is the rapid and un-ending decline in sales for Sears Holdings Corp (NASDAQ: SHLD). Other trends aren't quite as obvious in this picture, so let's focus on revenue growth rather than total revenue.

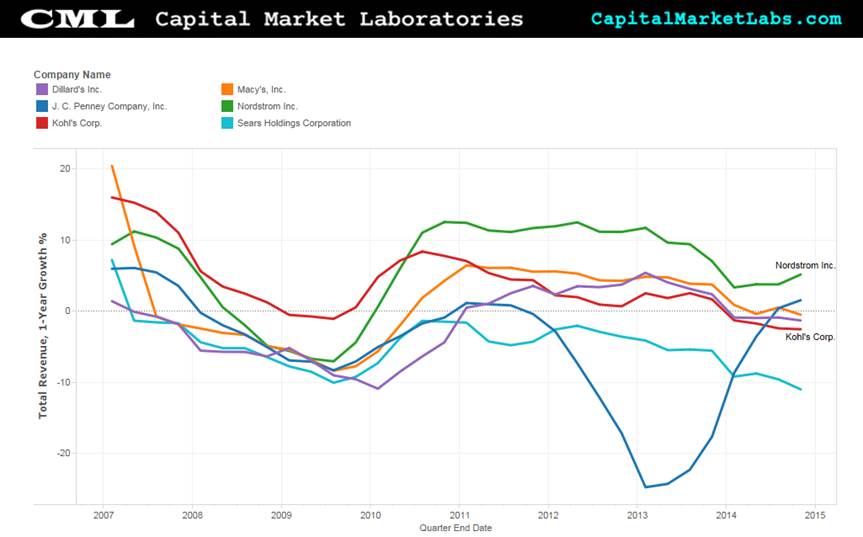

Now, the impact of the great recession in 2008 and 2009 is clear, as is how Kohl's Corporation (NYSE: KSS) substantially outperformed its competitors during this time.

The tenure of ex-CEO Ron Johnson at J C Penney Company Inc (NYSE: JCP) is almost comically obvious -- let's focus in on just J.C. Penney for a minute.

The recovery from the Ron Johnson era has been nearly as impressive as the collapse itself.

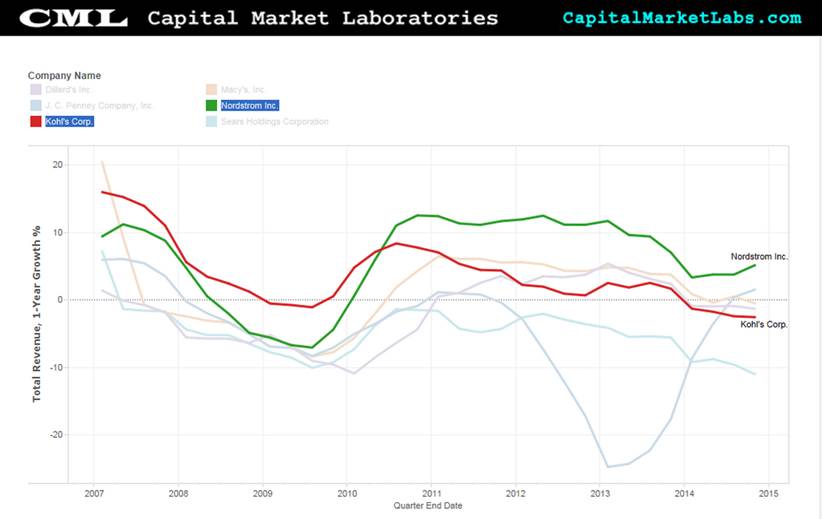

Finally, let's focus on two ends of the department store spectrum in Nordstrom and Kohl's.

As one would expect, Nordstrom, Inc. (NYSE: JWN) took a bigger hit during the Great Recession, but as the economy stabilized and improved, it has been Nordstrom leading the way in revenue growth among department stores.

Kohl's, which performed so well during the bleak economic years, has seen its revenue growth turn negative.

With cheap oil, and an improving economy, these two trends seem likely to continue in 2015.

Image credit: Public Domain

Tom White can be found on Twitter @tbwhite67.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Department store stocksTechnicals Trading Ideas Best of Benzinga