Goldman Sachs Downgrades Global Equities To Neutral, Remains Overweight Cash

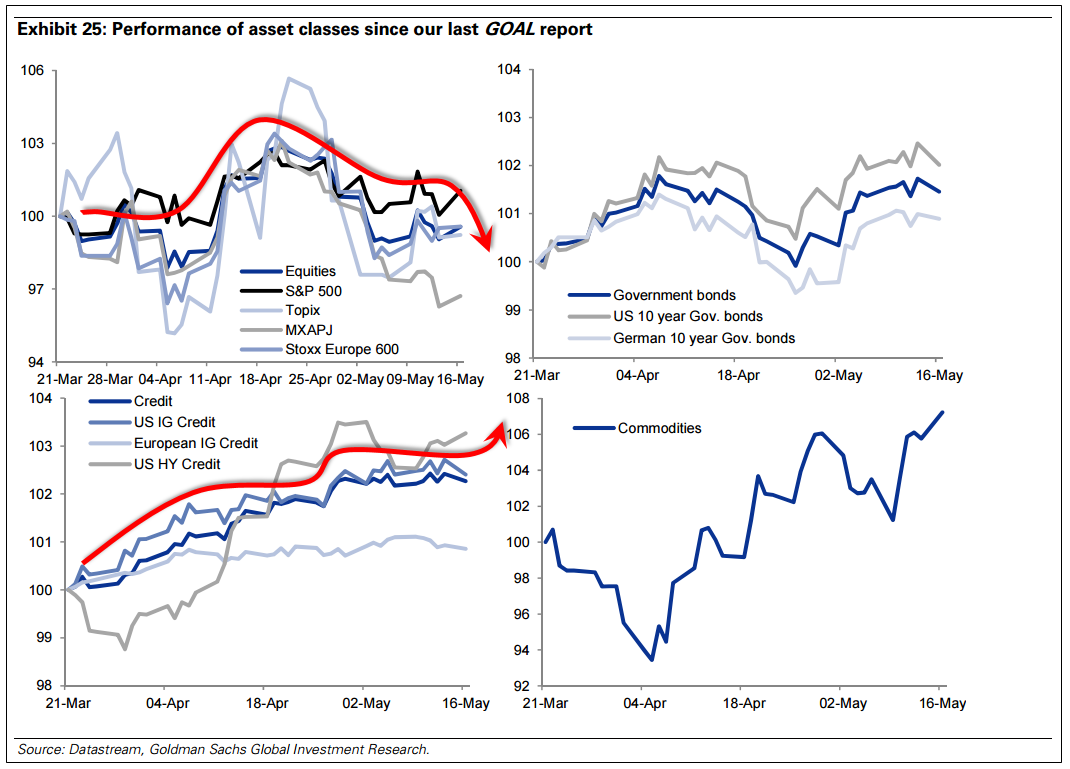

After Tuesday's close, Goldman Sachs downgraded global equities from Buy to Neutral citing weak prospects for returns. The bank maintains an Overweight position on cash as the potential for increased cross-asset volatility persists. The commodity complex was upgraded from Sell to Neutral for the next three months on the heels of less-than-expected future downside to oil over the next quarter.

The driving force for Goldman's cloudy outlook comes in the form of lacking sustainable signals of growth and the bank remains cautious when it comes to equity market risk and exposure. Instead of owning equities, Goldman's Christian Mueller-Glissmann recommends exposure to US High Yield credit markets.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Christian Mueller-Glissmann Goldman SachsAnalyst Color Economics After-Hours Center Analyst Ratings