Should Biotech Investors Take Hillary Clinton's Drug Pricing Plan Seriously?

- Democratic presidential frontrunner Hillary Clinton has sent biotech stocks plummeting this week after announcing the creation of a new plan to fight drug price gouging.

- Evercore ISI believes that there is a very slim chance the plan will ever become law.

- Political analyst Terry Haines believes that the plan is more about politics than policy.

Democratic presidential frontrunner Hillary Clinton sent shares of biotech stocks plummeting this week after pledging that her new plan would put an end to biotech drug price gouging. In a new report, Evercore ISI analyst Umer Raffat looks at what exactly biotech investors can expect from the Clinton campaign and how much of a threat she would be to the industry if elected.

Related Link: Investors In This Biotech ETF Must Have Loved Hillary Clinton's Tweet

What’s In The Plan

The plan that Clinton outlines on her website includes provisions that limit monthly out-of-pocket pending on covered drugs at $250, that clean up the generic drug approval backlog, that mandate that new drug pricing be reflective of improved value and that eliminate corporate write-offs for direct-to-consumer advertising.

The potential for a major overhaul of the biotech industry has clearly spooked the market, but Evercore assures investors that this proposal is likely more about politics rather than policy.

Political Motivation

According to policy analyst Terry Haines, the likelihood of any of Clinton’s biotech proposals becoming law is slim to none. Hanes makes the following points about the Clinton plan:

- In all likelihood, it won’t happen.

- If it does happen, it won’t go into effect for at least another two years.

- The plan is probably nothing more than a campaign talking point.

In fact, a Clinton drug proposal could be more a matter of campaign defense than offense, as leading Democratic competitor Bernie Sanders has been working hard on The Prescription Drug Affordability Act of 2015.

Largest Possible Impact

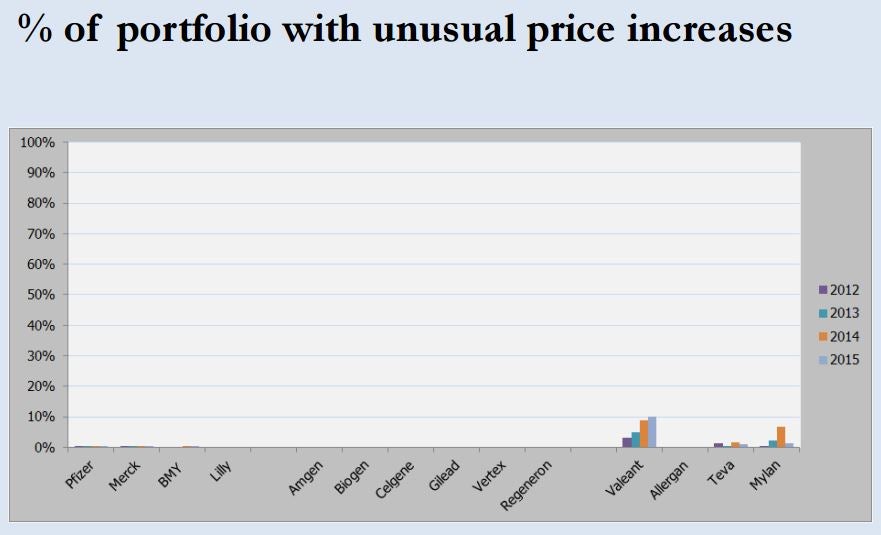

The Evercore report includes this graph of companies with drugs that have seen unusual price increases in recent years.

The names with the most unusual pricing activity could see the largest negative impact from potential new regulation, including Valeant Pharmaceuticals International Inc (NYSE: VRX), Teva Pharmaceutical Industries Ltd (NYSE: TEVA) and Mylan N.V. (NASDAQ: MYL).

On the other hand, for traders that agree with Haines that the likelihood of Clinton’s new plan ever becoming law is very small, the nearly 8.0 percent two-day decline in the SPDR S&P Biotech ETF (NYSE: XBI) resulting from Clinton’s plan could provide an excellent buying opportunity for longer-term investors.

Disclosure: the author holds no position in the stocks mentioned.

Latest Ratings for VRX

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jun 2018 | TD Securities | Downgrades | Buy | Hold |

| Jun 2018 | Barclays | Upgrades | Equal-Weight | Overweight |

| May 2018 | Mizuho | Upgrades | Neutral | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Evercore ISI Hillary ClintonAnalyst Color Biotech Politics Top Stories Analyst Ratings General Best of Benzinga