Traders Keep Piling Into Natural Gas Futures

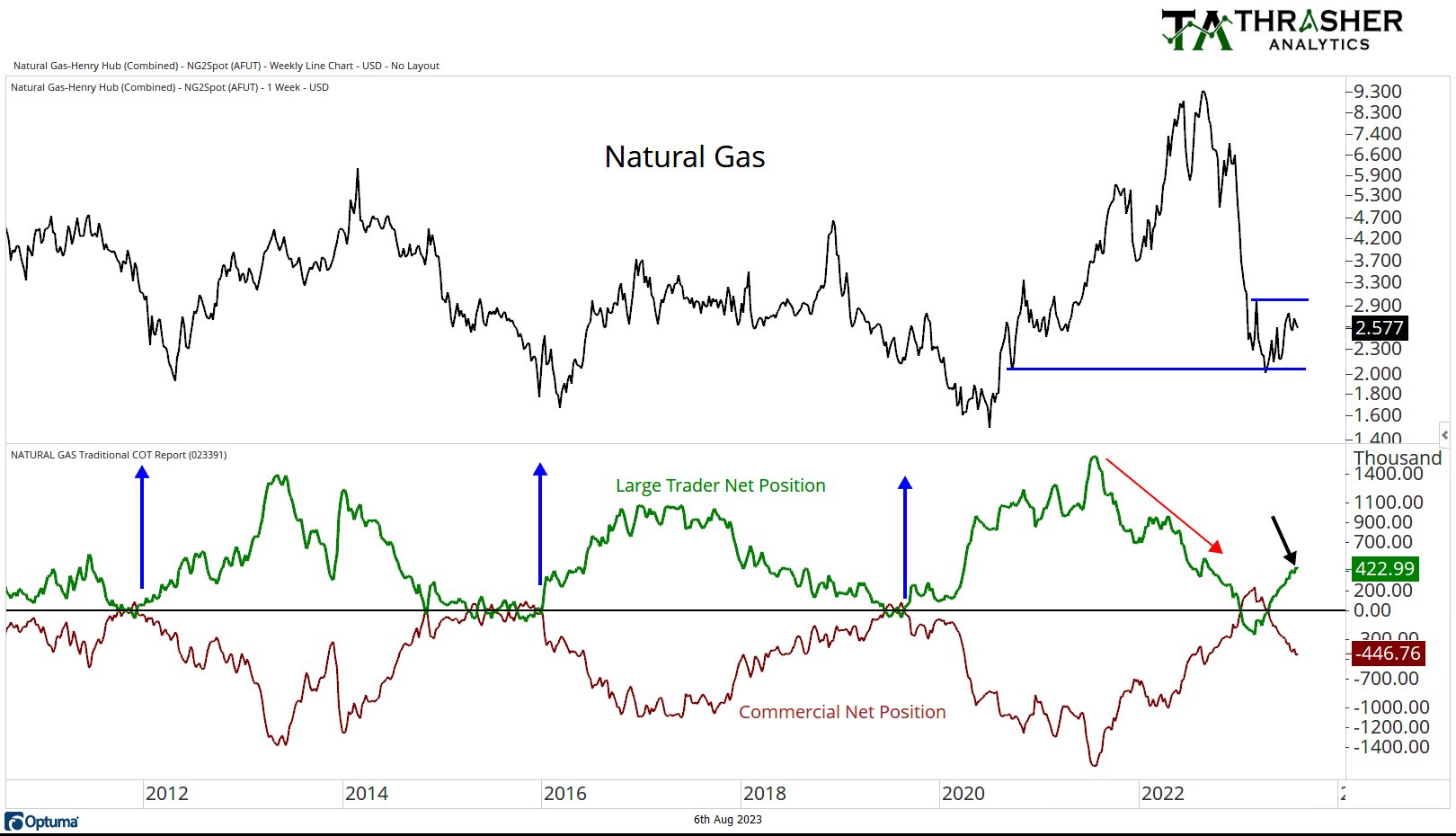

Energy has been a large topic in several of the recent Thrasher Analytics letters, both from a sector and commodity standpoint. One of the energy-related charts shared in Sunday’s letter to subscribers looked at the Commitment of Traders (COT) data for Natural Gas futures. The report is broken up by trade size into Large Traders, Commercial Traders, and Small Traders (terminology can vary but this keeps things simple) Large Traders, which are mostly CTAs/hedge funds/ some institutions (while Commercial Traders are firms or companies that often use the underlying commodity within their business and often use futures to hedge their exposure).

We can see historically that Large Traders net position has a strong correlation to the price direction of natural gas prices. This group got massively long coming out of the 2020 crash but began lowering their exposure as prices got above $7 and eventually went net-short. I began discussing the bullish setup in nat gas when Large Traders went net-long in April ‘23 as price bounced off $2 (Can see on the blue arrows on the chart when Large Traders got net long in the prior three instances). Since then, Large Traders have continued to pile into natural gas futures, even as the commodity stagnates under $2.8. Yesterday (Monday) futures rose 7% and I’m watching how price acts as it gets closer to the $3 level, which was the brief counter-swing high in March.

Want to subscribe to Thrasher Analytics? Visit www.ThrasherAnalytics.com to learn more.

Disclaimer: Do not construe anything written in this post or this Substack in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned. 15% discount code “substack” applies to first subscription charge for time period selected upon subscribing, renewals will be at original price.

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

Posted-In: contributors Expert Ideas Natural GasFutures Technicals Markets Trading Ideas General