Wall Street's Most Accurate Analysts Spotlight On 3 Industrials Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the industrials sector.

Robert Half Inc. (NYSE:RHI)

- Dividend Yield: 4.33%

- JP Morgan analyst Andrew Steinerman maintained a Neutral rating and cut the price target from $69 to $65 on Jan. 30, 2025. This analyst has an accuracy rate of 78%.

- Barclays analyst Manav Patnaik upgraded the stock from Underweight to Equal-Weight and boosted the price target from $60 to $80 on Jan. 3, 2025. This analyst has an accuracy rate of 77%.

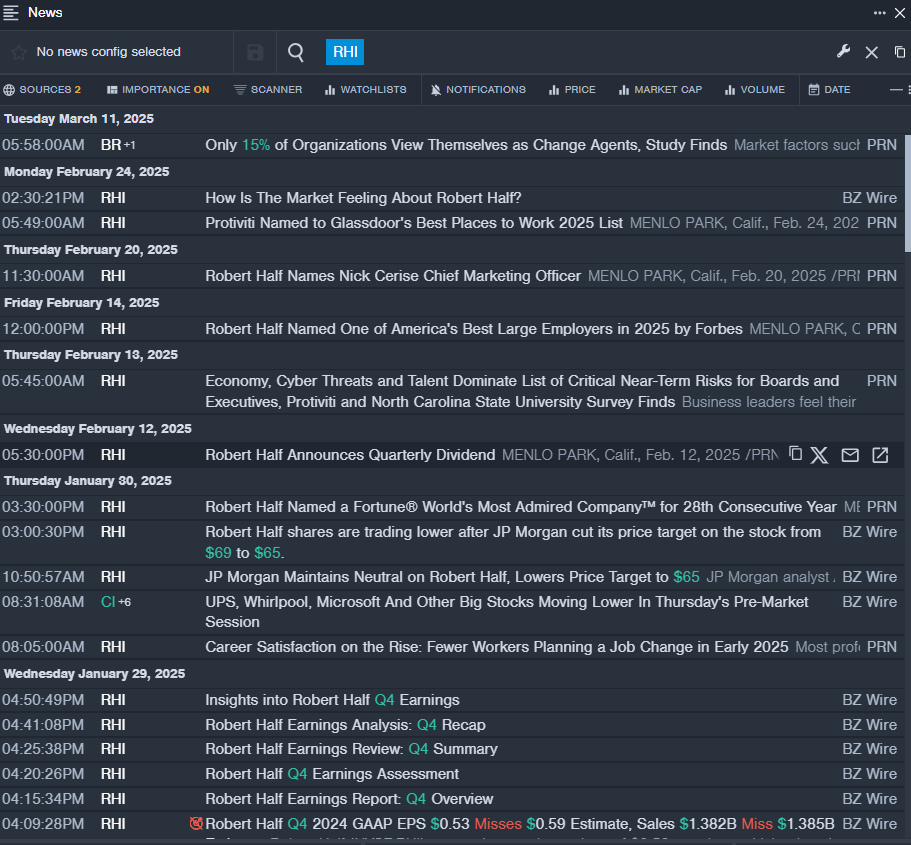

- Recent News: On Feb. 20, Robert Half named Nick Cerise as Chief Marketing Officer.

- Benzinga Pro’s real-time newsfeed alerted to latest RHI news.

ManpowerGroup Inc (NYSE:MAN)

- Dividend Yield: 5.03%

- JP Morgan analyst Andrew Steinerman maintained a Neutral rating and cut the price target from $67 to $65 on Jan. 31, 2025. This analyst has an accuracy rate of 78%.

- Truist Securities analyst Tobey Sommer reiterated a Hold rating and slashed the price target from $74 to $70 on Jan. 31, 2025. This analyst has an accuracy rate of 69%.

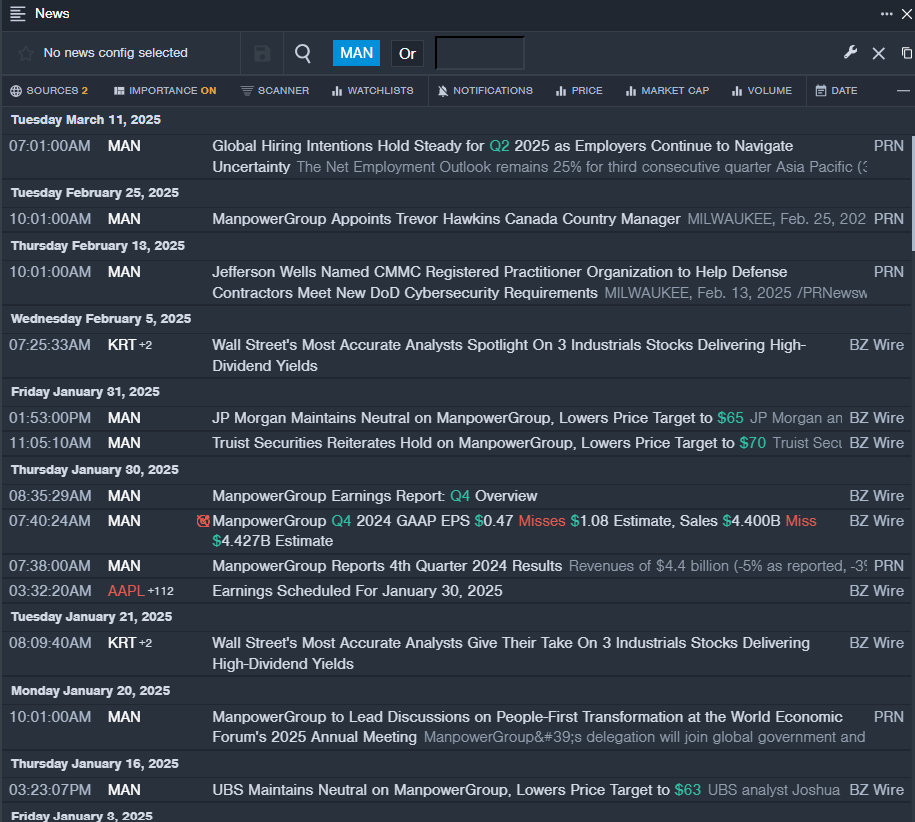

- Recent News: On Feb. 25, ManpowerGroup named Trevor Hawkins Canada Country Manager.

- Benzinga Pro's real-time newsfeed alerted to latest MAN news

United Parcel Service, Inc. (NYSE:UPS)

- Dividend Yield: 5.44%

- Citigroup analyst Ariel Rosa maintained a Buy rating and cut the price target from $158 to $149 on Jan. 31, 2025. This analyst has an accuracy rate of 67%.

- UBS analyst Thomas Wadewitz maintained a Buy rating and slashed the price target from $170 to $141 on Jan. 31, 2025. This analyst has an accuracy rate of 72%.

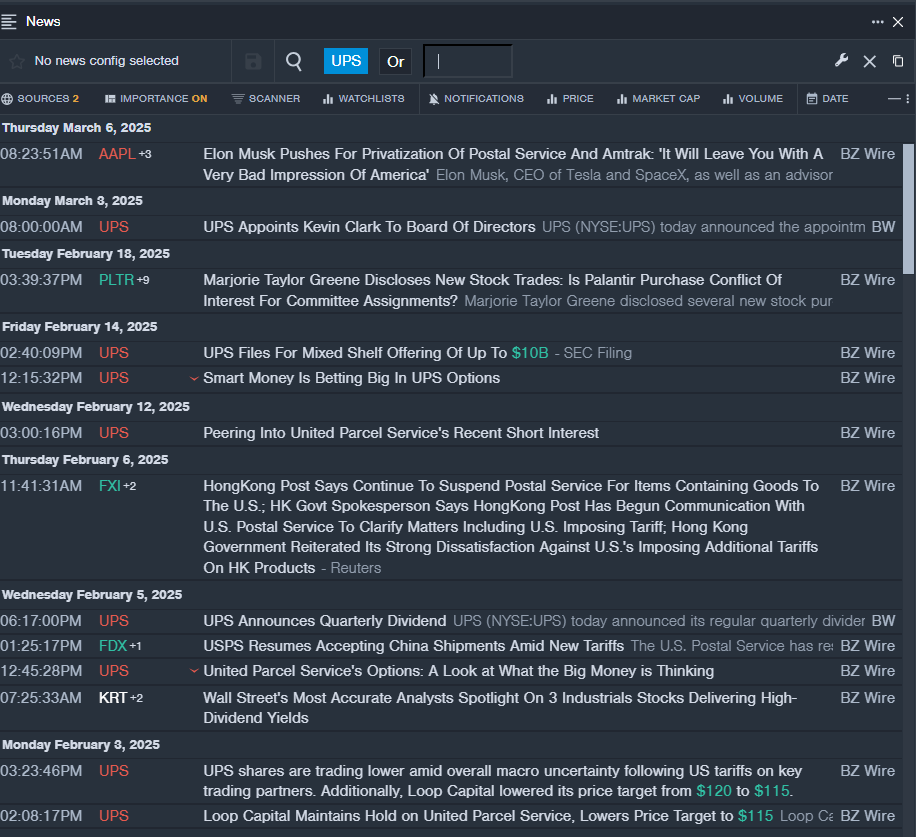

- Recent News: On Feb. 14, UPS filed for mixed shelf offering of up to $10 billion.

- Benzinga Pro’s real-time newsfeed alerted to latest UPS news

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Dividend expert ideadNews Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas