How Asian-Based Hedge Funds Outperform U.S. And European Funds

A new report by SunGard analyst Madalin Prout discussed the evolving world of Asian hedge funds. The industry has demonstrated rapid growth in recent years, and it now plays a major role in Asian equity markets.

Growth

According to SunGard, the total assets under management (AUM) of Asian hedge funds grew by 29 percent in 2014 to $145 billion. Hong Kong and Singapore are the two largest Asian hedge fund hubs, accounting for two-thirds of all Asian AUM.

Strategic Differences

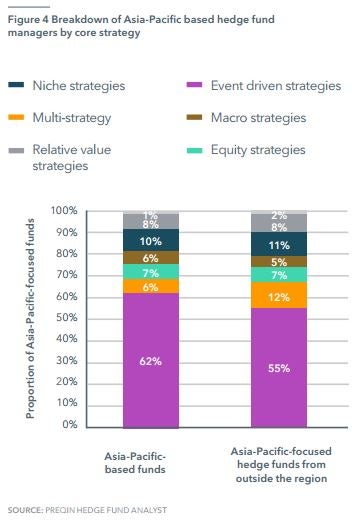

Prout pointed out that only about two-thirds (65 percent) of global Asia-Pacific-focused hedge funds are headquartered within Asia, and about a third of funds are run out of the United States or Europe.

She noted a difference in investing approaches between funds managed within Asia and those managed outside the region. Specifically, locally-managed funds prefer equities strategies, while remotely-managed funds prefer macro strategies.

“Even more revealing is that analysis of the funds’ performance shows the Asia-Pacific-managed funds consistently outperform those managed outside the region, suggesting a distinct advantage in having local knowledge of the markets,” Prout added.

What’s Next In Asia?

According to Prout, several new markets in Asia are developing quickly, including Malaysia and Indonesia.

Technology will continue to play an expanding role in Asian finance. Prout identified systems consolidation and industry utilities as two key strategic areas that firms will likely target in coming years.

Image Credit: Public Domain

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Madalin ProutAnalyst Color Emerging Markets Hedge Funds Top Stories Markets Analyst Ratings General Best of Benzinga