Why Are Chip Stocks Trading Lower On Monday?

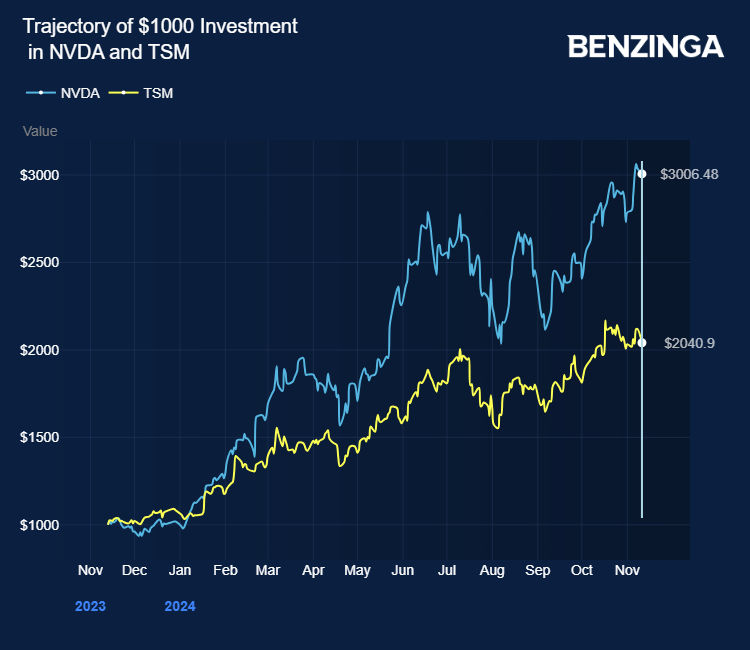

Chip stocks including Nvidia Corp (NASDAQ:NVDA), Broadcom Inc (NASDAQ:AVGO), Intel Corp (NASDAQ:INTC), Arm Holdings plc (NASDAQ:ARM), Advanced Micro Devices, Inc (NASDAQ:AMD) Credo Technology Group Holding (NASDAQ:CRDO), Lattice Semiconductor Corp (NASDAQ:LSCC), Microchip Technology Inc (NASDAQ:MCHP), Marvell Technology, Inc (NASDAQ:MRVL), MACOM Technology Solutions Holdings (NASDAQ:MTSI), Micron Technology, Inc (NASDAQ:MU), Qualcomm Inc (NASDAQ:QCOM), Qorvo, Inc (NASDAQ:QRVO), United Microelectronics Corp (NYSE:UMC) are trading lower Monday in sympathy with contract chipmaker Taiwan Semiconductor Manufacturing Co (NYSE:TSM).

Taiwan Semiconductor stock took a hit after the U.S. Department of Commerce instructed the chipmaker to cease supplying China with sophisticated chips—of 7 nanometers or more advanced designs—that support AI and graphics processing capabilities.

The U.S. move sent jitters across the sector, anticipating further actions from President-elect Donald Trump’s administration, which had previously attacked the U.S. Chips Act and Taiwan, the hometown of Taiwan Semiconductor.

Also Read: Monday.com Stock Tanks Despite Q3 Beat, Raised Outlook

Taiwan Semiconductor is a crucial supplier to tech giants like Apple Inc (NASDAQ:AAPL) and Nvidia.

The semiconductor stocks also got a hit from Edgewater Research analysts, flagging Monolithic Power Systems (NASDAQ:MPWR), which faced a significant setback and sent its stock plunging on Monday.

The analysts noted Monolithic’s allocation to Nvidia’s Blackwell GPUs is in jeopardy due to performance problems with its Power Management ICs.

The analysts highlighted that Japanese company Renesas and German firm Infineon have stepped in, receiving rush orders, potentially replacing Monolithic in Nvidia’s B200 and GB200 SKUs.

Edgewater expressed concern that supply chain partners perceived Monolithic’s temporary solution as a stopgap measure rather than a complete fix.

Investors can gain exposure to semiconductor stocks through VanEck Semiconductor ETF (NASDAQ:SMH) and iShares Semiconductor ETF (NASDAQ:SOXX).

Price Action: At the last check on Monday, NVDA stock was trading lower by 1.67% to $145.19, INTC was down 4.16%, and ARM was down 4.07%.

Also Read:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Briefs BZ Data Project Stock Battles Stories That MatterNews Tech Media