Airline PRASM Fell 3.9% Last Month; What's It Mean For Investors?

Airline stocks fell Wednesday following news that passenger unit revenue (PRASM) fell 3.9 percent in April.

JetBlue Airways Corporation (NASDAQ: JBLU), Southwest Airlines Co (NYSE: LUV), Alaska Air Group, Inc. (NYSE: ALK), Delta Air Lines, Inc. (NYSE: DAL), United Continental Holdings Inc (NYSE: UAL) and American Airlines Group Inc (NASDAQ: AAL) were among the stocks declining amid the news.

Deutsche Bank analyst Michael Linenberg noted that while April PRASM was down 3.9 percent year-over-year, the result was slightly better than the UBS forecast of down 4 to 5 percent.

Alaska PRASM was down 6.4 percent (vs. the Deutsche Bank estimate of -8.0 percent), Delta PRASM was down 3.5 percent (vs. the analyst’s estimate of -4.0 percent), JetBlue PRASM was up 4.0 percent (vs. the analyst’s estimate of +3.5 percent) and Southwest PRASM was down 2.0 percent, in-line with Deutsche Bank’s estimate.

Linenberg felt that based on industry results, “American and/or United likely produced PRASM prints better than our forecasts of -6.0% for both carriers.”

April International PRASM decreased 9.7 percent year-over-year, “driven by both a decrease in yields (-5.8% year-over-year) and a decline in the industry load factor (down 3.3 points).”

“Weak yields continue to be the primary driver of the subpar performance, as the metric declined 10.1% year-over-year while load factor improved 1.8 points to 78.7%,” according to the Deutsche Bank analysts.

Linenberg concluded that the “sluggish yield trends in all international markets” supported the firm’s view that "international pricing remained under pressure as a consequence of lower international fuel surcharges along with weak demand, depreciating currencies, and oversupply in certain overseas markets."

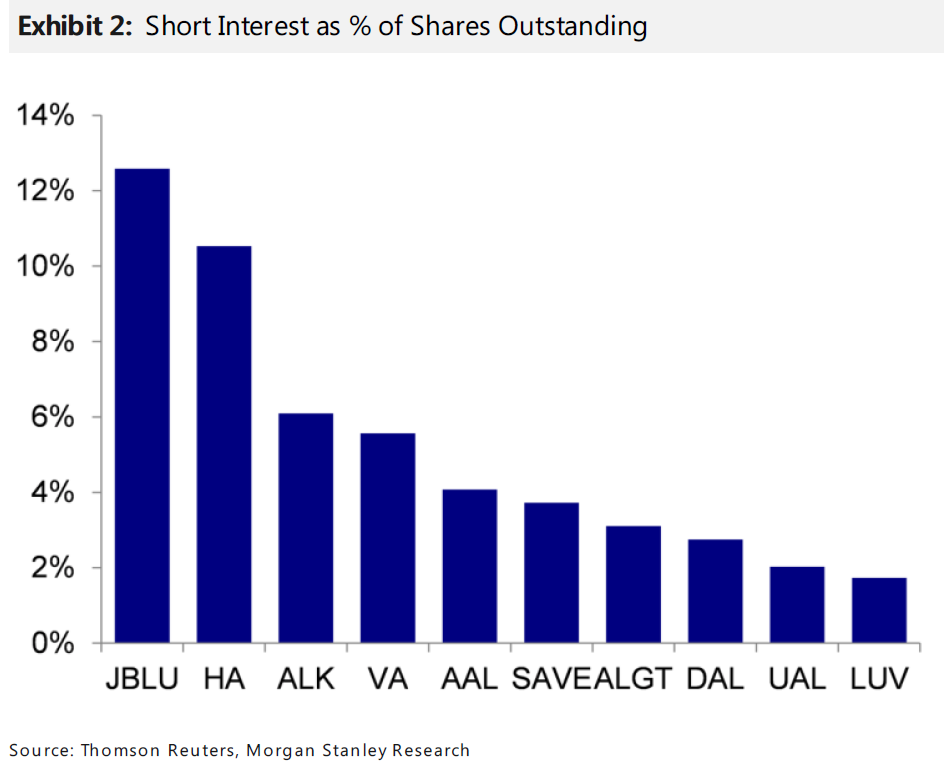

Morgan Stanley recently published short interest percentages on airline stocks which could be used as an indicator for a potential short squeeze.

Latest Ratings for JBLU

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Barclays | Maintains | Equal-Weight | |

| Jan 2022 | Morgan Stanley | Maintains | Overweight | |

| Jan 2022 | MKM Partners | Downgrades | Neutral | Sell |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Deutsche Bank Eric Scott Hunsader Michael Linenberg Morgan StanleyAnalyst Color Analyst Ratings Movers Best of Benzinga