Bill Ackman-Backed Nike Reports Worst Footwear Revenue In More Than A Decade, Takes Action To Continue 'Liquidating Inventory' Amid Grim Outlook

Nike Inc. (NYSE:NKE) reported its worst footwear revenue in over a decade as the company transitions under its new CEO. The athletic footwear and apparel company beat its third-quarter earnings and revenue expectations while issuing a disappointing outlook for the fourth quarter.

What Happened: Nike posted a total footwear revenue of $7.208 billion in the third quarter as compared to $8.162 billion in the same quarter of the previous fiscal. This represents a 12% year-on-year decline in its footwear revenue, which was worse in over a decade according to FinChat.

CFO Matthew Friend spoke about clearing excess inventory picking up from the previous quarter, during the company’s earnings call. He said, “Inventory declined 2% versus the prior year. But as I said last quarter, inventory remains elevated across all geographies.”

He emphasized that the company has been providing its wholesale partners with higher “discounts to liquidate aged inventory.”

Elliott Hill, the president and CEO participated in his second earnings call after rejoining Nike in October 2024. He said that “rightsizing” the inventory will help the company get back to running a “complete and balanced portfolio.”

Friend added, “We are going to continue to be liquidating inventory. And we expect that it’s going to take us several quarters to work through. But the reason why we’re confident is because we know we’ll be liquidating it through the channels where we’re used to liquidating that inventory.”

Why It Matters: Nike surpassed Wall Street expectations in its third quarter, reporting revenue of $11.27 billion and earnings of 54 cents per share, exceeding analyst estimates of $11.01 billion and 28 cents per share, respectively.

“Win Now” is a set of strategic priorities that Nike is working on to improve its business. Talking about the company’s fourth-quarter outlook, the CFO said “Looking ahead, we believe that the fourth quarter will reflect the largest impact from our Win Now actions, and at the headwinds to revenue and gross margin will begin to moderate from there.”

While he expects revenue to be down in the mid-teens range, the firm expects gross margins to be down approximately 400 to 500 basis points in the next quarter. “We have included the estimated impact from newly implemented tariffs on imports from China and Mexico,” he added.

Price Action: Shares of Nike fell 1.55% on Thursday and declined 5.23% in afterhours. The exchange-traded fund tracking the S&P 500 index, SPDR S&P 500 ETF Trust (NYSE:SPY), fell 0.29% during the same session. Nike was down 2.46% on a year-to-date basis, whereas it was 28.72% lower over a year.

Bill Ackman‘s Pershing Square Capital Management increased its stake in Nike by 15% in the fourth quarter after a 436% increase in the third quarter. As per its 13F filing, Nike now represents 11% of Pershing Square's holdings with a total of 18.768 million shares valued at $1.420 billion.

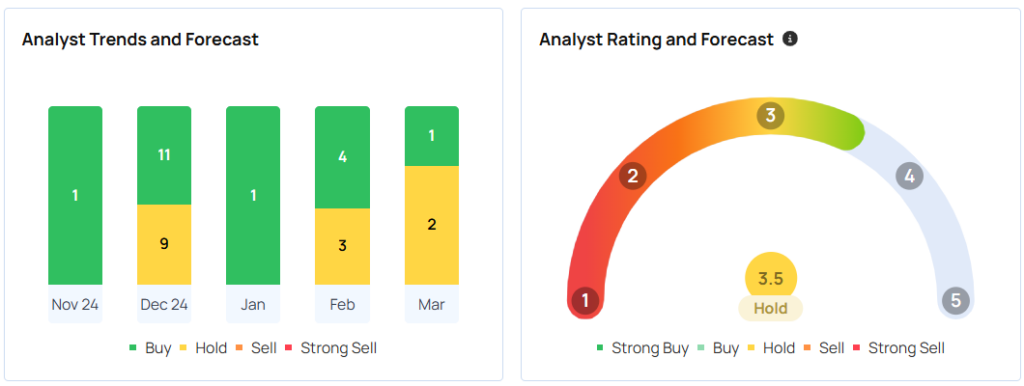

Its consensus price target was $91.41, with a ‘hold’ rating, based on the 32 analysts tracked by Benzinga. The price targets ranged from a low of $70 to a high of $120. The three latest ratings from Needham, TAG, and Morgan Stanley averaged $77.44, implying a 13.56% upside.

Read Next:

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Apparel Earnings Elliott HillEarnings Equities Market Summary News Markets