UnitedHealth Hit By $6.5 Billion Medical Cost Blowout: Launches AI-Led Overhaul, Drops 600K Members To Regain Margins — 'These Are Serious Challenges'

Healthcare company, UnitedHealth Group Inc. (NYSE:UNH), says that it will drop 600,000 Medicare Advantage members and launch a sweeping operational overhaul after being blindsided by $6.5 billion in unanticipated medical costs.

What Happened: During its second-quarter earnings call on Tuesday, UnitedHealthcare’s CEO, Tim Noel, said, “Our pricing assumptions were well short of actual medical costs.”

“We know these are serious challenges. We are humbled by them,” Noel says. As the company now expects the full-year Medicare Advantage trend, which refers to the year-over-year increase in healthcare costs per member, to be approximately 7.5%, well above the 5% trend it had assumed when setting 2025 bids.

Under Medicare Advantage, private insurers such as UnitedHealth get paid a fixed amount by the U.S. Government, per enrollee, to manage their care.

“Physician and outpatient care together represent 70% of the pressure year to date,” Noel said. “In short, most encounters are intensifying in services and costing more.”

The decision to exit underperforming plans, which affect more than 600,000 members, is centered around “less managed products such as PPO (Preferred Provider Organization) offerings,” according to Noel. He added that UnitedHealth has made “significant adjustments to benefits” in response to margin compression.

Executive Chairman, Stephen Hemsley, who recently returned to the top role, said the company is undergoing a fundamental reset. He says, “We have embarked on a real cultural shift in our relationship with regulators and all external stakeholders.”

Hemsleys says they “intend to infuse this entire enterprise with an AI-first orientation,” as the company reaffirmed its plans to deliver nearly $1 billion in cost reductions by 2026, while targeting a return to earnings growth starting in 2027.

Why It Matters: UnitedHealth Group has had a rough year in 2025, with the stock down 48% year-to-date, amid a slew of challenges in recent months.

It began with the assassination of its former CEO, Brian Thompson, in December 2024, by Luigi Mangione, which later became the subject of an investor lawsuit that alleges the company downplayed the potential impact of this murder on its performance.

In May, the stock plunged again due to the abrupt resignation of the company’s CEO, Andrew Witty, with former CEO, Hemsley, succeeding him. The company also suspended its guidance for 2025 at the same time, citing continued acceleration in care activity.

Last week, the company announced that it was cooperating with the U.S. Department of Justice’s criminal healthcare fraud unit, which has brought UnitedHealth’s Medicare billing practices into scrutiny.

The company released its second-quarter results on Tuesday, reporting $111.62 billion in revenue, up 13% year-over-year, but missing consensus estimates of $111.69 billion. It posted a profit of $4.08, down from $6.80 a year ago, and missing the consensus of $4.95.

Price Action: Shares of UnitedHealth Group were down 7.46% on Tuesday, closing at $261.07, but are up 0.72% after hours.

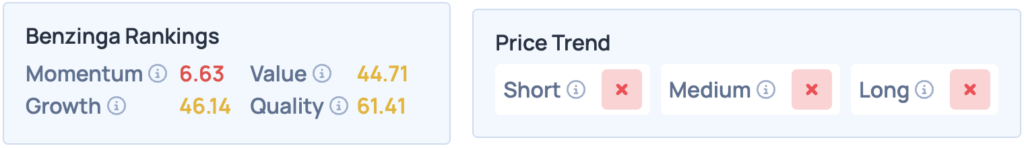

According to Benzinga’s Edge Stock Rankings, UnitedHealth Group scores poorly across the board, with an unfavorable price trend in the short, medium and long term. Click here for deeper insights into the stock, along with how it compares with peers and competitors.

Photo Courtesy: JHVEPhoto on Shutterstock.com

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Earnings Large Cap News Health Care General