Johnson & Johnson Credits Tariff Delays For Strong Earnings, While Jim Cramer Pegs It On 'Lower Than Thought' Levies

Johnson & Johnson (NYSE:JNJ) delivered better-than-expected second quarter results, with the management hinting at leveraging tariff delays to maintain its outlook; however, CNBC’s Jim Cramer credited the performance to lower tariffs.

Check out the current price of JNJ stock here.

What Happened: Cramer in an X post said "tariffs will be lower than thought" as the key driver for JNJ’s stock performance after the earnings, spotlighting oncology, MedTech, and neuro gains. However, JNJ executives paint a different picture.

Insights from JNJ's Executive Vice President John Reed during the earnings call reaffirmed JNJ's full-year operating margin guidance of a 300 basis point improvement, crediting efficiency programs and nonrecurring charges rather than a significant tariff reduction.

Initially projecting a $400 million tariff impact for 2025, Reed noted this cost now pertains exclusively to the MedTech business, with plans to reinvest savings into pipeline acceleration.

"We continue to monitor future tariff impacts," he added, signaling ongoing uncertainty amid U.S. trade policy shifts under the Donald Trump administration, which has hinted at 200% tariffs on pharmaceuticals.

Additionally, CFO Joe Wolk told Bloomberg that a slow tariff ramp-up, potentially starting late July with levies up to 200% if manufacturing doesn't shift to the U.S., offers strategic breathing room, not relief, given the time needed for biopharma facilities.

This comes as President Trump announced last week that the pharma tariffs, part of a Section 232 investigation launched in April, are expected to be detailed by month’s end, with a grace period of “about a year, year and a half” before implementation.

The delay shows "there's an understanding you can't put up a biopharmaceutical manufacturing facility overnight," Wolk told Bloomberg. "As long as those conversations continue to occur, I think we're in a pretty good position."

Why It Matters: JNJ reported a second-quarter adjusted earnings of $2.77 per share, down 1.8% year over year, beating the consensus of $2.68. Its revenue of $23.74 billion was up 5.8% year over year, beating the consensus of $22.85 billion.

The company expects adjusted earnings of $10.80-$10.90, up from prior guidance of $10.50-$10.70, compared to the consensus of $10.62. It also raised sales guidance from $91 billion-$91.8 billion to $93.2 billion-$93.6 billion versus $91.4 billion.

Price Action: JNJ advanced 6.19% on Wednesday, and it was up 14.41% in 2025 and 5.24% over the past year.

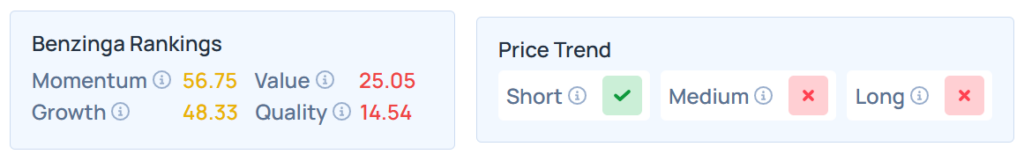

Benzinga Edge Stock Rankings shows that JNJ had a weaker price trend over the medium and long term but a stronger trend over the short term. Its momentum ranking was moderate, and its value ranking was poor at the 25.05th percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended higher on Wednesday. The SPY was up 0.33% at $624.22, while the QQQ advanced 0.10% to $557.29, according to Benzinga Pro data.

Read Next:

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Equities