Deep Dive Into Stanley Black & Decker Stock: Analyst Perspectives (7 Ratings)

Providing a diverse range of perspectives from bullish to bearish, 7 analysts have published ratings on Stanley Black & Decker (NYSE:SWK) in the last three months.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 3 | 1 | 0 |

| Last 30D | 0 | 1 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 1 | 0 |

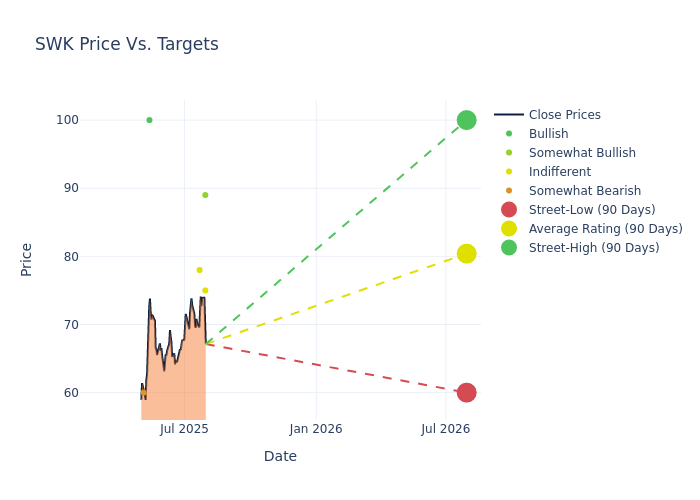

The 12-month price targets, analyzed by analysts, offer insights with an average target of $80.29, a high estimate of $100.00, and a low estimate of $60.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 0.88%.

Breaking Down Analyst Ratings: A Detailed Examination

The perception of Stanley Black & Decker by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Julian Mitchell | Barclays | Lowers | Overweight | $89.00 | $90.00 |

| Joseph O'Dea | Wells Fargo | Raises | Equal-Weight | $75.00 | $70.00 |

| Timothy Wojs | Baird | Raises | Neutral | $78.00 | $65.00 |

| Joseph O'Dea | Wells Fargo | Raises | Equal-Weight | $70.00 | $60.00 |

| Chris Snyder | UBS | Lowers | Buy | $100.00 | $120.00 |

| Julian Mitchell | Barclays | Raises | Overweight | $90.00 | $69.00 |

| Michael Rehaut | JP Morgan | Lowers | Underweight | $60.00 | $93.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Stanley Black & Decker. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Stanley Black & Decker compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Stanley Black & Decker's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Stanley Black & Decker's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Stanley Black & Decker analyst ratings.

About Stanley Black & Decker

Stanley Black & Decker Inc is a manufacturer of hand and power tools. The company operates in two reportable segments namely Tools and Outdoor and Industrial. It generates maximum revenue from the Tools and Outdoor segment. The Tools and Outdoor segment is comprised of the Power Tools Group (PTG), Hand Tools, Accessories and Storage (HTAS), and Outdoor Power Equipment (Outdoor) businesses. Geographically, the company generates revenue from the United States, Canada, Other Americas, Europe, and Asia. It derives a majority of its revenue from the United States.

Stanley Black & Decker: A Financial Overview

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3M period, Stanley Black & Decker faced challenges, resulting in a decline of approximately -3.23% in revenue growth as of 31 March, 2025. This signifies a reduction in the company's top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Stanley Black & Decker's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 2.41%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Stanley Black & Decker's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 1.03%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.41%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Stanley Black & Decker's debt-to-equity ratio stands notably higher than the industry average, reaching 0.76. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Significance of Analyst Ratings Explained

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for SWK

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | B of A Securities | Maintains | Underperform | |

| Feb 2022 | Morgan Stanley | Maintains | Overweight | |

| Jan 2022 | Morgan Stanley | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings