Why Homebuilder Lennar Is Looking Better

Cleveland Research Company on Tuesday issued a report primarily focused on Lennar Corporation (NYSE: LEN) while updating the homebuilding sector in general. The other builder specifically mentioned in the report was D.R. Horton, Inc. (NYSE: DHI).

Homebuilders - Big Picture

- Cleveland views on single-family starts remain unchanged, "up 9% year/year in 2015 versus 4% year/year growth in 2014;" noting new communities and first-time buyers as being the primary growth catalysts.

- CRC highlighted a new trend in the past 90 days of builders introducing a "lower mix of features" included in the home, as well as "lower-priced options."

- This appears to be both an attempt to maintain affordability appeal to first-time homebuyers, while attempting to bolster gross margins by reducing costs.

- Builders are dealing with increases in labor and materials costs, as well as delivering homes on more expensive lots in 2015 compared to last year.

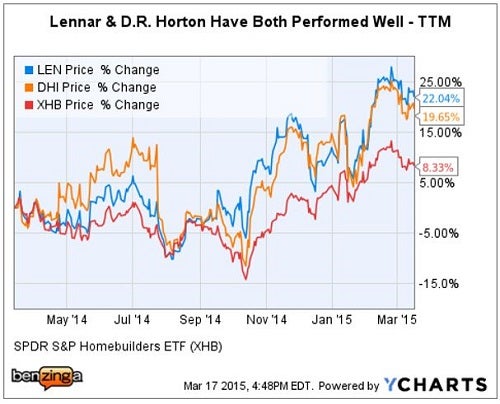

Tale Of The Tape - Past Year

CRC believes that Lennar & D.R. Horton were "best positioned" among the homebuilders in 2015 when it comes to gross margins. "DHI Express" was noted by Cleveland as a leading initiative for delivering entry-level housing on small lots.

However, Cleveland still expects Lennar and D.R. Horton to be down 140 bps and 130 bps, respectively, on a year-over-year basis. CRC noted that Lennar "specifically looks to be placing incremental pressure on suppliers year-to-date."

Lennar: Neutral rating

EPS Estimates:

- CRC FY 2015E is $3.17 per share vs. $3.10 per share consensus estimate.

- CRC FY 2016E is $3.60 per share vs. $3.49 per share consensus estimate.

- A $49.31 Lennar share price implies a 2015 CRC P/E of 15.5 and 2016 CRC P/E of 13.7.

Home Sales/Deliveries:

- Cleveland is modeling "LEN 1Q (February) orders up 20% year/year versus 4Q up 22%."

- Cleveland views total FY 2015 deliveries to be 24,300 which is above both the Lennar guidance range of 23,500 to 24,000 and the consensus average of 23,900 home deliveries.

Florida Update:

- The SE Florida region accounts for ~15 percent of units sold by Lennar.

- CRC sees strong new home demand in the region and specifically for Lennar.

- CRC noted that "looser lending" added some upside "in terms of volume and improving price/mix."

- Cleveland views Lennar improving the mix of homes and floor plans within its existing SE Florida communities.

Texas Update:

- Texas markets in aggregate account for 20 to 25 percent of units sold by Lennar.

- The big picture looks favorable, with strong year-to-date sales in the Dallas, Austin and San Antonio markets.

- Houston accounts for ~12 percent of Lennar unit sales and new home demand was noticeably softer during the past three months.

- CRC's research revealed that while traffic appeared to stay relatively consistent at Lennar's Houston communities, the buyer conversion rate has decreased. Order cancelations also have contributed to the overall softer sales in the Houston area.

Latest Ratings for LEN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | JP Morgan | Maintains | Overweight | |

| Jan 2022 | B of A Securities | Downgrades | Buy | Neutral |

| Jan 2022 | UBS | Initiates Coverage On | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Cleveland Research CompanyAnalyst Color Reiteration Analyst Ratings Real Estate Best of Benzinga