No Reason To Be In Procter & Gamble Tactically At Current Prices, Says JC Parets

In his most recent Dow 30 report, where he looks into the performance of the stocks in the Dow 30, market technician and founder of Eagle Bay Capital JC Parets provided some comments on Procter & Gamble Co (NYSE: PG).

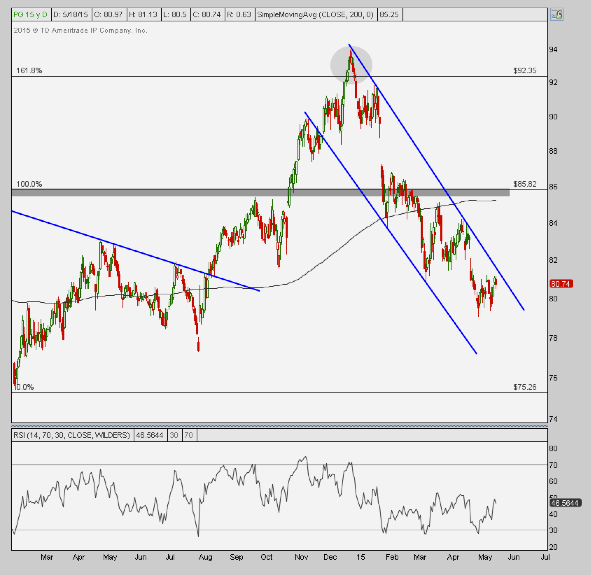

Weekly Chart

From a structural perspective, the company kept looking better as it broke out above the resistance created by the failed breakout from late 2013. Eagle Bay's targets between $90 and $92 were hit in December, "based on the measured move from the range in 2013-2014 and 161.8 percent extension from the early 2014 correction," Parets explained. Since then, the firm has wanted to see some consolidation and/or buy drops back down in the low to mid 80s. This month, the latter was actualized.

Parets then looked into the stock from a risk management standpoint, and said he sees no reason to be long under the gray shaded area in the chart, which marked the resistance (ex-failed breakout) since the highs in 2013. If the stock gets back above that, the expert said it would be worth consideration.

Daily Chart

Shorter term, Procter & Gamble has been doing great. However, the stock hit Eagle Bay's upside targets between $90 and $92 in December. At that point, the firm "either wanted to buy a dip back under 86 which was former resistance late last year or wait for consolidation," Parets stated.

Parets concluded, "We got the pullback the past few months but I don't like that momentum hit oversold conditions. There is no reason to be in this tactically if we are below those Nov 2013 highs shaded in gray."

Image Credit: Public Domain

Latest Ratings for PG

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | RBC Capital | Maintains | Sector Perform | |

| Jan 2022 | Deutsche Bank | Maintains | Buy | |

| Jan 2022 | Morgan Stanley | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Dow 30 Eagle Bay JC ParetsAnalyst Color Technicals Analyst Ratings Trading Ideas