Oppenheimer: Teva Is Now Worth $77/Share, More Deals To Come

Oppenheimer upgraded Teva Pharmaceutical Industries Ltd (ADR) (NYSE: TEVA) Tuesday from Perform to Outperform and set a price target of $77.

Analysts Akiva Felt and Angad Verma expected more deals to come following the announcement that the company would acquire Auspex Pharmaceuticals Inc (NASDAQ: ASPX).

The analysts felt the company would "continue rebuilding through M&A, with the capacity for additional smaller deals to build pipeline value, along with a larger deal focused on generics and established branded products."

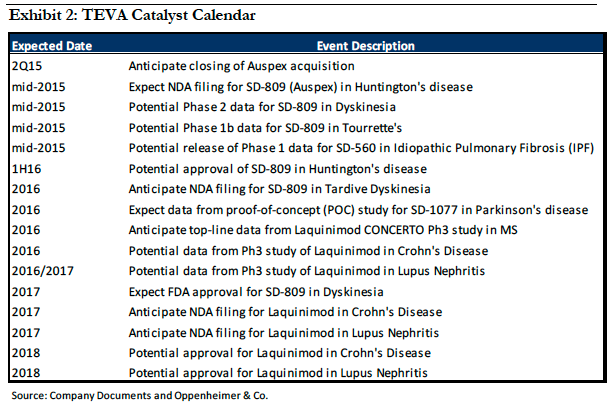

Felt and Verma thought that Mallinckrodt PLC (NYSE: MNK) would make sense for an acquisition, however, there were "multiple options for Teva" to pursue with numerous events in the pipeline.

The $77 price target was based on a DCF valuation discounted at 9 percent through 2020 and a terminal value (0 percent terminal growth) discounted at 10 percent.

The price target also represented a 14.9x multiple on the firm's 2016 EPS estimate of $5.03, "still modestly below other spec-pharma turnaround stories," according to the analysts.

Felt and Verma concluded, "While we wish we had been earlier with the upgrade, we think this turnaround story still has legs."

Shares of Teva recently traded at $62.92, up 0.64 percent.

Latest Ratings for TEVA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Barclays | Maintains | Equal-Weight | |

| Jan 2022 | Argus Research | Downgrades | Buy | Hold |

| Oct 2021 | Raymond James | Downgrades | Outperform | Market Perform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Akiva Felt Angad Verma OppenheimerAnalyst Color Upgrades Price Target Analyst Ratings