Wedbush Initiates Coverage On Etsy Before IPO

Wedbush initiated coverage on Etsy, Inc. (NASDAQ: ETSY) Monday with a Neutral rating and $14 price target ahead of the company’s IPO.

Analysts Gil Luria and Aaron Turner expected the company to “enjoy rapid near-term growth rates within its niche as marketing spend helps drive penetration.”

The analysts note described the company’s formula as one of “wage arbitration” on the labor of sellers and “typical of ‘shared economy’ platforms.”

“We believe Etsy benefits from the difference in what individuals expect to receive for their work time versus their free time, as well as the lack of overhead, resulting in lower prices when compared to similar goods on competing e-commerce outlets. However, we believe this arbitrage is only possible in limited categories of goods, thus capping Etsy’s ultimate growth,” according to the analysts.

The analysts cautioned, however, that practices of some sellers “may draw scrutiny, eventually limiting volume growth.”

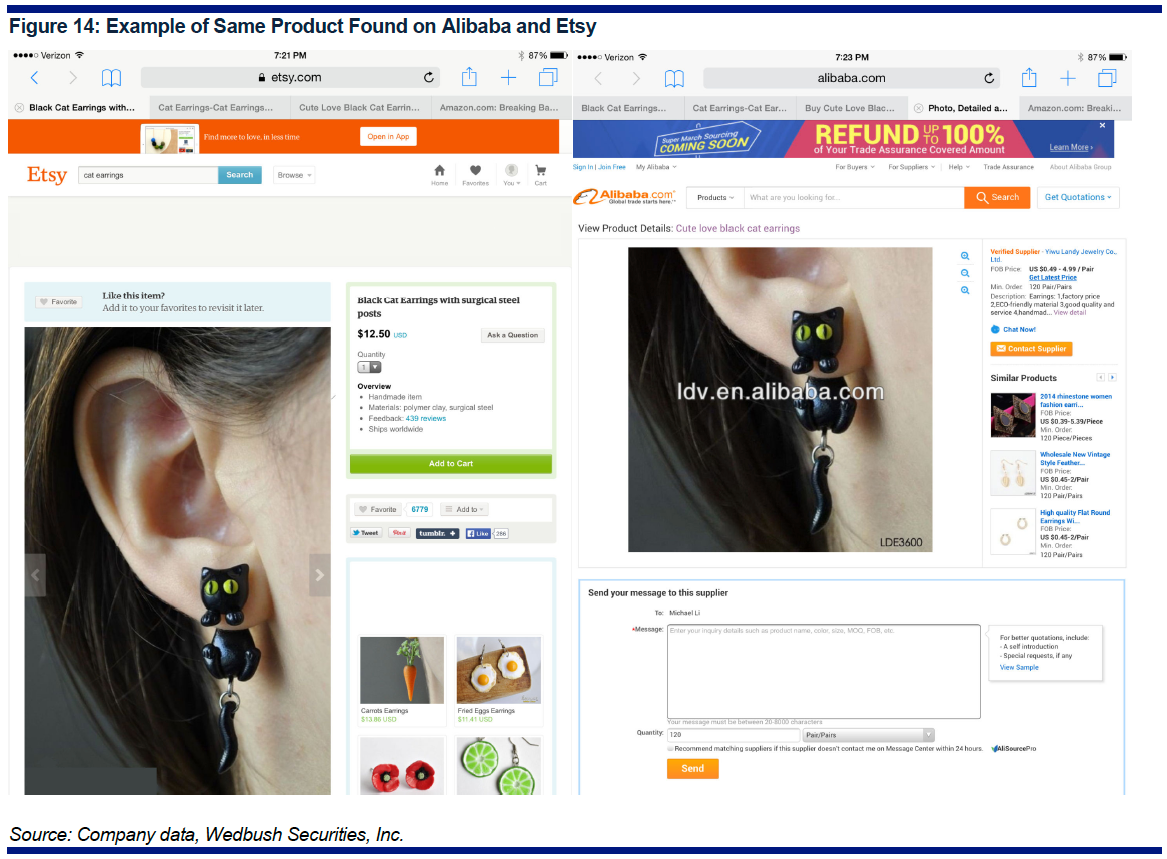

For example, the analysts found several examples of mass produced goods sold on the Alibaba Group Holding Ltd (NYSE: BABA) website being passed off as “handmade” goods on Etsy.

Related Link: IPO Outlook: Party City Pumps Up This Week's IPO Market

Additionally, other goods that appear to violate trademarks were also found on Etsy along with potentially false advertising, according to the research note.

Luria concluded that the problematic goods may be a result of Etsy allowing manufactured goods on the site, which drove much of the recent growth.

“Considering the broad backlash on Alibaba regarding inauthentic merchandise, we believe additional scrutiny could come from both Etsy buyers and other Etsy sellers. We believe this will be a particularly pressing issue for Etsy given the social responsibility ethos at the core of its brand,” Luria concluded.

Looking ahead, Luria felt that the company would “need to add new seller services in order to sustain current growth rates” as Seller Services revenue had increased over the last eight quarters from 31 percent to 47 percent as a percentage of total revenue.

The $14 price target was based on a 23x multiple on the FY16 EBITDA estimate and was “in line with closest comparable Alibaba, given similar growth trajectories.”

Etsy is scheduled to IPO on Wednesday with 16.7 million shares priced between $14 and $16.

Latest Ratings for ETSY

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Initiates Coverage On | Hold | |

| Feb 2022 | Truist Securities | Maintains | Buy | |

| Feb 2022 | UBS | Upgrades | Sell | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Aaron Turner Etsy Gil Luria WedbushAnalyst Color Initiation Analyst Ratings Best of Benzinga