Will Applied Materials Report Zero Earnings Growth?

Applied Materials, Inc. (NASDAQ: AMAT) is scheduled to announce its second quarter financial results after the market closes.

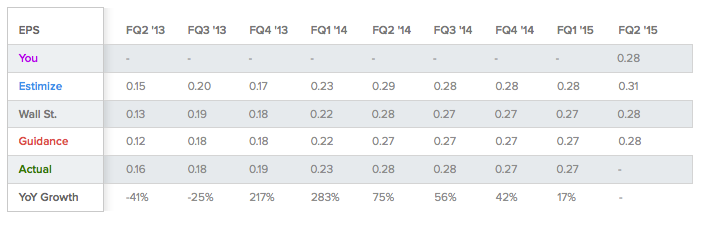

The company guided earnings of $0.28 per share, which imply zero year-over-year growth, and a small quarter-over-quarter increase.

The Street anticipates earnings in line with guidance of $0.28 per share, and revenue of $2.397 billion. For its part, the crowd is slightly more bullish, and expects earnings of $0.31 per share on revenue of $2.433 billion.

Applied Materials has a history of either meeting or beating its guidance, having done so for the past eight quarters, and having missed the Street’s estimate just once. Results have, however, come short of the crowd’s expectations in several occasions.

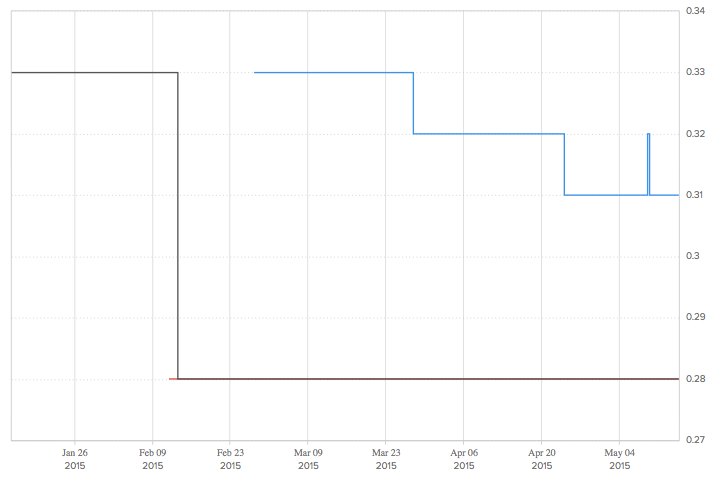

A second chart illustrates the evolution of sentiment over time. The Street’s consensus experienced a steep fall in February, and has remained at those levels ever since. On the other hand, the crowd has become increasingly bearish.

Another Growth Year For Semiconductors?

In a report published May 7, analysts at JP Morgan forecast another year of growth for semiconductors stocks in 2016. They see technology transitions in memory and 10nm FF driving the industry momentum: “The analysts believe that 2016 will be another growth year. Their bottom up analysis points to about $35B in spending, representing 4.5 percent y/y growth, based on technology transitions by memory customers. The technology transitions include continued 3D NAND ramps, additional 20nm conversions and initial 1Xnm DRAM deployments.”

The firm maintained an Overweight rating on Applied Materials, as well as on KLA-Tencor Corp and Lam Research.

Latest Ratings for AMAT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | UBS | Maintains | Neutral | |

| Feb 2022 | Needham | Maintains | Buy | |

| Feb 2022 | Piper Sandler | Maintains | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Estimize JP MorganAnalyst Color Previews Crowdsourcing Analyst Ratings Trading Ideas General