Verizon: Expert Recommends Taking Profits Quickly

Market technician and Eagle Bay Capital founder JC Parets tracks the movement and performance of the Dow 30 stocks, looking into the companies every week.

In the firm's most recent Dow 30 report, the expert delves into Verizon Communications Inc. (NYSE: VZ) and provides some insight into the stock.

Weekly Chart

Looking at the stock from a structural perspective, a big consolidation above the 2007 highs can still be witnessed. "With an upward sloping 200 week moving average, the benefit of the doubt continues to go to the bulls, especially with momentum in a bullish range," Parets explained.

However, the expert says he is worried about seeing relative strength breaking multi-year support, adding he doesn't want to be long anywhere below the downtrend line from 2013 and former resistance/support since the 2007 highs.

"If we break this key support the next target is down towards 41 based on former support and 61.8 percent Fibonacci extension from the 2013 rally," he explained.

By mode of conclusion, Parets assured he would still be a seller above $51 (the resistance in the past 2 years).

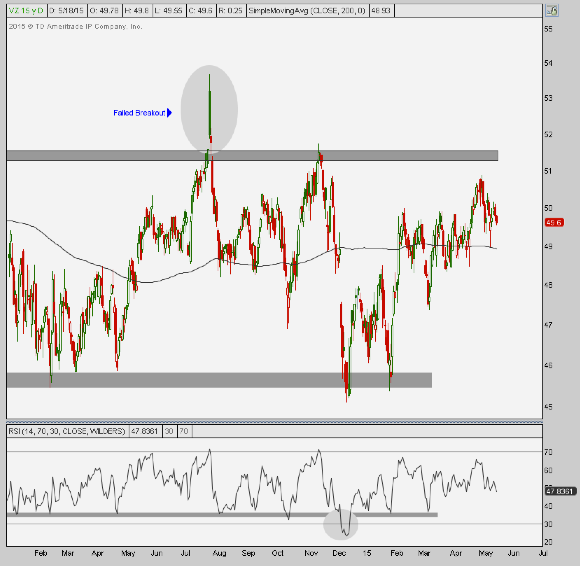

Daily Chart

Shorter term, Parets recommended approaching this neutrally, as the 200 day moving average remains flat. However, "longs last month off that key support have worked well," he explicated.

"With momentum hitting oversold conditions confirming a new bearish ranges, we said that profits should be taken quickly back near 49," the expert added. "These flat 200 day moving averages increase the likelihood of whipsaws which is precisely what has occurred the past few months."

Overall, this looks like a "messy situation," Parets stated, "and as nice of a trade as that was, we've suggested taking profits quickly and still feel that way."

Image Credit: Public Domain

Latest Ratings for VZ

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | JP Morgan | Downgrades | Overweight | Neutral |

| Jan 2022 | Tigress Financial | Maintains | Buy | |

| Dec 2021 | Daiwa Capital | Initiates Coverage On | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Dow 30 Eagle Bay JC ParetsAnalyst Color Long Ideas Technicals Analyst Ratings Trading Ideas