Trump's Charm Offense In Europe Unleashes Dollar Thunder

A trade deal designed to stabilize transatlantic relations is delivering a very unexpected outcome in currency markets: a surging U.S. dollar and a battered euro.

- SPY ETF hit new record highs on July 28. Check the price action here.

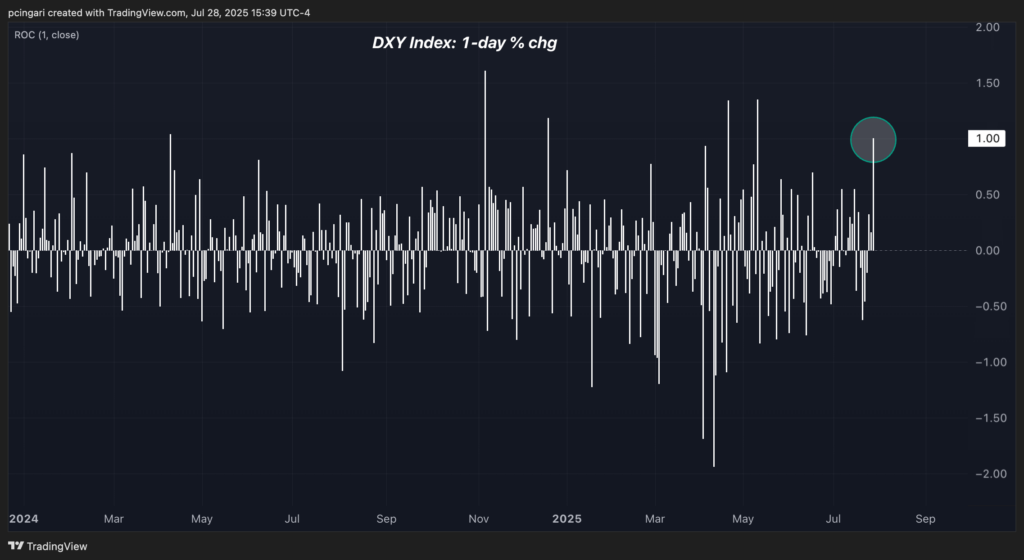

On Monday, the U.S. dollar index (DXY) jumped 1%, its best single-day performance in over two months, as investors absorbed the details of the U.S.-EU trade agreement struck by President Donald Trump and European Commission President Ursula von der Leyen over the weekend.

Mirroring the dollar move but in reverse, the euro posted its worst day since May—and its second-worst of 2025.

Chart: Dollar Index Notches Rare 1% Daily Rally After US-EU Trade Deal

A Deal That Strengthens The US Economic Hand

While headlines focused on the 15% tariff cap the U.S. will impose on EU goods—down from the 30% level previously threatened—the agreement includes massive fiscal and energy concessions from the European side.

Key terms of the deal include:

- $750 billion in U.S. energy purchases over three years, a 150% jump from current levels

- $600 billion in EU investment into the U.S. economy

- Large-scale purchases of U.S. AI chips and military equipment

- Zero tariffs on high-value sectors like aircraft and parts, despite sectoral tariffs of 50% on steel, aluminum and copper

"Politically, this agreement looks like a clear win for the U.S.," said Oliver Rakau, economist at Oxford Economics.

Read also: Trump’s $750 Billion Coup In Europe Could Bring Energy Stocks Back From The Dead

Why Is The Dollar Rallying After The US-EU Trade Deal?

The sharp move in the dollar wasn't just about the deal's fundamentals—it was also about positioning. Ahead of the weekend agreement, traders were heavily short the greenback.

Net non-commercial positions in CME dollar futures sat at a negative 14,749 contracts, near a three-year low, indicating widespread bearish bets.

That left the market vulnerable to a sharp reversal. Monday's rally may have already triggered a wave of short covering, and if the dollar continues climbing, positioning alone could further amplify the move.

"The U.S. dollar began the week on the front foot, making gains versus all the majors," said David Morrison, senior market analyst at Trade Nation.

"It's interesting that the U.S. dollar should be the major beneficiary from the breakthrough, rather than the euro. Could this signal that the bottom is in for the greenback after the Dollar Index hit a multi-year low at the beginning of the month?" he added.

While the trade deal tilted flows in the dollar's favor, the macro calendar is also fueling greenback strength.

Analysts at ING flagged this week's data slate—second-quarter GDP, Personal Consumption Expenditure inflation, July FOMC meeting and July’s jobs report—as likely to support the Fed's patient stance and challenge expectations for a September rate cut.

"This should leave the majority of the Fed comfortable in their patient position on interest rates," ING’s analyst Chris Turner wrote.

“We continue to favour a period of consolidation for the dollar,” he added.

Goldman Sticks To Long-Term Dollar Bearish View

Despite the dollar's strong reaction to the US-EU trade agreement, Goldman Sachs remains cautious on the long-term outlook.

According to Kamashka Trivedi, a currency analyst at the bank, the structure of the deal—while avoiding an all-out tariff war—cements higher baseline tariffs that could ultimately erode U.S. trade dynamics.

"This direction of travel should keep the dollar under pressure—especially as the baseline tariff turns from a ‘pause’ placeholder to the new reality," she said.

Goldman's position contrasts with the immediate bullish reaction from spot currency markets, suggesting that short-term strength may be temporary and potentially fade as the economic implications of the deal settle in.

Read now:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Government Regulations Currency ETFs Forex Top Stories Federal Reserve Analyst Ratings