Apigee Sell-Side Quiet Period Expires; Analysts Decidedly Bullish

The sell-side quiet period for Apigee Corp (NASDAQ: APIC) has ended and analysts have commented Tuesday on the stock.

Overall, analyst coverage has been bullish and shares responded by moving more than 4 percent higher Tuesday.

Credit Suisse initiated coverage with an Outperform rating and $21 price target.

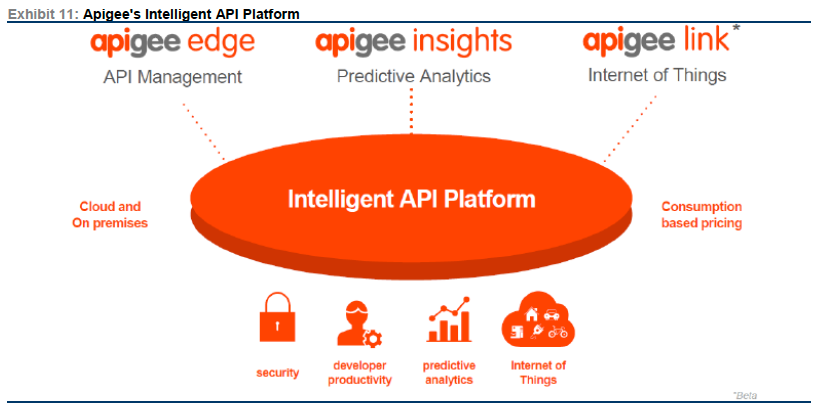

Analyst Michael Nemeroff felt that the company’s API platform was disruptive and “well positioned” to benefit as organizations “look for better ways of engaging with customers, optimizing business outcomes, and expanding their digital ecosystems.”

Source: Company documents and Credit Suisse

Nemeroff believed APIC had “a number of multi-year growth initiatives, including (1) new customer acquisition through its expanded direct sales force in recent years, (2) incremental penetration at existing customers through additional use cases and functional areas, (3) international expansion, (4) increased referrals from new/existing SI and OEM partners (ACN/SAP), and (5) stronger attach rates of new products.”

Morgan Stanley analyst Keith Weiss assigned the stock an Overweight rating and $19 price target.

“The Apigee platform addresses the $23B Application Infrastructure market, of which ~$600M is devoted to application service governance, according to Gartner, which we believe represents current spending on API management solutions such as Apigee Edge,” Weiss wrote.

Sales productivity, new customer additions, sales of solutions such as predictive analysts and subscription renewal rates were seen as key value drivers, according to Weiss.

Analyst Rob Owens at Pacific Crest Securities also rated the stock Overweight with a $21 price target.

Owens believed “revenue growth for Apigee could exceed 30% in the near term, putting the company within a select group of enterprise IT disruptors. While the lumpiness of the business and a lack of profitability will likely still be an investor concern,” Owens felt “the predictability and profitability will improve as subscription bookings ramp.”

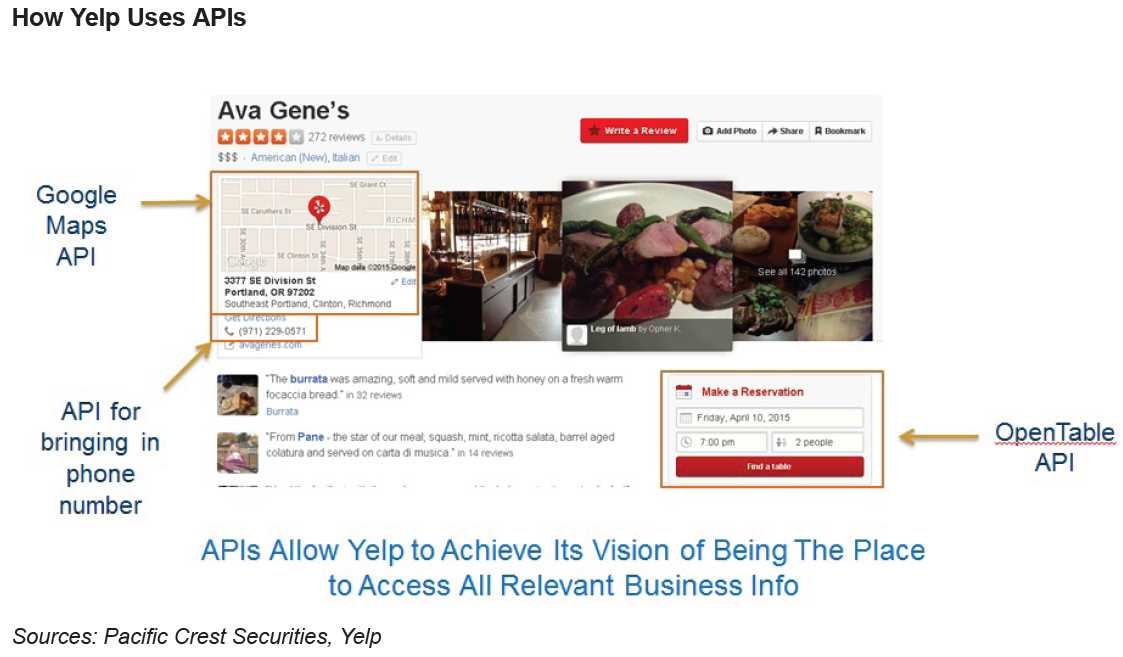

“Traditional enterprise software systems were not designed to connect to new mobile applications,” Owens added, and the company’s platform would assist in the transition from “mega-apps to micro-apps” due to “the need for a connection layer for applications” as illustrated in how Yelp Inc (NYSE: YELP) uses APIs below.

Apigee recently traded at $15.02, up 4.16 percent.

Latest Ratings for APIC

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Oct 2016 | JP Morgan | Downgrades | Market Outperform | Market Perform |

| Sep 2016 | Roth Capital | Downgrades | Buy | Neutral |

| Sep 2016 | Credit Suisse | Downgrades | Outperform | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Credit Suisse Keith Weiss Michael Nemeroff Morgan StanleyAnalyst Color Price Target Initiation Analyst Ratings