Oil Hits 18-Week Highs After US Inflation Data Print; Granholm Open To SPR Refills

Oil prices climbed in Wednesday's session, with a barrel of WTI crude reaching $82.50, after the Bureau of Labor Statistics reported lower-than-expected inflation in March and following remarks by the U.S. Energy Secretary Jennifer Granholm, who expressed intentions to return Strategic Petroleum Reserves (SPR) to pre-Ukraine war levels.

Only a few months ago, the Biden administration said it wished to replenish the SPR at $67-$70, levels that are 15% lower than WTI crude prices Wednesday.

The United States Oil Fund (ARCA: USO), an exchange traded fund that tracks the performance of WTI crude oil prices, is up 1.7% on Wednesday and 2.5% for the week.

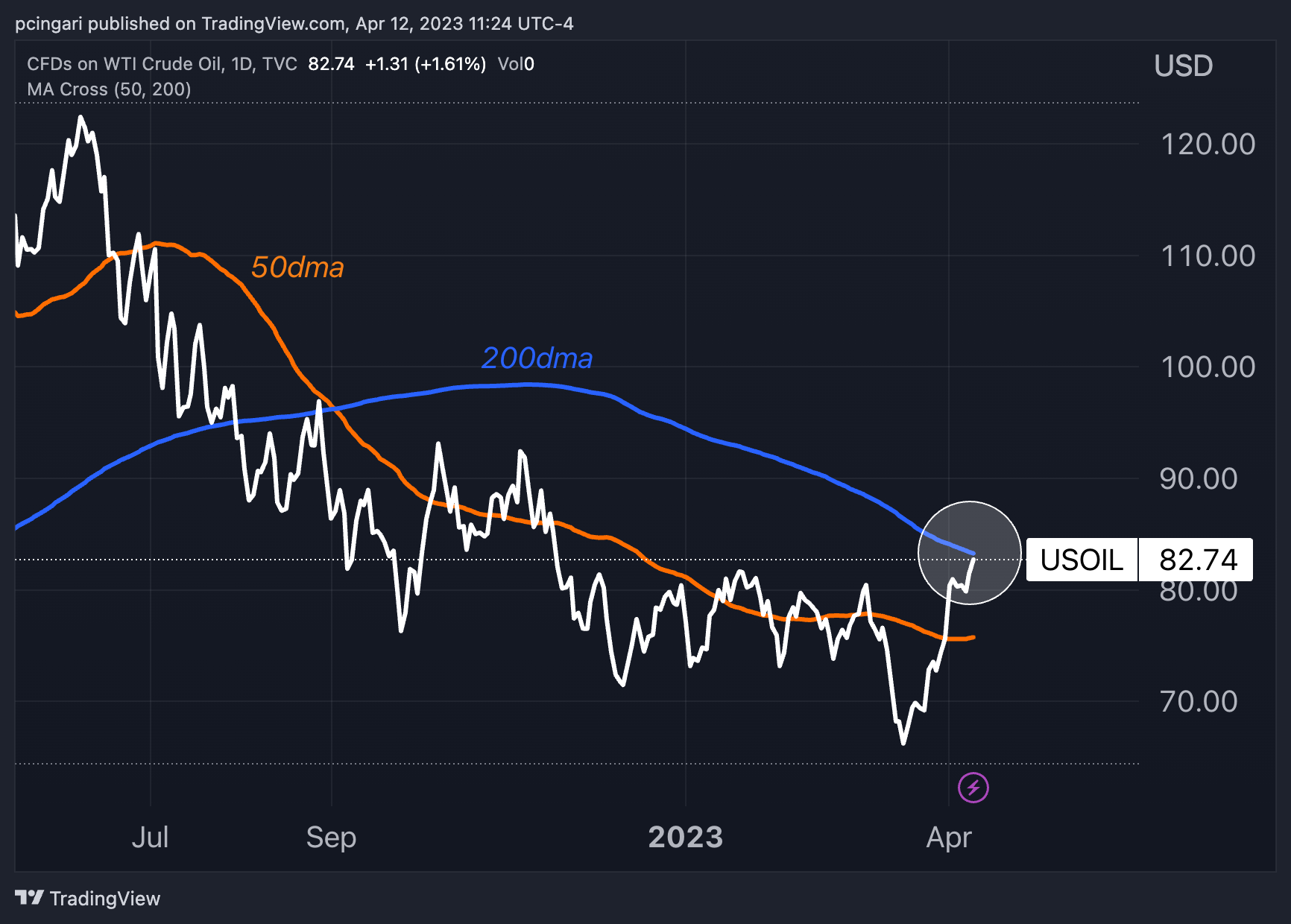

Crude prices are trading at their highest levels since late November 2022, nearing the crucial 200-day moving average, which lies at $83.30.

Read also: ExxonMobil Explores Acquisition Of Pioneer Natural Amid Bid To Dominate Permian Basin

OPEC+ Supply Cuts Push Oil Prices Higher, Strong Seasonality Adds Fuel To The Fire

On April 3, OPEC and its allies agreed to a 1.2-million-barrel-per-day reduction in crude oil output through the end of 2023.

After OPEC+ announced additional supply cutbacks, the U.S. Energy Information Administration (EIA) raised its projection for 2023 WTI oil prices by 2.8% to $79.24 per barrel in its latest Short-Term Energy Outlook, despite expecting U.S. oil output to climb by nearly 700,000 bpd this year, to 12.54 million bpd.

We are now approaching a phase of the year where oil stocks begin to draw, Giovanni Staunovo, commodity analyst, said on Twitter:

According to EIA statistics, crude oil stocks in SPR were 371,175 thousand barrels in the week ending March 31, the lowest level since November 1983.

The EIA reported that crude oil stockpiles in the United States grew by 0.60 million barrels in the week ending April 7, 2023, following two weeks of declines of more than 11 million barrels.

Charts on US petroleum inventories in million barrels - EIA #oott pic.twitter.com/SmoL8h3GUW

— Giovanni Staunovo🛢 (@staunovo) April 12, 2023

Photo via Shutterstock.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: EIA Expert IdeasTechnicals Commodities Top Stories Economics Markets Trading Ideas Best of Benzinga