These Analysts Increase Their Forecasts On Informatica

On Tuesday, Salesforce, Inc. (NYSE:CRM) officially agreed to acquire Informatica Inc. (NYSE:INFA) for approximately $8 billion in equity value, net of Salesforce's current investment in Informatica.

Under the terms of the agreement, holders of Informatica's Class A and Class B-1 common stock will receive $25 in cash per share.

Upon close, Salesforce plans to rapidly integrate Informatica's technology stack including data integration, quality, governance, and unified metadata for Agentforce, and a single data pipeline with MDM on Data Cloud.

Informatica shares gained 0.5% to trade at $24.04 on Wednesday.

These analysts made changes to their price targets on Informatica following the announcement.

- RBC Capital analyst Matthew Hedberg maintained Informatica with a Sector Perform and raised the price target from $22 to $25.

- Wells Fargo analyst Andrew Nowinski maintained Informatica with an Equal-Weight rating and raised the price target from $19 to $25.

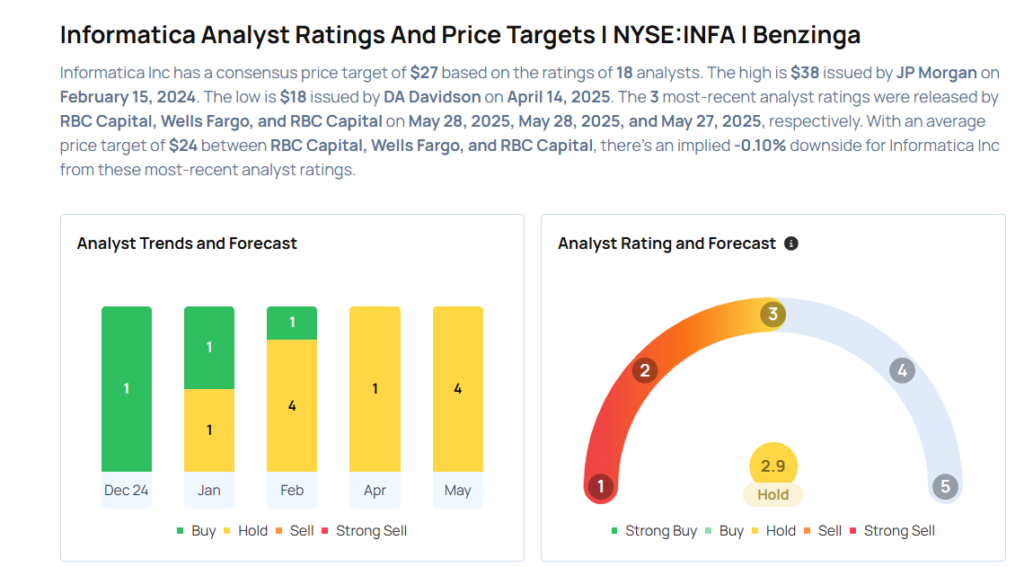

Considering buying INFA stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for CRM

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Wedbush | Maintains | Outperform | |

| Mar 2022 | Canaccord Genuity | Maintains | Buy | |

| Mar 2022 | Raymond James | Maintains | Strong Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesNews Price Target Markets Analyst Ratings Trading Ideas