A Dive Into Near Term S&P 500 Implied Volatility: Looking At How The Markets Are Pricing Upside And Downside Risk

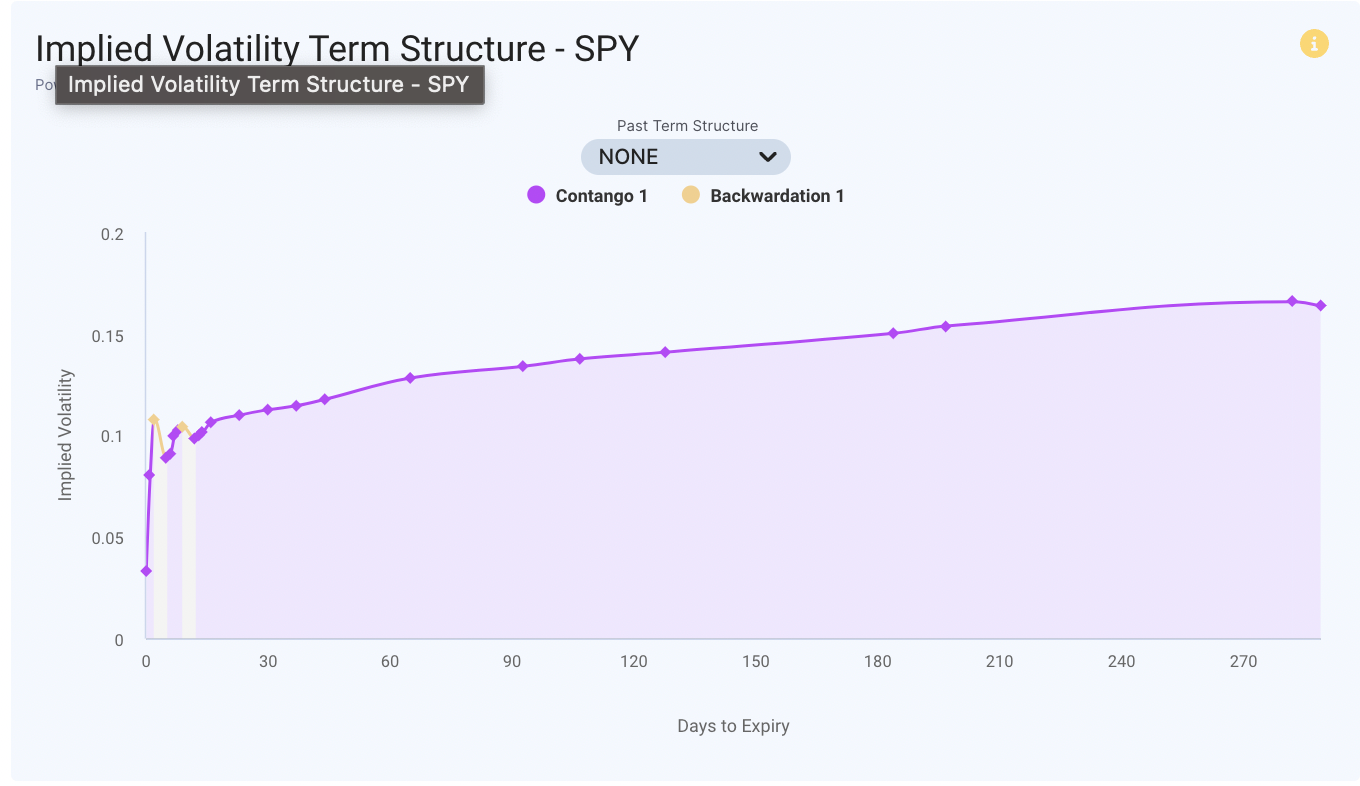

The SPDR S&P 500 ETF Trust (ARCA: SPY) is currently experiencing historically low levels of relative volatility, ranking in the bottom 3 percentile for relative historical volatility over the past twelve months. However, examining the near-term Implied Volatility (IV) term structure reveals interesting patterns. Contracts expiring on 9/14/2023 show elevated volatility levels, whereas for the 9/17/2023 expiry, IV displays backwardation properties and forms a local term structure minimum.

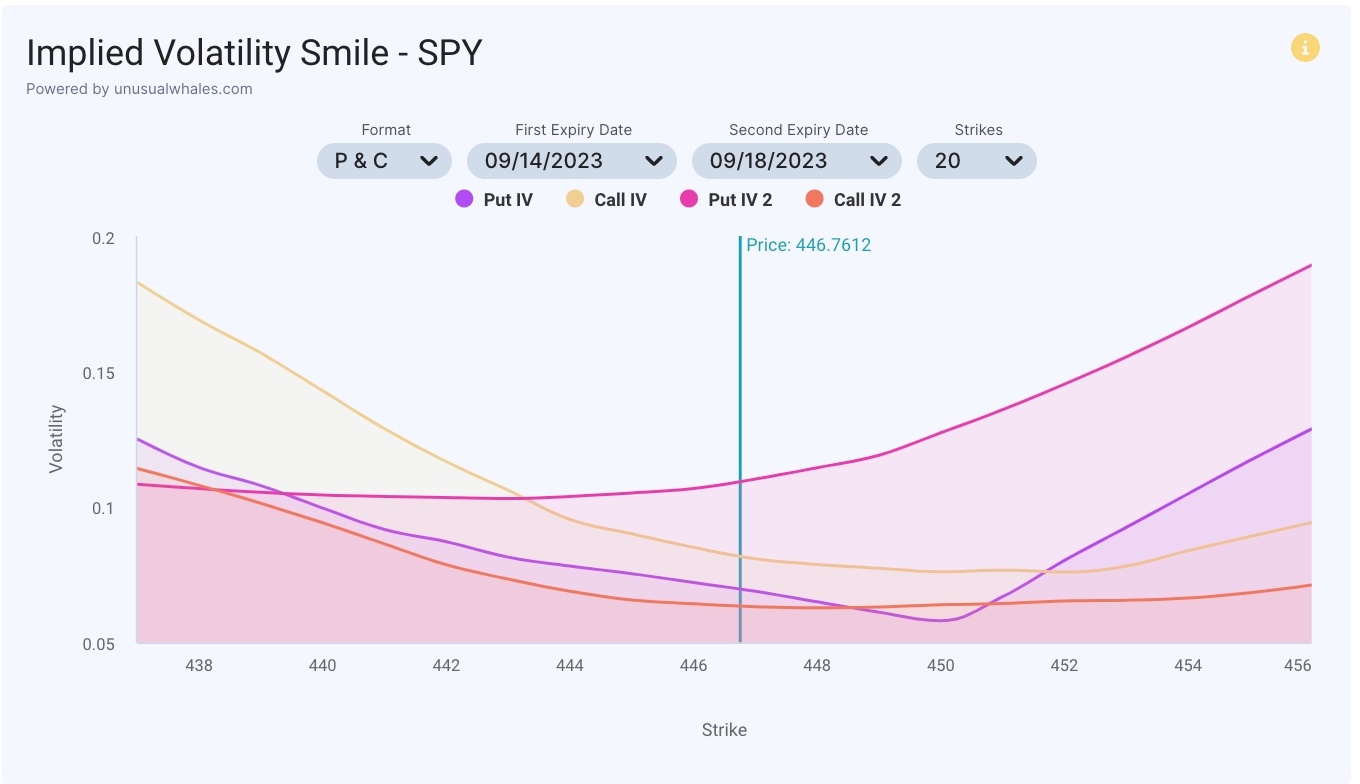

Now, let's delve into a comparison of the volatility smile for SPY options expiring on 9/14/2023 and 9/18/2023. In the case of the 9/14/2023 expiry, there's a noticeable disparity between implied volatility for calls and puts, particularly up to the 451 strike. Furthermore, there's a significant net positive difference in implied volatility for at-the-money contracts, indicating that calls are being priced higher than puts. However, the risk reversal skew suggests that out-of-the-money puts are commanding higher prices than out-of-the-money calls, highlighting a demand for downside risk protection.

Turning our attention to the implied volatility smile for 9/18/2023, we observe that put IV surpasses call IV at all observable strike levels (from 437 to 456). Additionally, the disparity between call and put IV tends to widen with higher strike prices, with call IV decreasing and stabilizing while put IV increases. This trend may signify that the market is factoring in the cost of protective measures against potential downward movements. All volatility and data were sourced from Unusualwhales.com.

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

Posted-In: contributors Expert Ideas VolatilityMarkets ETFs