The Global War Against Deflation In 10 Charts

Want an edge on volatility? Try this.

Get real-time, award-winning market intelligence from a Macro Insider.

In the years since the financial crisis, policy makers worldwide have fought a constant battle against deflation. According to a recent report by Bank of America, “monetary ammo is now close to exhaustion.” It’s unclear how this war against deflation will play out during the rest of 2015, but here are 10 charts that show how things have gone so far.

The first chart shows how global interest rate cuts have supported and boosted equity markets.

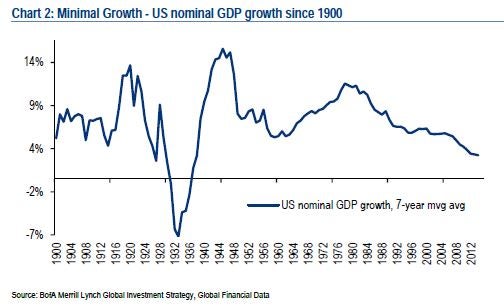

Even after massive government stimulus since the Great Financial Crisis, U.S. GDP growth remains historically low.

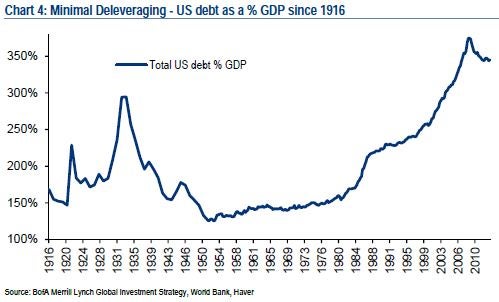

U.S. policy makers have taken measures to be more fiscally responsible in recent years, but the country remains extremely high-leveraged by historical standards.

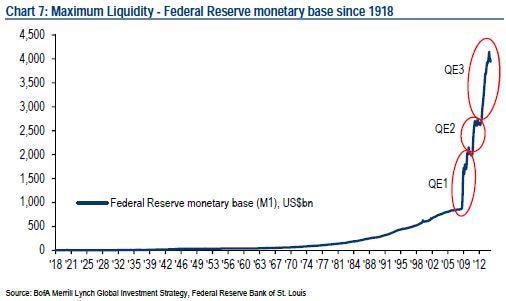

The U.S. monetary base has grown by a staggering rate in the past decade during the Federal Reserve’s three quantitative easing programs.

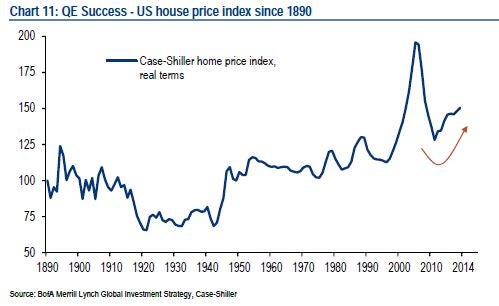

The housing market in the U.S. has recovered In recent years. Its crash was the root of the financial crisis.

Bank of America sees a recovery in the U.S. labor participation rate in 2015, which is at its lowest level since about 1978.

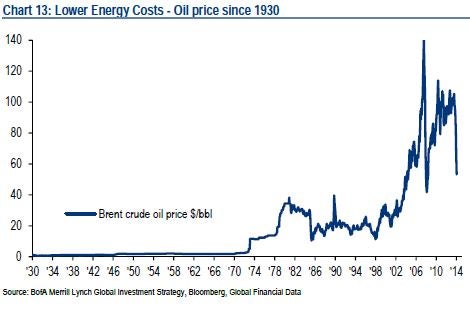

Lower oil prices have been devastating for the U.S. oil industry, but it has been an additional stimulus for most of the rest of the economy.

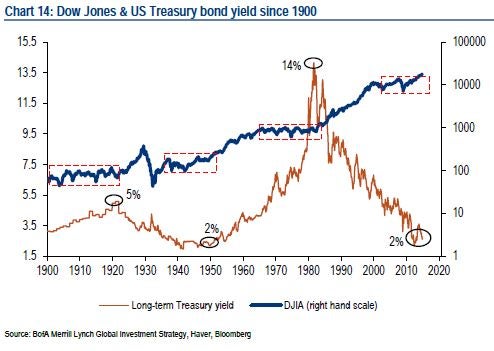

Bank of America is predicting rising bond yields in 2015, but analysts still believe stocks will outshine bonds for the year.

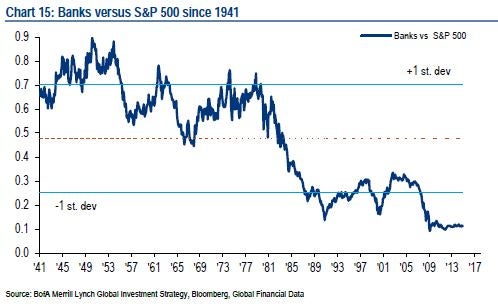

An uptick in the relative performance of banks versus the S&P 500 would be an indication that the economy is winning the war against deflation.

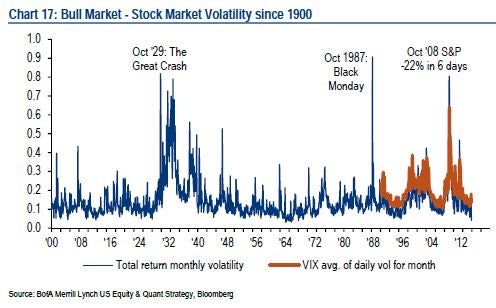

Bank of America sees volatility, the U.S. dollar, and gold as big winners in 2015.

For now, the war against deflation wages on. Although there are early signs that the global economy is close to victory, it has come at a heavy price.

Image credit: Alexey Kudenko, Wikimedia

Latest Ratings for SPX

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Nov 2015 | William Blair | Initiates Coverage On | Market Perform |

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Federal Reserve Great RecessionAnalyst Color Economics Federal Reserve Markets Analyst Ratings Best of Benzinga