Baird Bullishly Initiates Self-Storage REITs

On Thursday, Robert W. Baird & Co. analyst R.J. Milligan initiated coverage of the self-storage REIT sector with an Overweight sector rating.

This REIT subsector has been a strong performer during the past few years, and Milligan feels that there continues to be "a several-year runway for double-digit NAV growth in the backdrop of limited new supply."

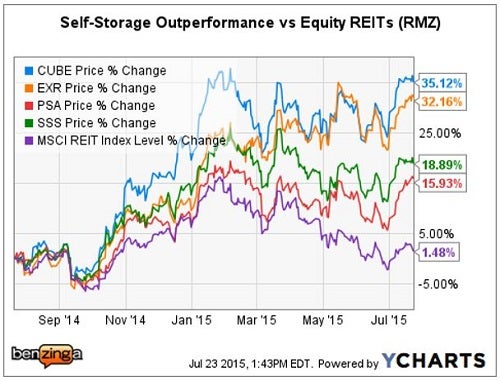

Although he initiated industry giant Public Storage (NYSE: PSA) at Hold, he still expects the entire sector to outperform the MSCI Equity REIT Index (RMZ).

The three Buy rated equity self-storage REITs are CubeSmart (NYSE: CUBE), Extra Space Storage, Inc. (NYSE: EXR) and Sovran Self Storage Inc (NYSE: SSS).

Tale Of The Tape: Past Year

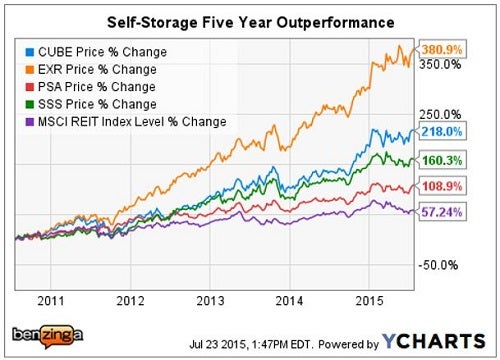

Tale Of The Tape: Past 5 Years

A look back shows that the recent outperformance by self-storage REITs was no fluke.

Another Top Pick

Additionally, Baird reiterated small-cap specialty mREIT Jernigan Capital Inc (NYSE: JCAP) at Outperform, while noting it higher risk due to its recent IPO.

Dean Jernigan is a former CEO of CubeSmart and is now spearheading an effort to selectively lend to private developers and self-storage operators in order to build new facilities.

Jernigan offers a participating loan product designed to address the lack of new supply, which essentially allows JCAP a 50 percent JV ownership stake at property stabilization.

Baird Sector Overweight Rationale

Investor Takeaway

While Baird noted that self-storage REITs are pricey relative to other subsectors, a fragmented industry full of "mom and pop" operators," strong self-storage fundamentals and the ability to raise rentals in a growing economy make this group of companies attractive moving forward.

Image Credit: Public Domain

Latest Ratings for CUBE

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Dec 2021 | Truist Securities | Maintains | Hold | |

| Dec 2021 | Raymond James | Upgrades | Market Perform | Outperform |

| Oct 2021 | Berenberg | Initiates Coverage On | Hold |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas REIT Initiation Reiteration Top Stories Analyst Ratings Trading Ideas Best of Benzinga