Wall Street's Most Accurate Analysts Give Their Take On 3 Industrials Stocks With Over 3% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the industrials sector.

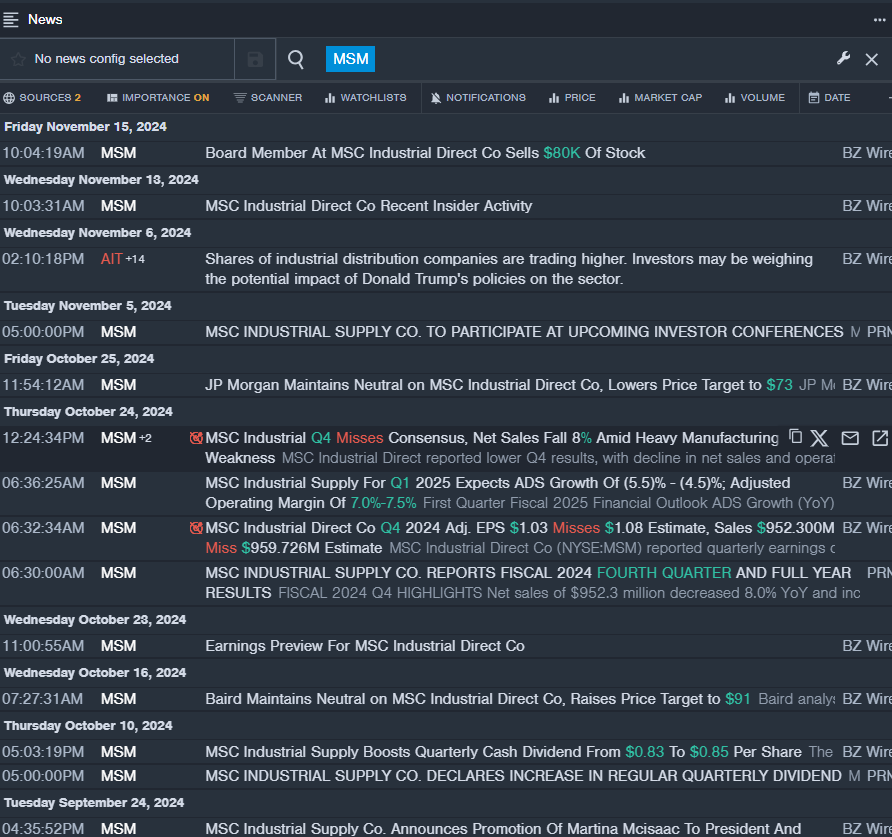

MSC Industrial Direct Co., Inc. (NYSE:MSM)

- Dividend Yield: 4.04%

- Baird analyst David Manthey maintained a Neutral rating and raised the price target from $84 to $91 on Oct. 16. This analyst has an accuracy rate of 82%.

- Loop Capital analyst Chris Dankert maintained a Hold rating and cut the price target from $80 to $75 on July 3. This analyst has an accuracy rate of 78%.

- Recent News: On Oct. 24, MSC Industrial Direct Company reported fourth-quarter results. Net sales declined 8.0% year-over-year to $952.3 million, missing the consensus of $959.7 million..

- Benzinga Pro's real-time newsfeed alerted to latest MSM news

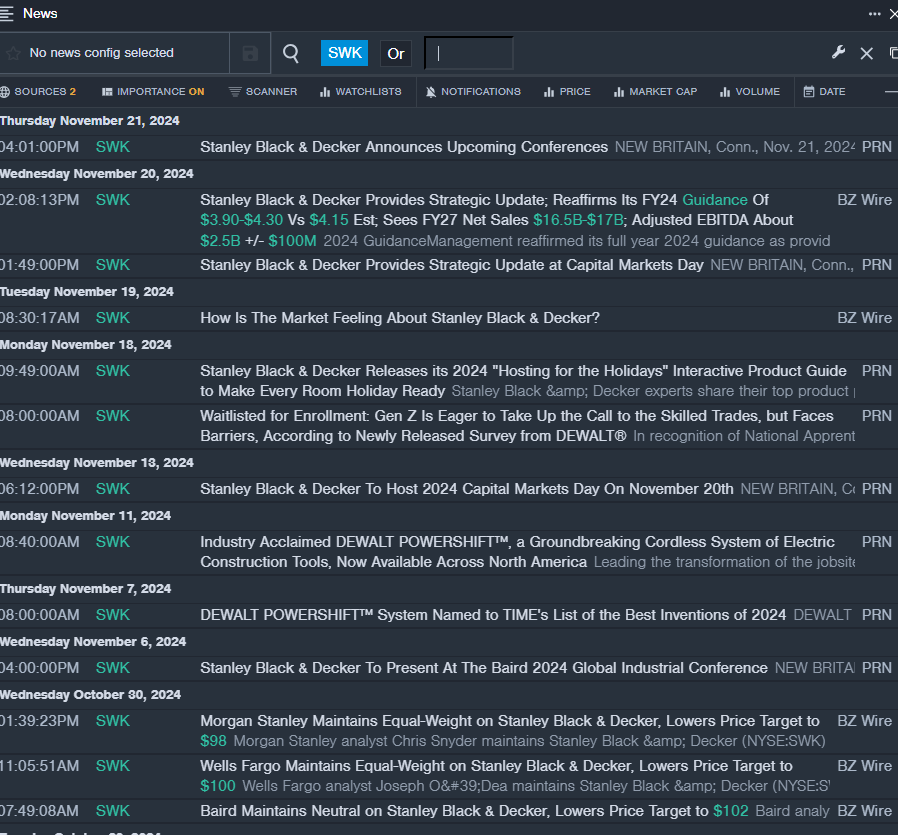

Stanley Black & Decker, Inc. (NYSE:SWK)

- Dividend Yield: 3.74%

- Morgan Stanley analyst Chris Snyder maintained an Equal-Weight rating and cut the price target from $107 to $98 on Oct. 30. This analyst has an accuracy rate of 74%.

- Goldman Sachs analyst Joe Ritchie maintained a Neutral rating and raised the price target from $94 to $107 on Oct. 10. This analyst has an accuracy rate of 75%.

- Recent News: On Nov. 20, Stanley Black & Decker issued a strategic update, reaffirming its FY24 earnings guidance of $3.90-$4.30 per share.

- Benzinga Pro's real-time newsfeed alerted to latest SWK news

United Parcel Service, Inc. (NYSE:UPS)

- Dividend Yield: 4.96%

- Citigroup analyst Ariel Rosa maintained a Buy rating and cut the price target from $163 to $158 on Nov. 12. This analyst has an accuracy rate of 76%.

- JP Morgan analyst Brian Osssenbeck maintained a Neutral rating and cut the price target from $140 to $139 on Oct. 25. This analyst has an accuracy rate of 73%.

- Recent News: On Oct. 24, United Parcel Service reported better-than-expected third-quarter financial results.

- Benzinga Pro’s charting tool helped identify the trend in UPS stock.

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: dividend yieldNews Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas