Intel's SuperFluid Cooling Tech 'Possibly Suitable For Nvidia's GB300' Chips, Says Expert Amid INTC's Efforts To Secure Commitments For Foundry Services

Intel Corp. (NASDAQ:INTC) SuperFluid cooling tech could be useful for Nvidia Corp.’s (NASDAQ:NVDA) Blackwell Ultra GB300 chips, which were launched during its GTC conference.

What Happened: Team Blue’s SuperFluid, launched in 2023, is positioned to capture a significant share of the burgeoning cooling market for Nvidia’s upcoming AI servers.

According to Beth Kindig, a tech analyst at I/O Fund, Intel’s SuperFluid liquid cooling technology has reportedly undergone verification testing demonstrating its ability to manage thermal dissipation of up to 1,500 watts.

This performance benchmark suggests that SuperFluid could be a viable cooling solution for Nvidia’s GB300 AI processor, which is anticipated to consume up to 1,400 watts of power.

At its GTC conference on March 18th, Nvidia unveiled its next-generation AI GPUs, outlining a timeline for their release: the Blackwell Ultra GB300, scheduled for the second half of this year; the Vera Rubin, expected in the latter half of next year; and the Rubin Ultra, targeted for the second half of 2027.

See Also: GameStop Follows MSTR’s Footsteps: Why Will Investors Buy Convertible Notes With No Interest?

Why It Matters: Apart from its SuperFluid cooling tech, Intel is also reportedly undertaking a strategic overhaul of its chip design and expanding its foundry services, aiming to attract Nvidia and Broadcom Inc. (NASDAQ:AVGO) as clients.

UBS analyst Timothy Arcuri predicts Intel’s new CEO, Lip-Bu Tan, will focus on design and foundry, with Intel potentially securing Nvidia as a foundry client for gaming chips, despite power concerns.

Arcuri also reports Intel is advancing its 18A process and aiming to challenge Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE:TSM) with packaging innovations.

Intel’s partnership with United Microelectronics Corp. (NYSE:UMC), targeting late 2026 production, could position them as a second high-voltage FinFET supplier after TSMC, potentially attracting Apple Inc. (NASDAQ:AAPL).

Price Action: INTC rose 0.85% on Thursday, and it was down 0.38% in premarket on Friday. The stock has risen 16.82% on a year-to-date basis, whereas it is 46.52% lower over the year.

Invesco QQQ Trust, Series 1 (NASDAQ:QQQ), tracking the Nasdaq 100 index, was down 0.21% at $480.62 in premarket trade.

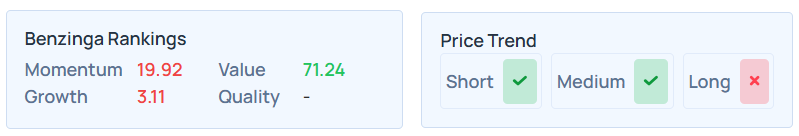

Benzinga's Edge Rankings indicate a poor price trend in the short and medium term. While the stock's value ranking is strong, ranking in the 71.24th percentile, it had weak growth and momentum rankings, the details for which are available here.

Its consensus price target was $26.12, with a ‘sell' rating, based on the 32 analysts tracked by Benzinga. The price targets ranged from a low of $20 to a high of $40. The latest ratings from BofA Securities, Cantor Fitzgerald, and JP Morgan averaged $25.67, implying a 9.13% upside.

Read Next:

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Beth Kindig Blackwell Ultra GB300Equities Market Summary News Markets Analyst Ratings Tech