Why The Auto Industry Had Its Strongest March In 15 Years

A new report by Morgan Stanley breaks down the strongest March for the auto industry in 15 years. According to analysts, the Asian original equipment manufacturers (OEMs) are responsible for much of the strength in the sector.

Impressive SAAR

The statistic at the center of the report is the auto seasonally adjusted annual rate (SAAR). March's number of 17.15 million came in ahead of February's number of 16.23 million and ahead of consensus expectations of 16.9 million.

In fact, not only was March's SAAR an improvement on 2014's March number of 16.49, it was the highest March number since 2000.

In addition to SAAR, average transaction price (ATP) rose to $32,201 in March, marking the ninth consecutive monthly year-over-year (Y/Y) gain. Analysts point to the increase in light truck mix (53.6 percent versus 50.9 percent in March 2014) as one of the drivers behind the rising ATP.

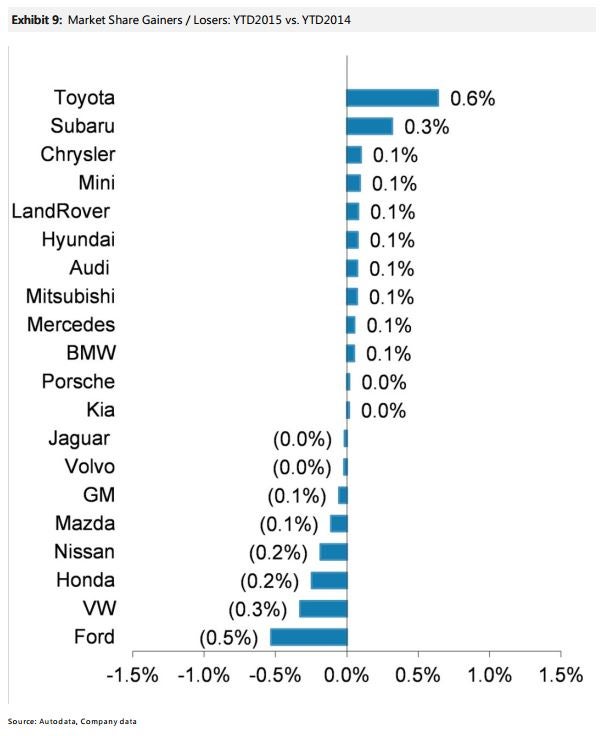

Shifting Market Share

Overall, the market share of the American "D3," Ford Motor Company (NYSE: F), General Motors Company (NYSE: GM) and Fiat Chrysler Automobiles NV (NYSE: FCAU), fell 0.5 percent Y/Y to 44.9 percent. GM share fell to 17.3 percent, but the biggest loser for the month was Ford, whose share dropped by 0.5 percent Y/Y to 15.0 percent.

Chrysler's share was slightly up Y/Y to 12.5 percent.

Asian OEM share rose 0.6 percent Y/Y to 46.1 percent overall. Nissan's share fell to 9.3 percent. Toyota Motor Corp (NYSE: TM) was the biggest winner, gaining 0.7 percent Y/Y to finish the month at 14.6 percent share.

Honda Motor Co (NYSE: HMC) market share fell to 8.4 percent, Hyundai/Kia's rose to 7.9 percent and Subaru's rose to 3.3 percent.

In Europe, Volkswagen share fell Y/Y to 2.0 percent, Audi share rose to 1.0 percent, BMW's share climbed to 2.0 percent and Mercedez Benz's share remained flat at 2.1 percent.

Outlook

Analysts see the March numbers as further indication that Asian OEMs are pushing to regain market share. Morgan Stanley has an Overweight rating on Fiat Chrysler and an Underweight rating on Ford and GM.

Latest Ratings for F

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Wells Fargo | Maintains | Overweight | |

| Feb 2022 | Morgan Stanley | Maintains | Underweight | |

| Feb 2022 | Credit Suisse | Maintains | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Auto IndustryAnalyst Color Long Ideas News Short Ideas Econ #s Analyst Ratings Trading Ideas Best of Benzinga