Etsy Options Trading: A Deep Dive into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bullish stance on Etsy.

Looking at options history for Etsy (NASDAQ:ETSY) we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $147,020 and 6, calls, for a total amount of $258,570.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $40.0 to $65.0 for Etsy over the recent three months.

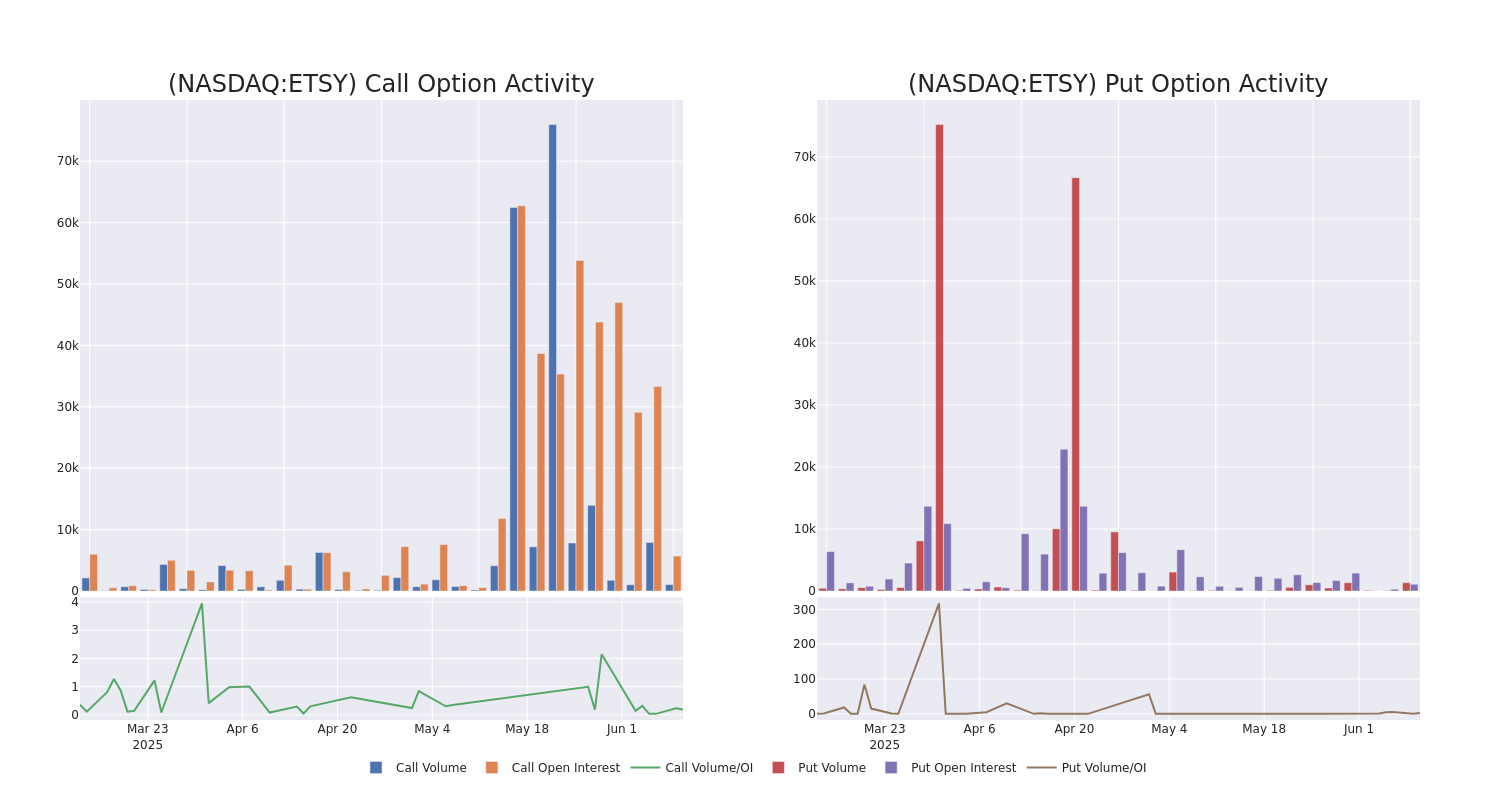

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Etsy's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Etsy's substantial trades, within a strike price spectrum from $40.0 to $65.0 over the preceding 30 days.

Etsy Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ETSY | CALL | TRADE | BULLISH | 07/18/25 | $4.55 | $4.4 | $4.55 | $60.00 | $65.5K | 5.3K | 153 |

| ETSY | CALL | SWEEP | BEARISH | 08/15/25 | $4.4 | $4.3 | $4.3 | $65.00 | $56.7K | 216 | 134 |

| ETSY | PUT | TRADE | BEARISH | 06/20/25 | $2.82 | $2.73 | $2.82 | $64.00 | $56.4K | 653 | 505 |

| ETSY | CALL | TRADE | BULLISH | 01/15/27 | $29.0 | $28.55 | $29.0 | $40.00 | $43.5K | 172 | 15 |

| ETSY | CALL | SWEEP | BEARISH | 08/15/25 | $4.65 | $4.55 | $4.55 | $65.00 | $36.8K | 216 | 220 |

About Etsy

Etsy operates a top-10 e-commerce marketplace in the US and the UK, with sizable operations in Germany, France, Australia, and Canada. The firm dominates an interesting niche, connecting buyers and sellers through its online market to exchange vintage and craft goods. With $12.5 billion in 2024 consolidated gross merchandise volume, Etsy has cemented itself as one of the largest players in a quickly growing space, generating revenue from listing fees, commissions on sold items, advertising services, payment processing, and shipping labels. The firm connects about 95 million buyers and 8 million sellers on its marketplace properties: Etsy and Depop (clothing resale).

Present Market Standing of Etsy

- Trading volume stands at 1,562,416, with ETSY's price down by 0.0%, positioned at $63.88.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 50 days.

Professional Analyst Ratings for Etsy

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $50.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Neutral rating for Etsy, targeting a price of $50.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Etsy options trades with real-time alerts from Benzinga Pro.